Western Australia has been getting quite a bit of attention in the past 18 months as a company called Novo Resources (NVO.V) claimed the region could host a new ‘Witwatersrand gold basin’ as the sedimentary and volcanic rocks appear to be the same age as the Witwatersrand reefs in South Africa. All you need is a hype and a strong desire to make a discovery, and Novo’s market capitalization increased from less than C$100M to in excess of a Billion.

Some people are still comparing the opportunity to invest in Novo to ‘buying bitcoin at 12 dollars’, but rather than ‘betting’ on an already mature company where the C$1B market cap skews the risk/reward ratio, it could make sense to look further down the chain for promising exploration companies targeting the same structures.

A number of junior exploration companies seem to be attempting to gain control of key land close to Novo, and be valued on the land position they acquire. If the geological and technical model created and being explored currently by Novo is correct, other companies in the area could be rerated based on proximity to and claim sizes to Novo. As we have seen, the “Pilbara Gold Rush Fever” has attracted many juniors but one seems to be have been particularly busy in the past few weeks.

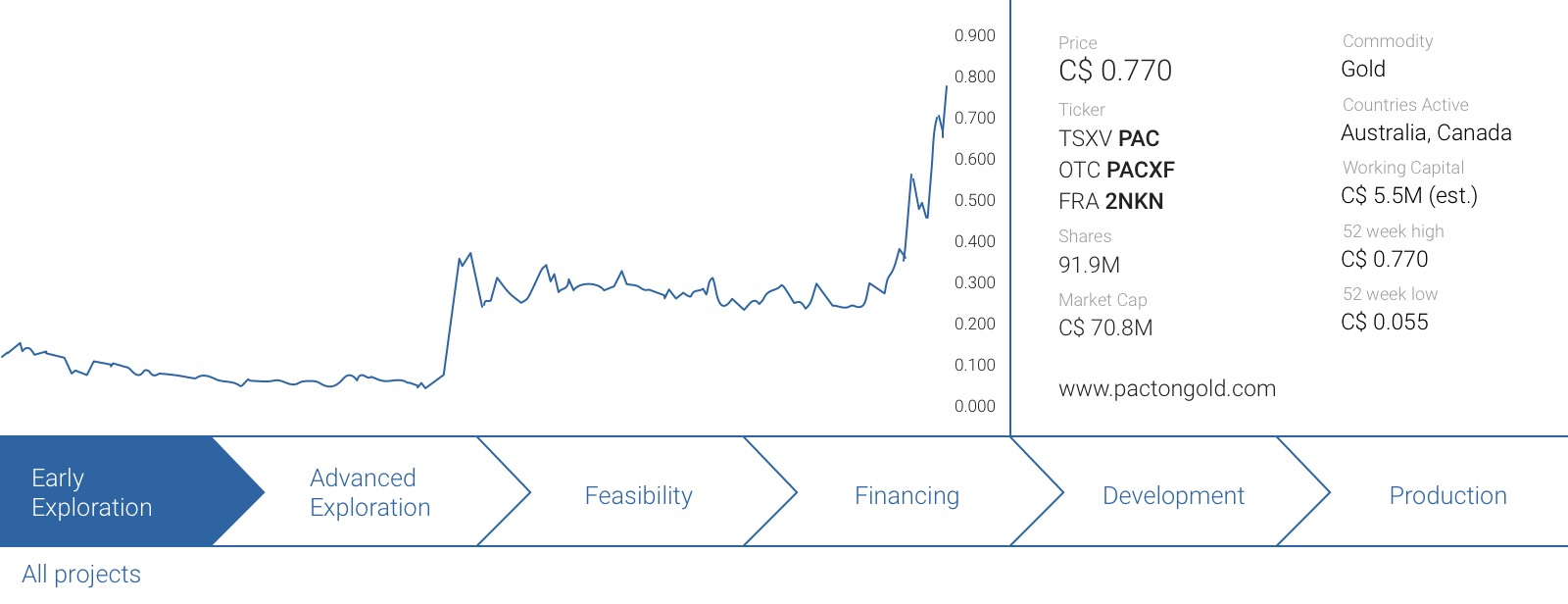

Entering the scene: Pacton Gold (PAC.V), the reincarnation of what was previously called Noka Resources Inc. The roll-out of the newly named Company started slowly but with a big kicker, naming Mr. Alec Pismiris as Interim President & CEO. Granted, he definitely is not a household name in Canada, where Pacton’s corporate headquarters are, but “Down Under”, Pismiris is a name that is highly recognized in the mining sector as several companies he was involved with made large multi-million ounce gold discoveries. Despite announcing an Australian Big Shot as President & CEO, Pacton became quiet after this November 2017 appointment.

