2018 is almost over and it wasn’t a great year for the natural resources sector. Some metals did very well, but this didn’t mean the share price of the companies moved along with the commodity price increases. Gold appears to be ending the year on a (relatively) strong note, but the gold equities remain weak. Silver and oil seem to have found a bottom but the equity markets still appear to be a bit cautious.

The tax loss selling season is almost over, and we think that whoever wanted to sell, has already sold by now, which could indicate the share prices may stabilize from here on and could benefit from investors taking new positions. UBS has recently released its precious metals outlook for 2019, and it’s interesting to see the Swiss bank is now expecting the gold price to average $1300/oz in 2019. That would be a great result for most gold miners and developers, but the UBS report doesn’t really provide any support for the silver sector. The bank has slashed its 2019 silver price forecast from $17/oz to just $15.8/oz, and it looks like we will see some more mine closures in 2019 as some miners can no longer justify keeping some of their mines open due to selling their silver at a loss.

Caesars Report is able to exist thanks to the companies sponsoring our mining portal. In this special exploration outlook report we are highlighting our sponsoring companies and have asked them the same three questions; how was 2018, what do you expect for 2019 and what are your projections for the commodity you focus on? All answers were provided by the companies and we pulled the other data (share count and cash position) from the company’s most recent presentations.

Enjoy the read, and happy holidays!

