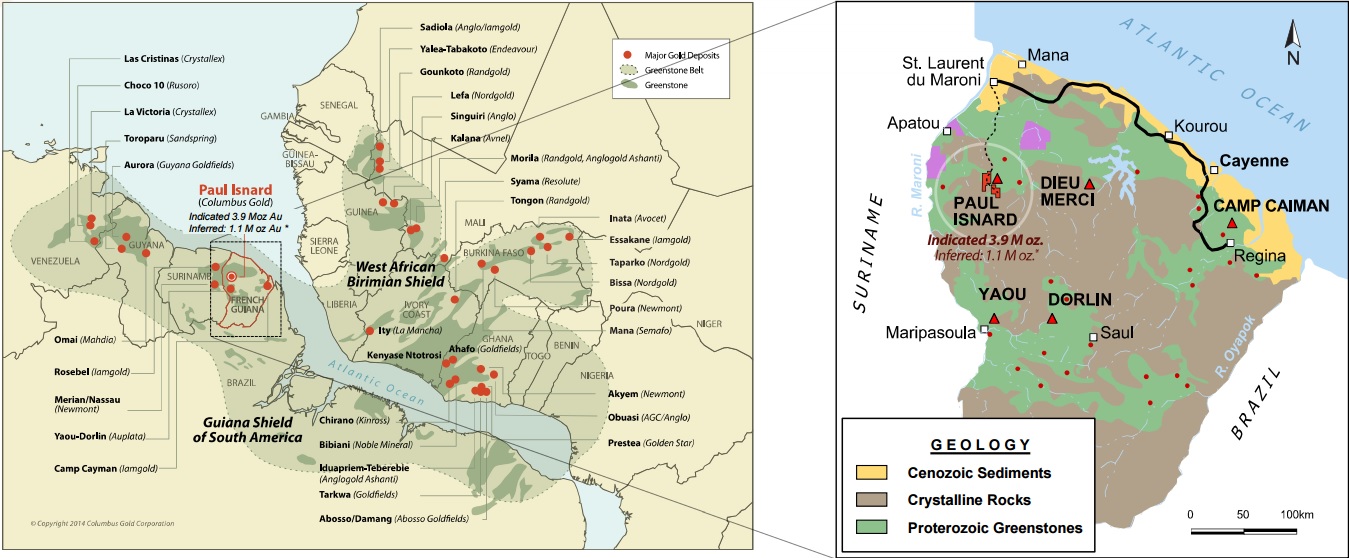

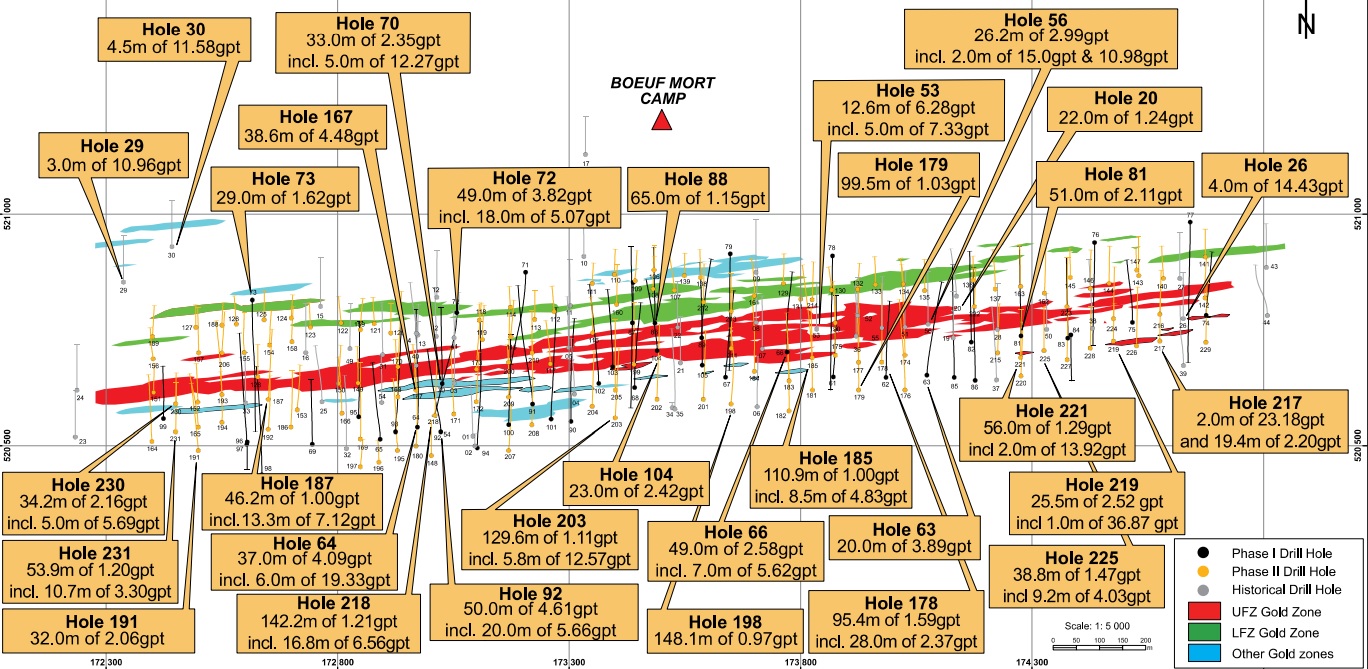

Columbus Gold (CGT.V) has pushed out several positive press releases in the past three weeks as it continues to advance its flagship Paul Isnard gold project in French Guiana, where Nordgold (NORD.L) is earning a 50.01% stake in the project. Both companies are now completing a substantial infill drill program and this has already yielded the expected results with true widths of 34 meters at 1.95 g/t gold and 16.8 meters at 1.54 g/t gold.

Columbus has now completed 37 infill holes for a total of almost 3,300 meters and the recently released results were encountered at the Lower Favorable Zone where Columbus is currently conducting a ‘priority 1’ drill program. The 34 meter intercept was drilled at the Upper Felsic Zone where 4,600 meters will be drilled.

Additionally, Columbus has engaged Brussels-based Tractebel to conduct an engineering study to link the Paul Isnard project onto the power grid in French Guiana. As the PEA has identified the power cost to be one of the largest contributors to the production cost per ounce of gold, any reduction in the power cost will improve the operating margin. The PEA has budgeted an expense of $0.20/kWh using diesel-fueled generators, and as the power cost based on the $0.20/kWh is expected to be $6 per processed tonne would a connection with the power grid save the company $2.7 per tonne.

Based on the 12,500 tpd production scenario the total benefit would be $33,000 per day, or $12M per year, so it will be interesting to see the trade-off between the higher initial capex associated with connecting the project with the power grid and the annual cost savings ($45/oz).

And finally, Columbus Gold will be farming out the non-core Mogollon asset to a group of private investors (‘Stand Up Investments’). SU Investments will pay US$250,000 per year during four years to earn a 100% interest in the project. As Mogollon wasn’t an important asset for Columbus Gold, this is a decent deal, providing the company with some incoming cash flow reducing the need for external financing.

Columbus will start trading on the Toronto Stock Exchange from early next year on, and this promotion from the TSX Venture Exchange should increase the visibility and credibility of the company.

Go to Columbus’ website

The author holds a long position in Columbus Gold. Columbus is a sponsor of this website. Please read the disclaimer