We spoke to the Pacton Team and it appeared they started on the acquisition trail, as they believed the opportunity in the Pilbara was still there as Novo’s exploration results could allure more companies to the region. In February 2018, Pacton started to put its land package together, Sprott Capital Partners became advisors and the company recently completed an oversubscribed financing where after gold bug Eric Sprott ended up with an 18% stake on a fully diluted basis.

Thanks to this financial backing, Pacton Gold is now well-financed to start its exploration program in Australia.

Why the Pilbara region?

The Pilbara gold rush started in 2016, when a new gold discovery was made around Karratha, a town in Western Australia. Geologists came to the conclusion the gold appeared to be coming from the conglomerates underlying parts of WA, and soon a new claim-staking rush was on its way. Novo Resources, led by respected geologist Dr. Quinton Hennigh, was probably one of the first companies figuring out the geological setting, and it provided a nice graphical overview of its theory in their corporate presentation:

And what exploration companies really are looking for are the zones where the older Pilbara greenstone rocks are in direct contact with the Fortescue Group rocks. Those are the ‘hot spots’ where gold nuggets generally occur.

Expanding the Western Australia Pilbara land position

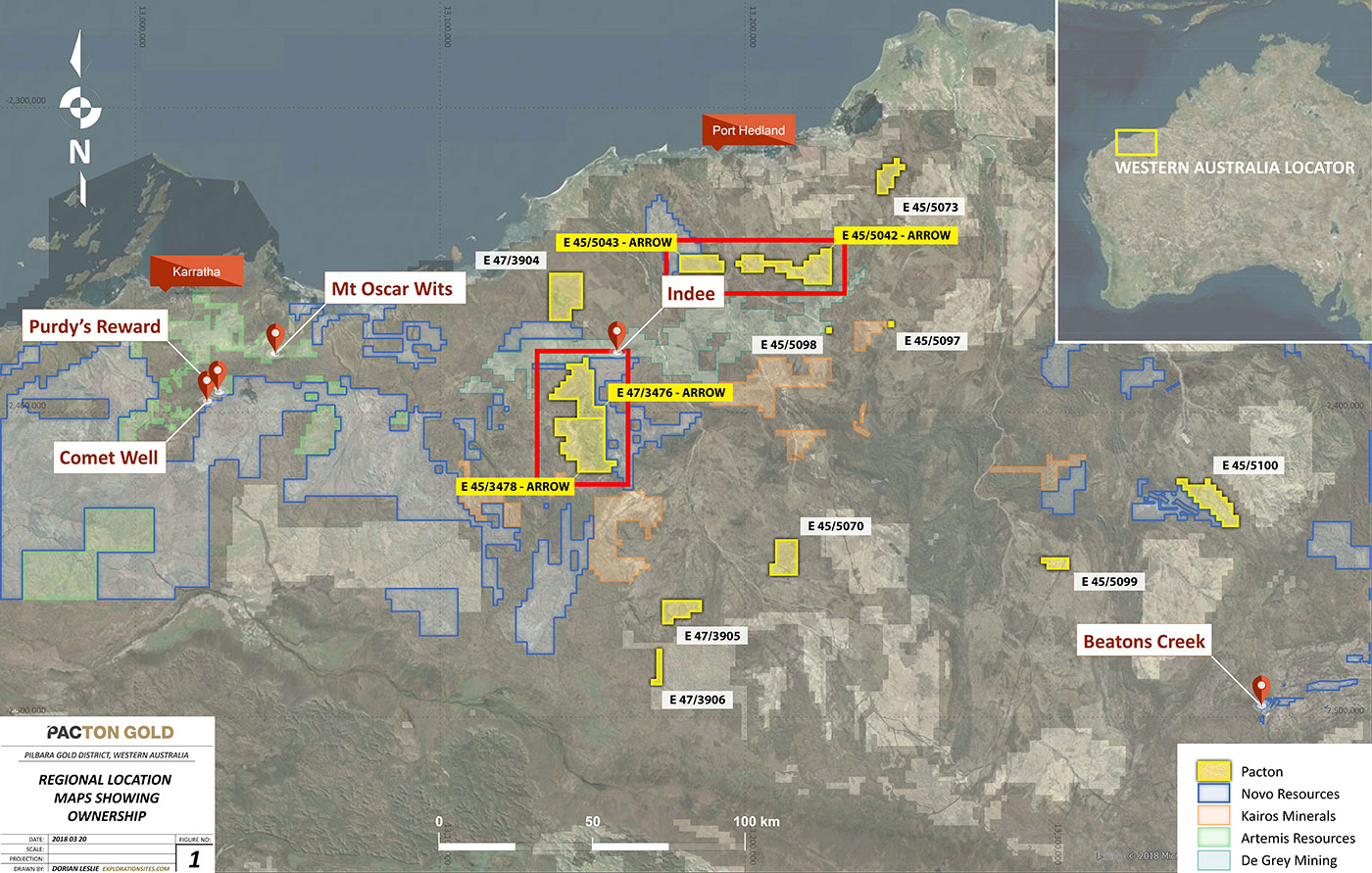

Pacton Gold has been building its strategic land position in Western Australia in three different stages through three different acquisitions.

Transaction 1: The CTTR tenements

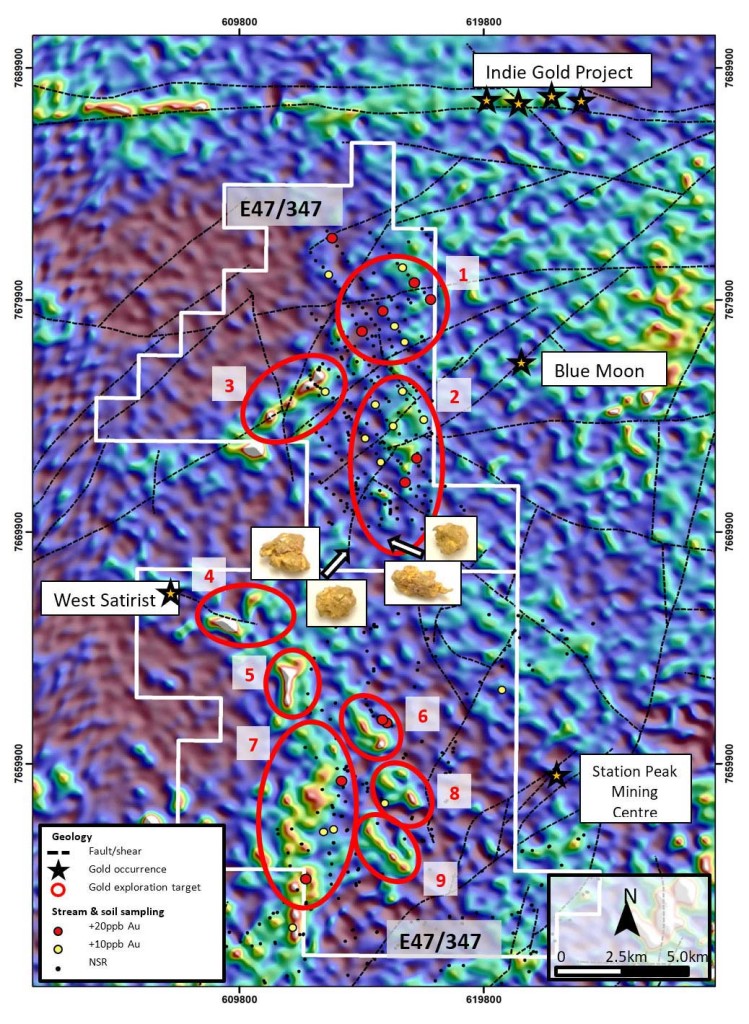

As a first baby step, Pacton acquired applications to a 492 square kilometer land package from CTTR Gold. CTTR was a newly-formed company with the purpose of putting a land package together in Western Australia’s Pilbara region. The acquisition consists of nine land claims, which were directly adjacent and proximal to the main properties controlled by De Grey Mining, Novo Resources and Kairos Minerals.

