Metanor Resources (MTO.V) has released a PEA on its Barry project wherein the ore at Barry will be trucked (with massive 150 tonne road trains) to the Bachelor Lake mill to reduce the capital expenditures to develop Barry. Indeed, the initial capex is estimated at just C$8.5M, and as Metanor will start to mine the higher grade zones at Barry, the after-tax Internal Rate of Return comes in at 94%.

A total of 193,000 ounces of gold will be produced during the entire nine year mine life resulting in an average production rate of approximately 21,500 ounces per year, with peak production expected in the second year of the mine life wherein up to 37,500 ounces will be produced. The after-tax NPV6% of Barry is estimated at C$25.9M which is less than half the pre-tax NPV, so we would like to see the full technical report to figure out why the tax bill is relatively high.

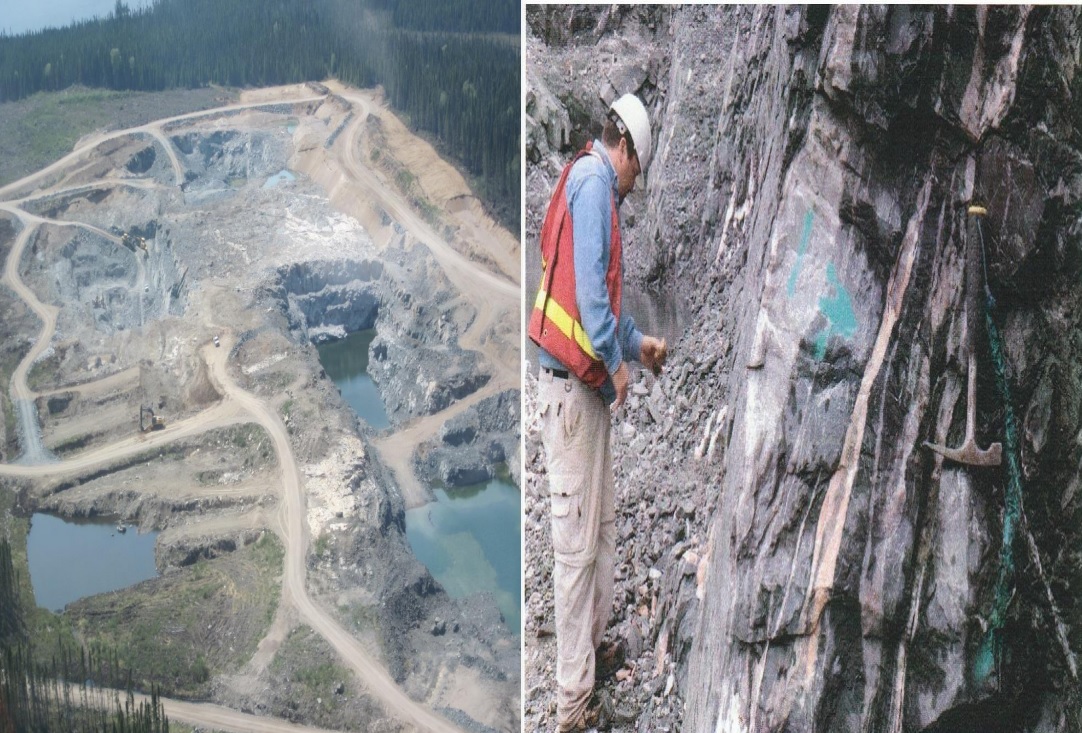

Keep in mind the after-tax NPV and IRR were based on a gold price of C$1560/oz, whilst the current gold price is approximately C$1760/oz. This means the total pre-tax undiscounted cash flow over the entire mine life will be roughly C$38M higher than what has been used in the Preliminary Economic Assessment, and this will further increase the value of Barry as a standalone project. Keep in mind Barry is fully permitted, and Metanor should have no difficulties whatsoever to start mining at the existing open pit.

We are looking forward to comb through the final technical report, and will share our findings with you once the report will be filed.

Go to Metanor’s website

The author has a long position in Metanor Resources. Metanor is a sponsor of the website. Please read the disclaimer