Duran Ventures (DRV.V) has issued a total of 1.067 million shares to settle a total of C$96,000 in outstanding debt. This means the shares were issued at a deemed price of C$0.09 per share, which is actually very reasonable compared to other shares for debt deals which usually include a substantial discount on the share value.

This shares for debt deal is actually pretty important as Duran Ventures will have to do something to bolster its balance sheet again. At the end of March 2017, it had just C$26,000 in cash left, resulting in a negative working capital position of C$368,000.

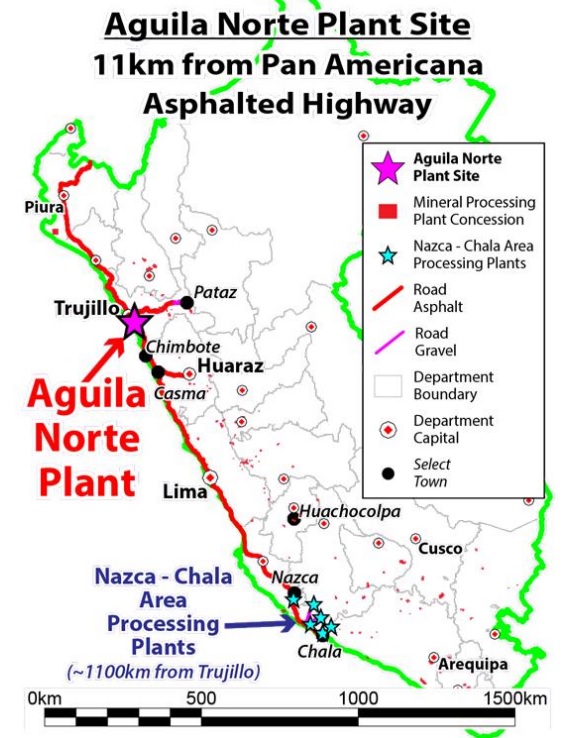

It also explains Duran’s ‘rush’ to sell off assets as the C$100,000 cash inflow related to the sale of the Don Pancho and Ichuna properties will have been very welcome for Duran, which is still working to get the Aguila Norte plant at full capacity.

A first batch of concentrae was sold in April, and Duran expected to receive approximately US$141,000 (almost C$200,000) from the sale of these concentrates, of which 80% will be attributable to Duran Ventures. Duran continues to process third party rock whilst it’s still negotiating to secure new sources that could provide mineralized rock to the plant. In an April update, Duran said these additional purchases would start in May (undoubtedly funded by the cash proceeds from the sale of the first batch of concentrate), aiming for the plant to reach full capacity by the end of June.

The clock is ticking for Duran Ventures, and although Jeff Reeder and his team are doing their best to minimize the impact on their shareholders, we cannot rule out another private placement to create some breathing room.

Go to Duran’s website

The author has a long position in Duran Ventures. Duran Ventures is a sponsor of the website. Please read the disclaimer