One of the first things Pacton would like to do on these tenements is to figure out if there’s a northern extension of the Mallina Basin gold occurrence, where DeGrey Mining discovered a nugget-bearing conglomerate zone with a thickness of 5-80 meters.

The acquisition was relatively cheap: Pacton will pay an initial C$100,000 in cash and will issue 916,666 shares (and half that number in warrants exercisable at C$0.45 for a period of 18 months). When at least six of the applications have been converted into exploration licenses, Pacton will pay an additional C$50,000, and issue an additional 416,666 shares (and 208,333 warrants, exercise price to be determined, as it will be 150% of the 5-day VWAP of the Pacton stock before the warrants are being issued). It was a first good step, but although this highlighted a new company was entering the Pilbara region, the market didn’t really care – perhaps also because ‘big brother’ Novo Resources was relatively quiet as well.

Transaction 2

Again under the radar, Pacton completed a second deal, which was announced just two days after receiving exchange approval for the first acquisition. Pacton Gold entered into a Letter of Intent with Arrow Minerals (ASX:AMD), whereby Pacton could earn an 80% stake in a Pilbara property with a total surface area of 609 square kilometers.

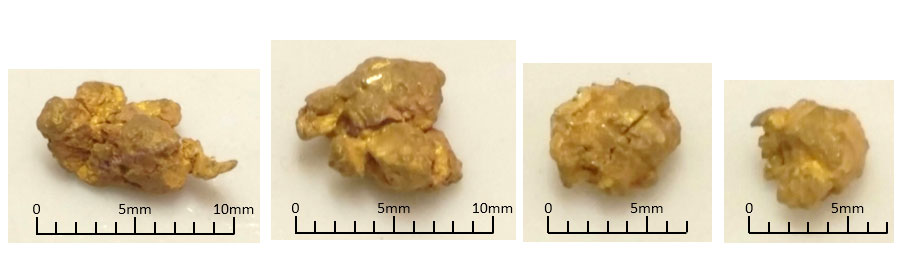

This is an even more attractive acquisition than the first transaction, as actual gold nuggets have been found on this property. Sampling outcropping conglomerates yielded several nuggets with sizes ranging from 0.5-1 centimeter. Needless to say this area is very prospective as well: not only is it directly adjacent to the Pilbara properties of the three other key players (Novo Resources, DeGrey Mining, Kairos Minerals), there’s zero doubt there actually is gold on the property. Not only did Arrow Minerals find gold nuggets, the entire land claim shows evidence of prospector activity.

Pacton could earn an initial 51% stake in the Arrow tenements by making a cash payment of C$500,000 and issuing C$250,000 worth of stock, followed by an additional C$250,000 in stock and the commitment to spend C$0.5M on exploration to earn the 80% stake.

Once Pacton has reached that 80% threshold, it will have to carry Arrow Minerals through the first C$5M in exploration expenditures made on the property. Note, Arrow Minerals retains all mineral rights on lithium, cesium and tantalum that could be mined from the property. But that’s fine, as Pacton is only interested in the gold anyway.

Now Pacton controlled in excess of 1,100 square kilometers in the Pilbara region, and the market still didn’t care about it too much. Until…

Strategic Financing

Despite a subdued market reaction on the land acquisitions, Pacton seemed to have gained the interest of the investment community, including Eric Sprott. The company quickly closed an oversubcribed strategic financing, rejecting several potential participants in the process to protect the share structure. Now the treasury has been topped up, Pacton could start to look at other accretive acquisitions to become an even larger player in the Pilbara. PAC didn’t waste any time and almost immediately announced a third acquisition in the Pilbara region.

