Paringa Resources (ASX:PNL) has announced it has started the permitting process for its Buck Creek No 2 mine, which should ensure the company to receive all necessary approvals by the end of Q2 net year. We don’t expect the company to encounter any difficulties, considering Paringa now already has some experience with the permitting process, having permitted the No 1 mine earlier this year.

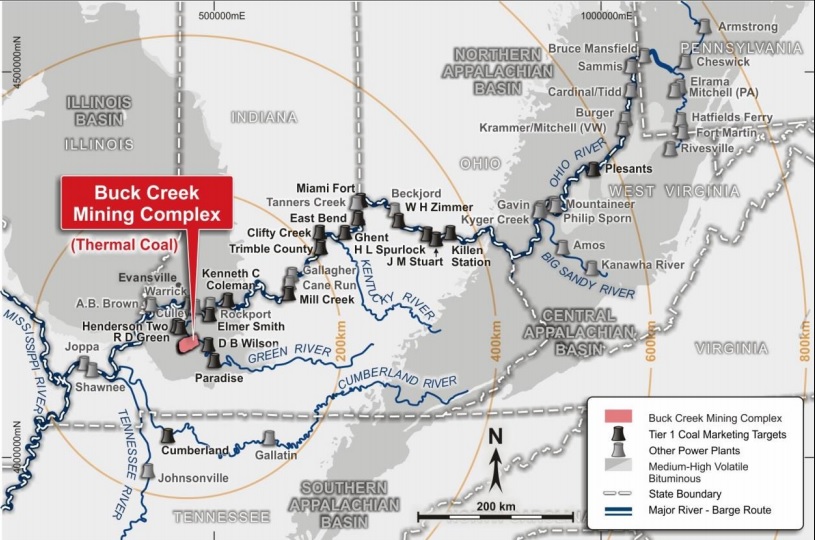

Coal might be a dirty commodity, but the market Paringa will be serving is still looking for additional coal as the Ohio River market is filled with coal-fired power plants. For those customers, the price they are paying for their coal is subordinated to the quality of the coal as well as the reliability of the deliveries, and that’s why the company’s offtake partners have no problem locking in the prices for future delivery.

Approximately 60% of Paringa’s production in the first five years of the Buck Creek mine life has now found buyers, and this will simplify the financing process (which should be fairly straightforward given the existing offtake agreements and the low capital intensity). As the company is operating in the territory of Alliance Resources Partners (ARLP), it’s not unlikely Alliance could see the Buck Creek mine as an interesting addition for its own assets, to fully benefit from a potential uptick of the coal prices further down the road.

Paringa is also raising A$6.5M at A$0.17 per share to top up its cash position.

Go to Paringa’s website

The author has a small long position in Paringa Resources. Please read the disclaimer