After several difficult years, it looks like Base Resources (ASX:BSE, LON:BSE) is finally turning a corner as it reported a net income and a very strong cash flow result in its financial year 2017 which ended on June 30th.

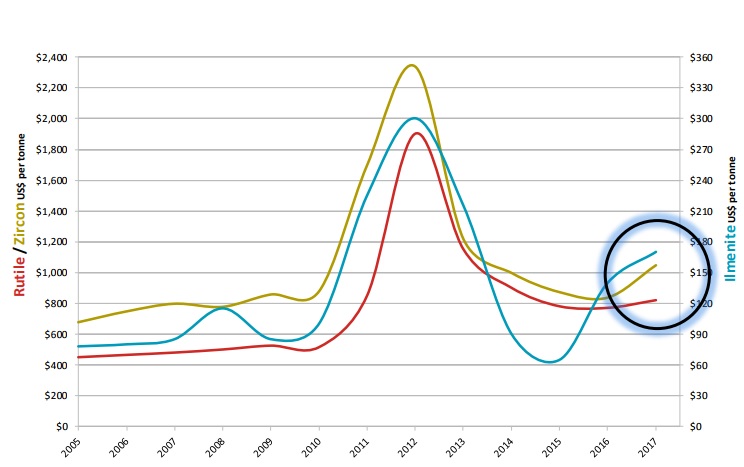

During FY 2017, Base shipped 502,000 tonnes of ilmenite, 92,000 tonnes of rutile and almost 35,000 tonnes of zircon, which is a moderate increase compared to the previous year. Fortunately the commodity prices were cooperating as the average received price increased by approximately 25%, whilst the total production cost fell by almost 3% to just US$88/tonne.

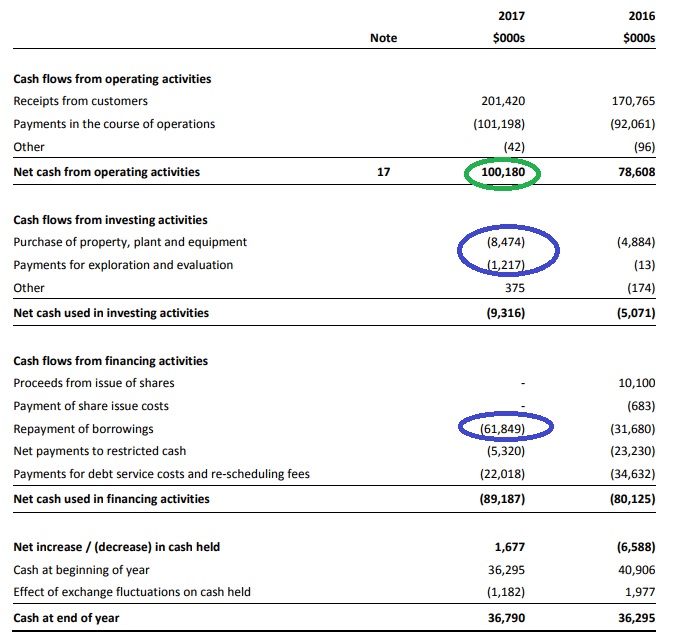

Both elements had a really important impact on the company’s performance and after reporting a net loss of A$21M in FY 2016, Base was now very profitable as it reported a net income of A$21M or 2.85 cents per share. On an adjusted basis (excluding working capital changes but including àll financial charges), Base generated A$79M in operating cash flow, resulting in a free cash flow of approximately A$70M which was almost entirely used to reduce Base’s net debt.

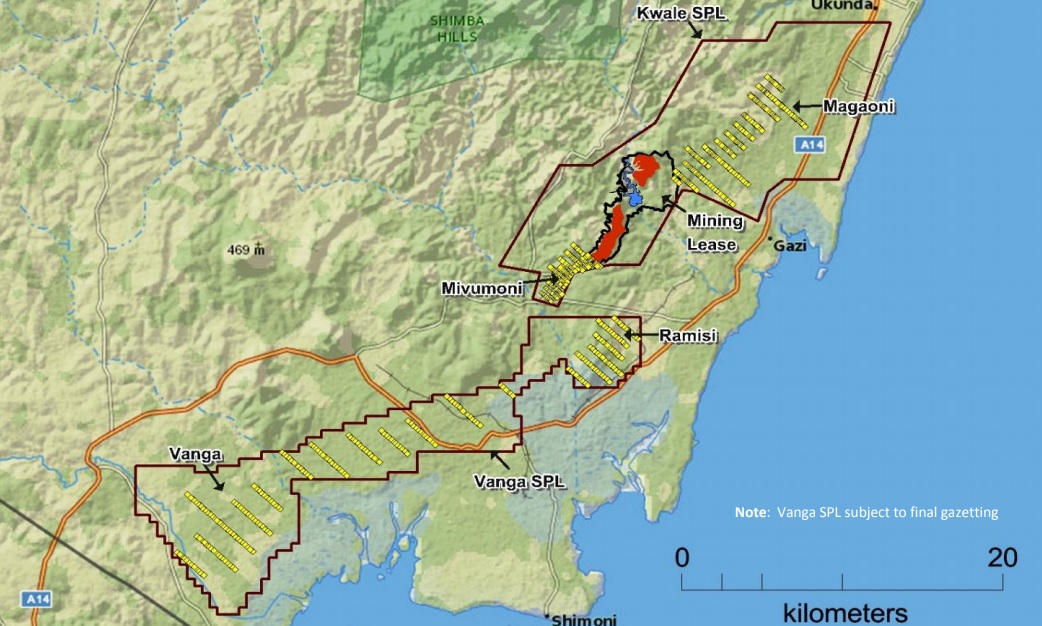

At the end of June, Base’s cash position remained stable at A$36.8M (with an additional A$34M in restricted cash) but the gross debt decreased from A$258M to A$192M, reducing the net debt position to less than A$125M if you take the restricted cash into consideration as well. This means that Base could be debt free within two years if it’s able to keep its margins up. Base’s market capitalization is just 3.5 times its free cash flow, and even looking at its enterprise value, Base Resources is trading at just 5 times its free cash flow. This seems to indicate the market is discounting Base’s plans to extend the mine life at Kwale beyond 2022.

Go to Base’s website

The author has no position in Base Resources. Please read the disclaimer