Northern Empire Resources (NM.V) has entered into an agreement with Coeur Mining (CDE), whereby the latter will acquire all of NM’s shares it doesn’t already own. Coeur is offering an all-share deal which values the Northern Empire shares at C$1.64 based on yesterday’s closing prices of both companies. The premium might seem to be a bit on the lower end (just 20% based on the closing prices and 40% based on the VWAP) as especially the VWAP premium isn’t an acceptable metric considering Coeur’s share price collapsed after it reported its financial results just a few days ago. This means the 20 day VWAP price contains 15 days of Coeur trading at US$8/share, and 5 days of Coeur trading at just US$7/share.

However, this also means that if Coeur’s pre-crash share price of US$8 would be used, Northern Empire’s shares would have been valued at approximately C$1.95/share, which would be a heftier premium. So in a way, we think the recent weakness in Coeur’s share price has been bad for the ‘optics’ of this deal. If it would have been announced just two weeks earlier at a similar exchange ratio (Northern Empire shareholders will receive 0.185 shares of Coeur per share of Northern Empire), the C$1.90-2 price tag for NM would have seemed to be more impressive.

It’s pretty much a ‘done deal’ as the board of directors is unanimously supporting the sale, and the board and management have committed to tender their 8% stake in the company to the bid. It will also be interesting to see how much cash the Northern Empire management will take home as part of the ‘change of control’ termination clauses in their employment contracts, as that will have had an impact on the decision making process as well.

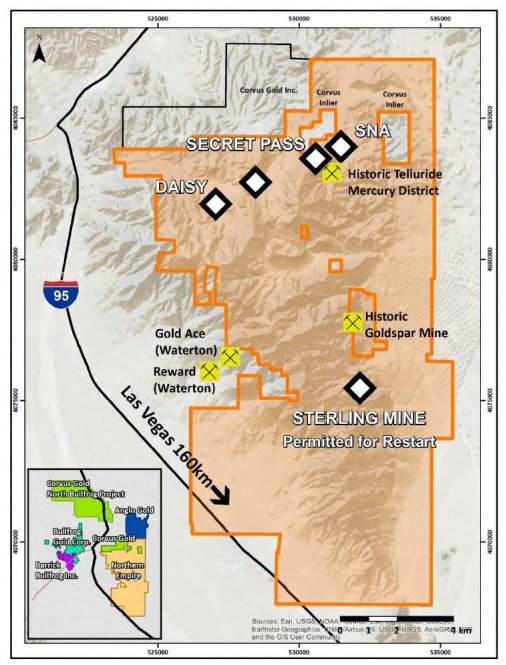

That being said, the relatively low break fee of C$4.7M (which represents just 4% of the transaction value) could perhaps entice a second bidder (Newmont Mining (NEM, NEM.TO)? Perhaps Corvus Gold (KOR.TO) in a merger?…) to show up. But that would be just pure speculation.

As one interesting Nevada junior will now be removed from the playing field, it will be interesting to see where the current shareholders of Northern Empire will ‘park’ their money. Will they invest in other Discovery Group deals (Great Bear Resources (GBR.V) released the results a very interesting hole in the Red Lake gold district earlier this week, encountering 16.8 meters of 5.6 g/t gold , whilst Bluestone Resources (BSR.V) is still aggressively advancing its Cerro Blanco project in Guatemala)? Or will the money flow towards other Nevada-based exploration companies like Contact Gold (C.V) or NuLegacy Gold (NUG.V)? Because the Northern Empire sale should be seen as a C$100M liquidity event (the C$120M deal value minus the value of existing stakes of Coeur and the Northern Empire management team).

Go to Northern Empire’s website

The author has a long position in Northern Empire and plans to sell it in the market. Please read the disclaimer