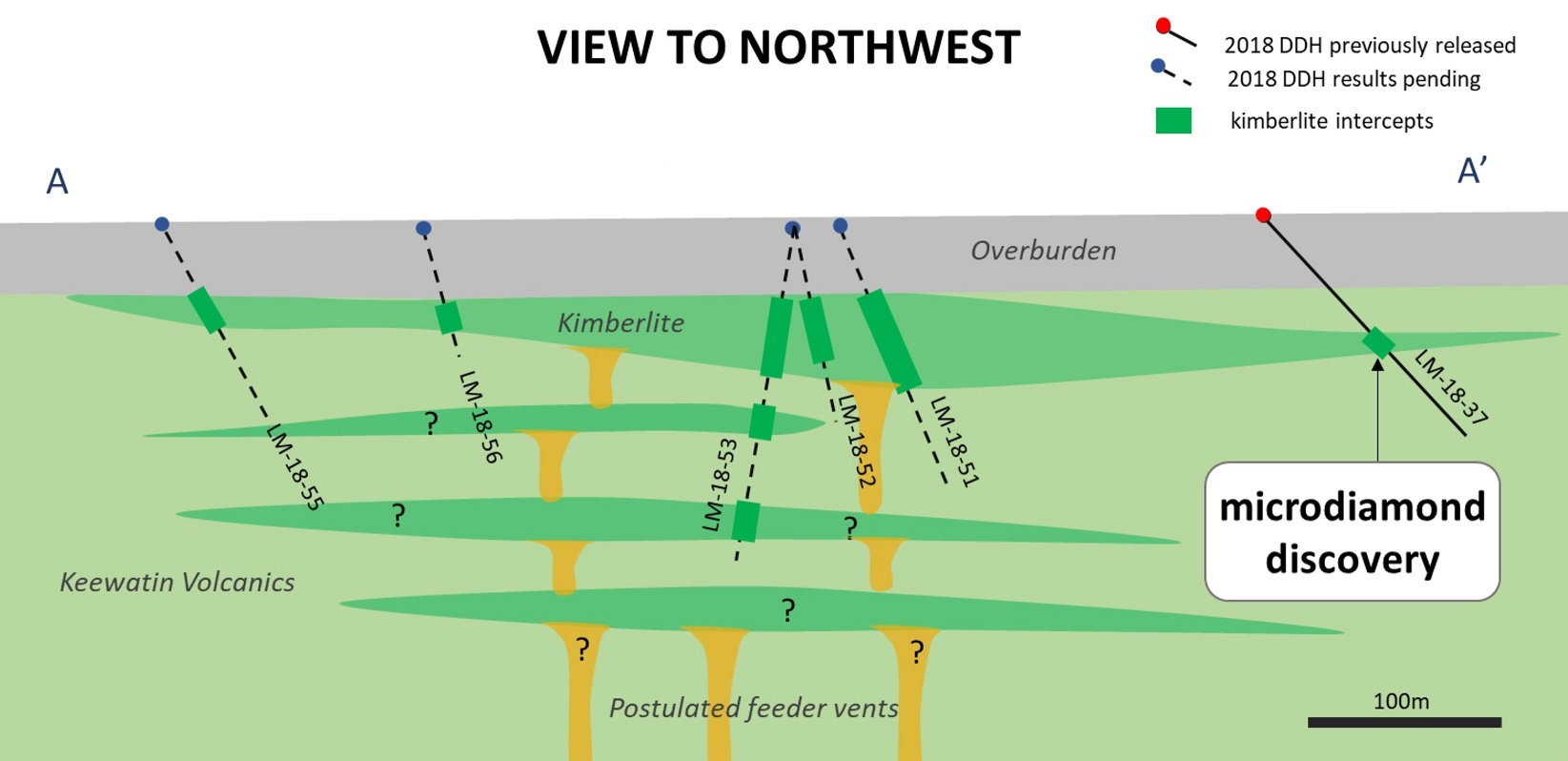

Brixton Metals (BBB.V) has successfully completed a drill program on the kimberlite target at its Langis project in Ontario, as 10 of the 11 holes effectively contained kimberlite. The current surface area of the kimberlite zone is approximately 20 hectares (0.2 square kilometers) and has an average thickness of 20-70 meters, but the ongoing drill program could extend the kimberlite zones even further.

This is an interesting find, and Brixton Metals is now discussing the drill results with diamond experts to figure out what the potential is of this new near-surface discovery. Some of the current holes will very likely target some deeper zones of the kimberlite structures in an attempt to intersect the feeder vents.

Although the main focus will be on the massive Atlin Gold Camp in 2019, Brixton will very likely continue to work on the kimberlite zones to get a better understanding of this system. To fund the 2019 exploration activities, Brixton Metals is raising C$2M in a hard dollar and flow-through placement whereby the hard dollar financing has been priced at C$0.15 per unit, with each unit consisting of one common share as well as a full warrant with an exercise price of 25 cents, valid for a period of two years. There’s an accelerator attached to the warrants which accelerates the expiry date should the company’s share price trade above C$0.50 for at least 20 consecutive days. The flow-through shares were priced at C$0.17 but don’t have a warrant attached.

Brixton Metals anticipates to close this financing on December 18th, and could upsize it from C$2M to C$2.5M. It’s our understanding the order book is already getting close to the initially eyed C$2M, so we wouldn’t be surprised to see the company effectively increases the size of its financing.

Go to Brixton’s website

The author has a long position in Brixton Metals. Brixton is a sponsor of the website. Please read the disclaimer