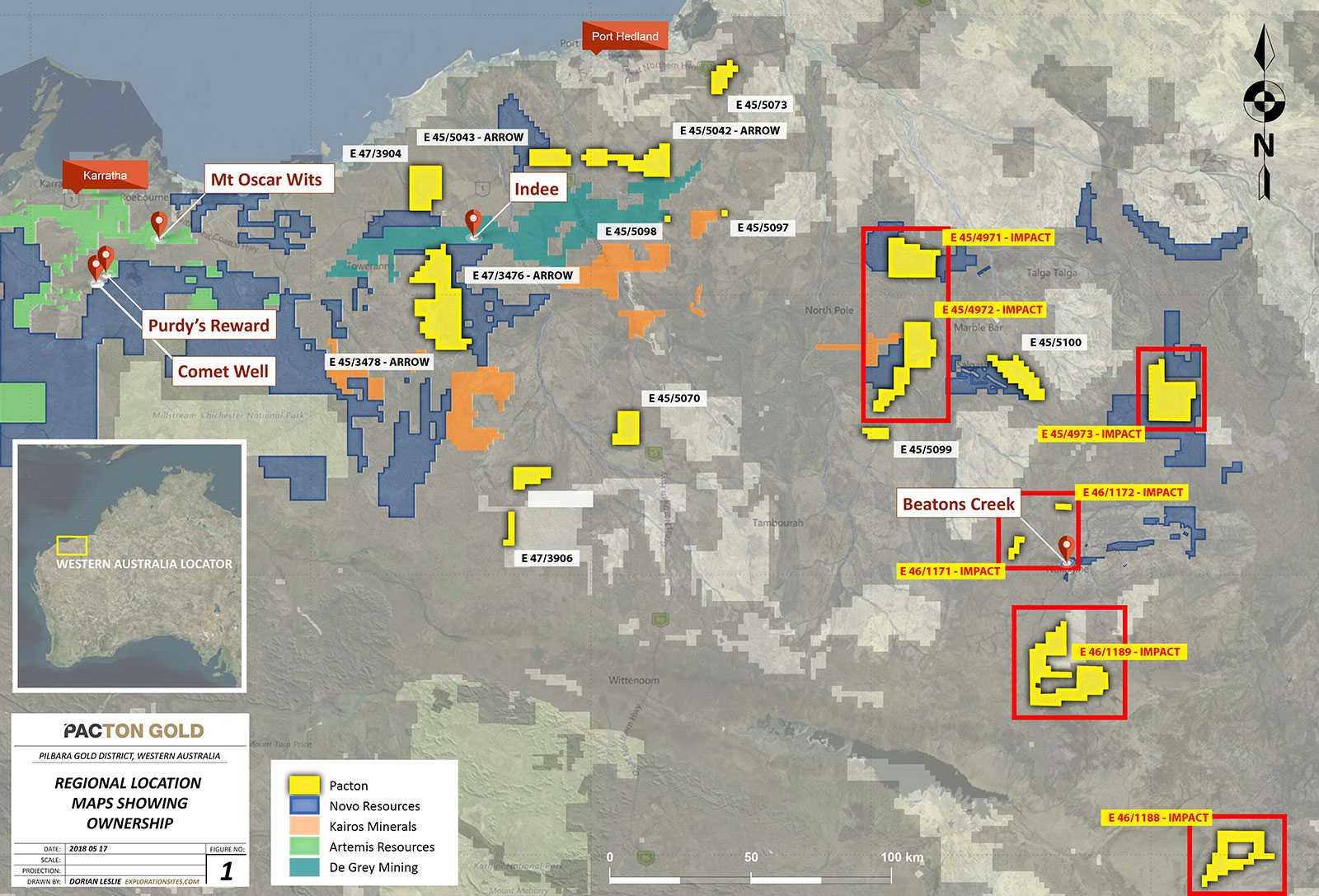

Transaction 3

The third acquisition catapulted Pacton to the status of having the third largest land position in the Pilbara region. And the market really liked this deal as Pacton’s share price increased by 30% on the day of the announcement.