Aben Resources

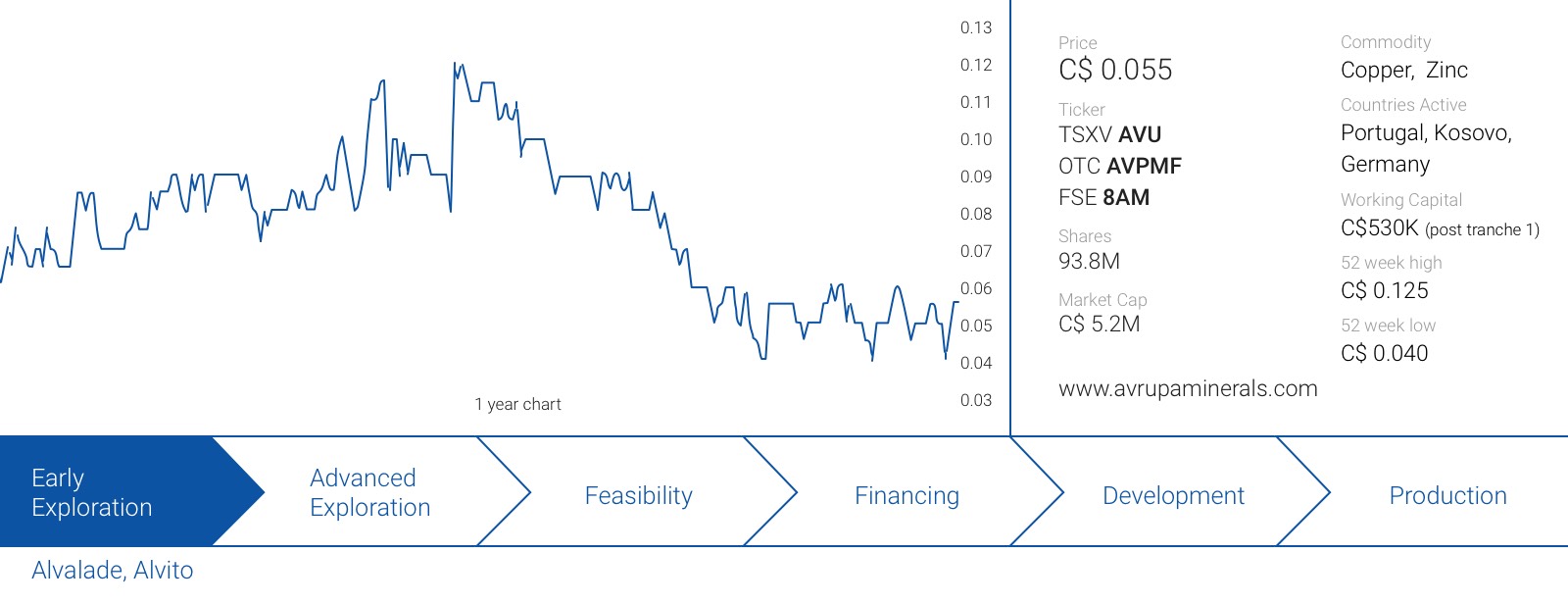

Avrupa Minerals

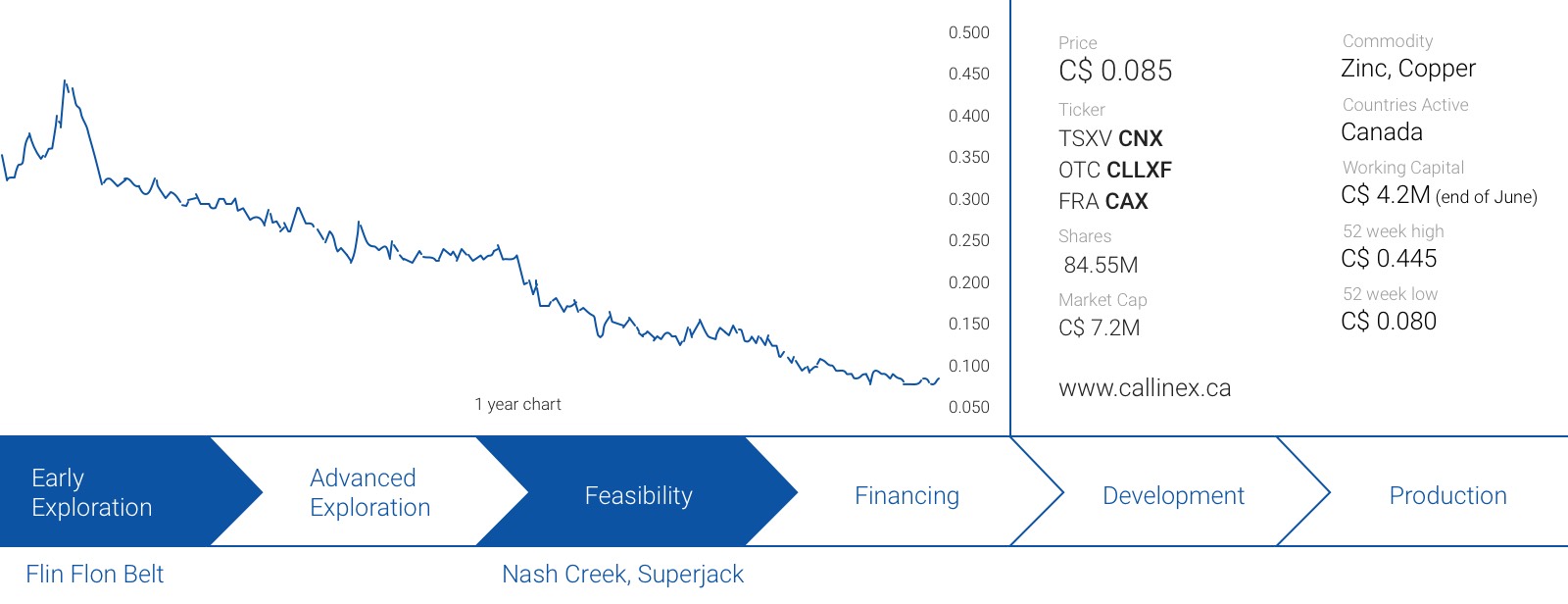

Callinex Mines

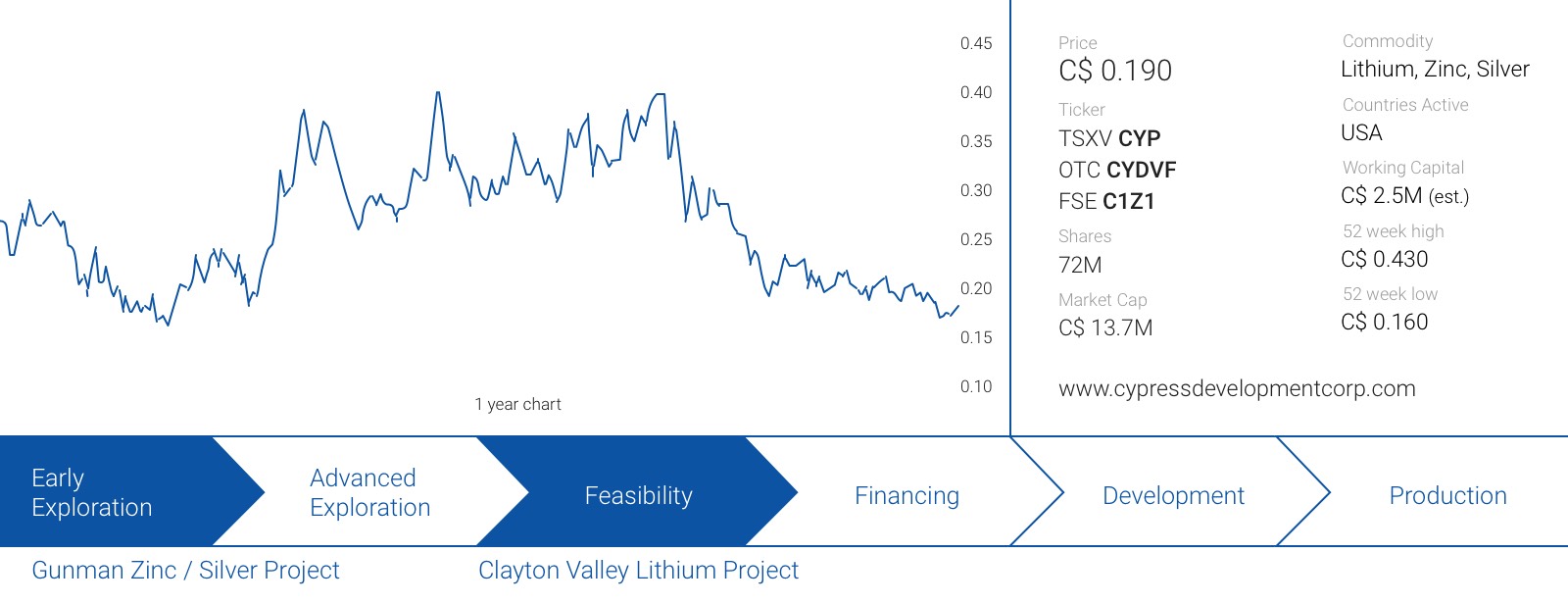

Cypress Development

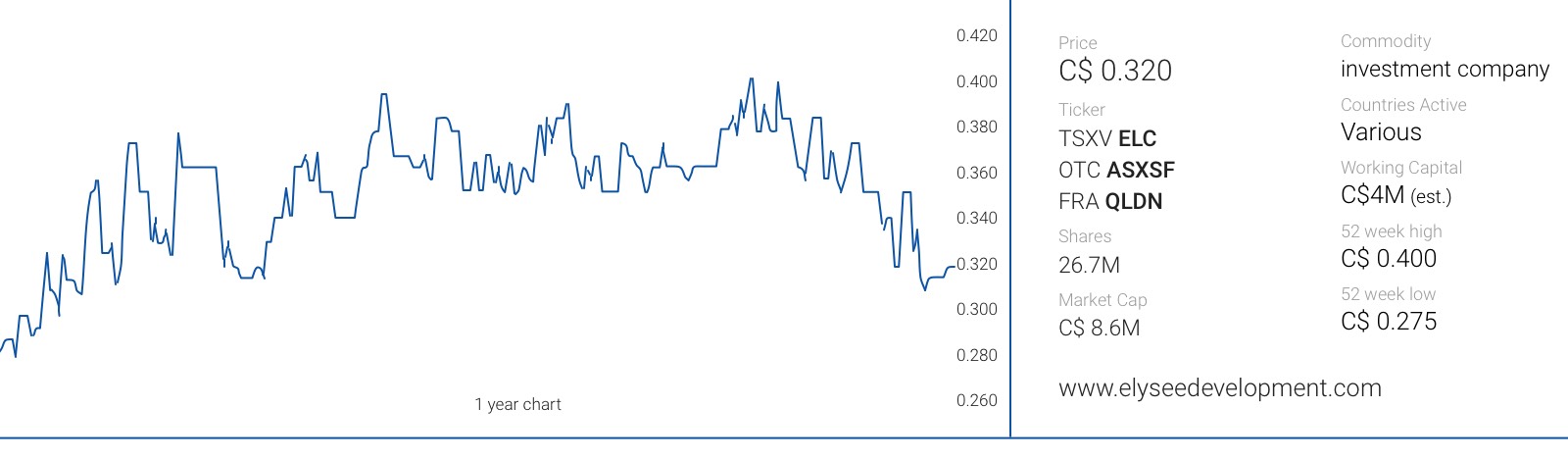

Elysee Development

Great Bear Resources

Aben Resources (ABN.V) had a roller coaster year as excellent initial drill results with high-grade gold sent the stock soaring over the summer, but the market appeared to be unimpressed by the follow-up drill results. Aben’s management team was smart enough to cash up on the back of the good drill results, and approximately half of the current share price is backed by hard dollars in the bank. This means the company should be fully funded for the 2019 exploration season in the Golden Triangle, but it will also advance its Justin gold project in the Yukon and the Chico gold project in Saskatchewan. Getting back to work on the Saskatchewan project should help the company to provide a year-round news flow instead of being hindered by the seasonal exploration campaigns in the Golden Triangle.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Aben completed almost 10,000 meters of drilling at Forrest Kerr, the company’s gold project in British Columbia’s Golden Triangle. The company had a major discovery hole in August as drilling encountered 6 meters of 62.4 g/t gold within 10 meters of 