Panoro Minerals (PML.V) continues to work on its fully owned Cotabambas copper-gold-silver project in Peru, and it has now released excellent assay results from its Petra target where the drill bit intersected 79 meters containing 0.32% copper, 0.08 g/t gold and 2.2 g/t silver in an interval starting at surface. The mineralization appears to be oxidized which could perhaps be beneficial to a plan to start the development of Cotabambas by bringing the oxide zones into production before tackling the sulphide mineralization.

In a second hole, drilled at Maria Jose 1, more oxide mineralization was discovered with almost 113 meters at 0.23% copper, 0.02 g/t gold and 1.1 g/t silver. The grade is low, but depending on the metallurgical qualities of the rock, it could be fairly cheap to (mine and) process the rock. An average grade of 0.3% copper has a rock value of just over $21/t using a copper price of $3.25/lb and this could provide some optionality.

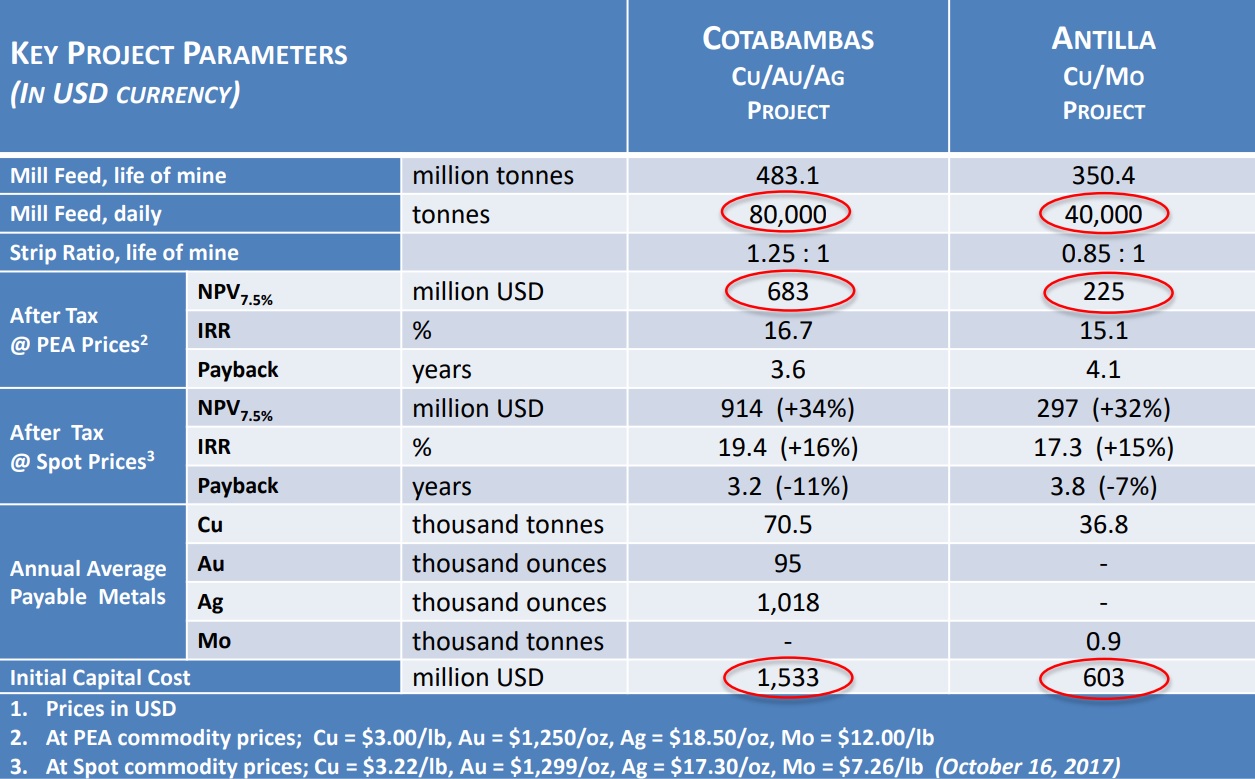

Of course, the big prize consists of the sulfide zones at Cotabambas. At a copper price of $2.5 per pound, Cotabambas wouldn’t be viable (well, it would be ‘viable’, but it would have been very tough to secure construction financing), but the economics look pretty decent at $3 copper. The after-tax NPV7.5% is approximately $684M with an Internal Rate of Return of 16.7%. The IRR is low, but as the total mine life is in excess of 16 years, this type of project could be attractive to more senior copper producers which have the financial resources to fund the initial $1.53B capex.

Go to Panoro’s website

The author has no position in Panoro Minerals. Please read the disclaimer