Pacton will acquire 1,126 square kilometers of licenses (which brings its total Pilbara land package to 2,227 square kilometers) from Impact Minerals (ASX:IPT). And once again, Pacton carefully selected the properties as these additional licenses are also adjacent to some of the Kairos and Novo tenements.

This also appears to be the property with the liveliest exploration history: the existence of at least 90 kilometers of Fortescue Group conglomerate close to surface or even at surface has already been confirmed whilst two conglomerates have already been discovered. These two conglomerate zones are pretty similar to the Witwatersrand type of mineralization, which is the specialty of Dr. Mike Jones, Impact Minerals’ CEO and leading geologist with decades of experience with Witwatersrand types.

At the Glen Herring prospect, a sampling program – conducted 30 years ago – discovered gold grades of up to 11.2 g/t from a conglomerate with a strike length of approximately 10 kilometers, whilst one drill hole at the Shady Camp Well prospect discovered anomalous gold values at a depth of 174 meters. 0.9 meters at 0.6 g/t isn’t exciting at all, but keep in mind these conglomerate-hosted zones can’t really be explored by conventional methods. It’s not unlikely the sniff of gold (0.6 g/t) is related to the existence of a ‘halo’ around the nugget-rich zones, and one drill hole clearly isn’t sufficient to form a decent opinion on this prospect.

The strike length of these conglomerates are already very decent, but apparently they just continue outside of the Impact Minerals license as Novo Resources sampled 15.9 g/t gold at its Contact Creek zone, which is located directly west of one of the licenses that are being acquired from Impact Minerals.

And once again, Pacton seems to have negotiated a very fair deal. The initial payment for the properties is just C$350,000 in cash and 2.125 million shares of Pacton. However, Impact Minerals also required a ‘bonus’ just in case Pacton is indeed successful in outlining a resource. Should Pacton have in excess of a quarter of a million ounces of gold in any resource category, an additional C$500,000 payment will be due, whilst Impact will also walk home with a 2% NSR. A small price to pay, should Pacton indeed be able to report a mineable resource.

And just to summarize: this is a schematic overview of the earn-in terms of all three acquisitions:

The exploration plans for 2018

Pacton Gold is now fully cashed up (see later) and will hit the ground running in 2018. On the CTTR tenements – which were acquired first), Pacton will start doing the basic things (as soon as the exploration licenses have been granted), and a substantial sampling program (consisting of rock chip sampling, soil sampling and stream sediment sampling) could hopefully point Pacton Gold in the direction of discovering a ‘nuggety’ conglomerate zone.

Having the ‘second mover advantage’ in the Pilbara region

As the gold in the Pilbara region is predominantly found in conglomerates, there was a lot of education to be done. Novo’s main issue in the past few years was how to explain to investors that any potential mining operation would be relatively unconventional (compared to Canadian and Australian standards). Exactly due to the ‘nuggety’ occurrence of the gold (gold in the Pilbara region occurs as primary nuggets, surrounded by gold haloes), it will be virtually impossible to compile a resource estimate to today’s standards.

Very few independent consultants will be willing to sign off on resources on extremely nugget deposits as the grade variations mean that mining Pilbara tenements will be a real case of ‘the proof is in the pudding’. A ‘mine as you go’ strategy will very likely be the only one that works, that’s why Novo deemed its 300-kilogram sample size to be insufficient in size. But 5 tonnes might give a much better representation of the expected average head grade. Production numbers and cash flows will be erratic, and that’s something the market had some difficulties to wrap its head around.

Another example: Novo has already conducted a recovery test, which determined mechanical ore sorting very likely will be the most efficient way to mine these types of deposits. In excess of 80% of the gold was recovered in just 2% of the total mass, providing a higher grade feed for further processing. A small detail, but it definitely will make Pacton’s life easier as it can piggyback on the preliminary findings of big brother Novo Resources (which is also being backed by Eric Sprott).

And that’s why we think being the ‘second mover’ could actually be positive for Pacton Gold. The first mover (Novo Resources) has done the tough job of preparing and educating the market for these type of deposits, and the ‘mine as you go’ concept will slowly sink in with the investor community. Pacton Gold is still years away from production, and probably won’t have to jump through the same hoops and deal with the same issues like Novo had to do.