38.7 g/t gold. The company is excited about these results and continues to work on the geological model at Forrest Kerr. The 9,900 meters of NQ drilling completed in 2018 will be a great help to connect the dots.

The geology is complex; however, ABN has plenty of cash in the treasury to continue to unlock the theory. After the initial excellent assay results, ABN was able to attract Eric Sprott as a new investor in Aben Resources. Sprott participated in a C$4.3M hard dollar financing priced at C$0.30, while the company raised an additional C$950,000 in flow-through funds at C$0.40. ABN currently has approximately C$5.5M in cash on the bank.

What will 2019 bring? What will you be working on and what budget do you have in mind?

ABN continues to drill the flagship Forrest Kerr gold project, but also expects to do some work on the Chico property in Saskatchewan (where ABN can earn an 80% stake) and the Justin gold project in the Yukon Territory where the company completed a field program last summer.

That field program indicated the presence of visible gold in trenches and channel samples, and the team on the ground thinks the type of mineralization it encountered could be similar to Golden Predator’s (GPY.V) 3 Aces property.

What’s your near-term and longer-term outlook for your main commodity?

With recent equity and credit market volatility, the price of Gold could be expected to perform well in 2019 and beyond.

We recently released a report on Avrupa Minerals (AVU.V) (read it here), which is a Europe-focused prospect generator focusing on gold and base metals. The majority of the company’s projects are located in Portugal where a drill program on the Alvalade project is currently underway. We asked Mark Brown, Executive Chairman, the same three questions.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

We had a very busy year in Portugal where we completed the field work and a drill program on our Alvito IOCG project. The activities were funded by OZ Minerals (OZL.AX) as part of their earn-in agreement. However, OZ dropped the option and returned the project to us after spending in excess of 1 million euros, even though the earn in was for AUD$1m.

We are also advancing our Alvalade project in Portugal which was drill-ready. We had initially hoped to complete some partner-funded work on Alvalade, but the final decision on the previously-announced 13M EUR option agreement with a major North American copper company hasn’t been concluded yet. We didn’t want to wait for Godot and are currently in the process of raising C$1.5M in a private placement priced at C$0.05. C$500,000 of the financing has already closed, and the two drill rigs have been mobilized to site where the drill program is well underway.