Pacton is now fully cashed up after raising C$5.5M

The Pilbara region remains very hot, and this was evidenced by Pacton Gold’s most recent capital raise. Right after announcing a deal to acquire a second set of gold properties in the Pilbara region, Pacton Gold announced a C$4M placement but immediately had to increase the size to C$5.5M due to a very strong demand.

The placement priced at C$0.23 per unit, with each unit consisting of one share and a full warrant, valid for three years, with an exercise price of C$0.35 per share. A placement ‘priced to sell’, indeed, and it attracted some heavy hitters. After closing the C$5.5M raise, Pacton Gold announced Eric Sprott purchased 8.7 million units after writing a cheque for C$2M. This results in Sprott owning just over 10% of the company’s share count, potentially increasing to just over 18% when Sprott exercises his warrants (which are already way in the money).

Hardly a surprise as Eric Sprott has been one of the most vocal backers of Novo Resources and remains a big believer in the Pilbara gold systems.

After this financing round, Pacton Gold’s share count increased to 87.9 million shares (which still is very reasonable), and the cheap full warrant also has an additional consequence. It’s not unlikely some of the warrant holders will start exercising their warrants after the initial 4-month hold period is over. And whilst we aren’t expecting a wave of sellers (the liquidity is really good, and with a weekly volume of 4-5 million shares it looks like the market should be able to absorb anything that’s being fed into it), a constant stream of warrant exercises could keep the treasury relatively filled. Should all warrants be exercised, an additional C$8.5M will hit the bank account.

A strong and experienced management team

The owners of Pacton Gold did a thorough job in converting the company from what basically was a shell to a gold exploration company. A first step was made in November last year, when the company announced Alec Pismiris as its new CEO and interim president.

The owners of Pacton Gold did a thorough job in converting the company from what basically was a shell to a gold exploration company. A first step was made in November last year, when the company announced Alec Pismiris as its new CEO and interim president.

Whilst a CEO announcement doesn’t usually indicate much, it was interesting to see where Pismiris was coming from. Although he didn’t occupy executive roles, he was involved with numerous successful gold exploration (and development) companies in the recent past. Pismiris was a founding shareholder of Papillon Resources (sold to B2Gold, which has started production on the Fekola gold asset in Mali) and Cardinal Resources (which will publish an updated PEA on its multi-million-ounce open pit project in Ghana in the next few weeks).

Pacton is also looking to add more experts to the management and board to assist with the ongoing development of its activities in the Pilbara.

The company recently announced Mr. Alf. Stewart joining the Board, who is currently President of BlueBird Battery Metals Inc. (BATT.V), focused on the Cobalt-Nickel-Copper battery metals. Stewart, a geologist, brings over 40 years in the technical and capital markets and actually helped finance a number of ‘Australian’ deals in his days as a broker with Canaccord and Haywood.

Management indicated they just came back from a 10-day tour of projects in Australia and are hoping to make other acquisitions when the timing is right. And considering Pacton’s recent acquisition had a positive impact on the share price and trading volumes, it looks like the market is finally waking up.

Conclusion

We don’t like to surf on the waves created by hypes, but Pacton Gold has been able to put a large land position together in just a few months. Of course, Pacton is and should be seen as an early stage exploration company but with proven gold (nugget) occurrences on several of the tenements it purchased/is earning in to. It is clear that there’s a lot of smoke in the Pilbara region and now it’s up to Pacton Gold to find the source of that smoke.

We think having Novo Resources as first mover could be beneficial to Pacton Gold, as Novo will do all the heavy lifting in terms of A) educating the market and B) designing the exploration programs as efficient as possible. We know the conventional exploration and processing techniques very likely won’t work on a nuggety type of deposit.

But one thing is pretty clear. With Novo Resources trading at a market cap of C$1B, Pacton Gold’s current market capitalization of approximately C$70M seems to be offering a more enticing risk/reward ratio.

Disclosure: Pacton Gold is a sponsor of the website. Please read the disclaimer