We are still hoping to complete that 13M EUR joint venture agreement which would include 10M EUR earmarked for Alvalade with an additional 2M EUR to be spent on Marateca and 1M EUR on Mertola. It’s needless to say this would be a major boost for our exploration plans on these projects.

What will 2019 bring? What will you be working on and what budget do you have in mind?

As our drill program on the Alvalade project is in full swing, we hope to have the assay results out in January/February and this will tell us more about our exploration theory. Irrespective of whether or not the Alvalade drilling yields the desired results, we will continue to pursue the 13M EUR option deal with the large copper company.

Also in Portugal we will review the assay results from Alvito and re-market the project to potential joint venture partners.

In Kosovo, we will be looking to monetize our interest in the Slivovo gold project, which we have been able to keep above the 10% threshold, the critical level before it would be converted into a 2% Net Smelter Royalty. If we are indeed successful in selling our stake, we anticipate reinvesting the proceeds in additional exploration programs in Kosovo, as we think this region provides excellent exploration potential.

While we are now mainly focused on Kosovo and Portugal, we are looking to broaden our horizons and are actively looking in other mining-friendly jurisdictions in Europe and North Africa.

What’s your near-term and longer-term outlook for your main commodity?

Avrupa is exploring for base and precious metals:

We expect gold to continue at current or higher levels based on the effects of the US dollar and strengthening based on expansion in demand and reductions in supply.

Base metals are in a similar situation and we expect Zinc and Copper to have a very positive year, with additional upside due to potential production interruptions at some of the larger mines (but those are short lived).

Callinex Mines (CNX.V) aggressively advanced the Nash Creek zinc project in New Brunswick this year. A resource update in April was used to determine the economics of the project in a Preliminary Economic Assessment in May which provided the market with a first look at the numbers. Exploration continued throughout the year as Callinex is trying to expand the resource at Nash Creek which will allow it to further optimize the mine plan to improve the economics.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Callinex had a busy year in 2018 with the most significant developments including an updated resource estimate and maiden Preliminary Economic Assessment at our Nash Creek Project located in the Bathurst Mining District of New Brunswick.

The updated resource at Nash Creek now hosts a near-surface Indicated mineral resource totaling 13.6 Mt averaging 3.2% Zn Eq. (2.7% Zn, 0.6% Pb and 17.8 g/t Ag) containing 963 million pounds of zinc equivalent mineralization and an Inferred mineral resource totaling 5.9 Mt averaging 3.1% Zn Eq. (2.7% Zn, 0.5% Pb and 14.0 g/t Ag) containing 407 million pounds of zinc equivalent mineralization.

Based on a very successful initial drill program in the second half of 2017, the Company efforts led to an increase in Indicated zinc equivalent pounds by 74% and Inferred zinc equivalent pounds by 385%. The ability to rapidly expand the deposit, and with drilling costs that averaged less than $75 per meter, underscores the exploration potential of the deposit.

With an updated resource in hand, our next focus was to demonstrate the economic potential of the project which we felt the market was underappreciating. As more than 80% of all zinc mines are underground there is generally a misunderstanding of what sort of grades make sense for an open pit zinc mine. The maiden PEA outlined attractive economics over a ten-year mine plan with an after-tax internal rate of return of 25%, NPV8% of C$128 million and highlighted several intriguing opportunities to further enhance the economic potential.

Importantly, the PEA outlined an operating margin of over 60% indicating that the ability to further expand mineral resources at comparable grades and extending the life of mine is likely to materially improve the economics further. This scenario is readily achievable given the cost-effective and timely exploration success we have achieved to-date and the deposit remains open in several directions. Nearly all previous drilling at the project has been limited to the immediate vicinity of the deposit so the upside potential to discovery additional deposits throughout the district-scale project is compelling.

These achievements in 2018 highlight the exciting growth potential of our flagship Nash Creek Project and demonstrates the ability of our team to acquire, explore and develop assets on accretive terms for our shareholders.

What will 2019 bring? What will you be working on and what budget do you have in mind?

In 2019 we are looking to be extremely efficient with capital allocation decisions given current market conditions. Early in 2018 we completed a raise at C$0.40 to fund a two-year exploration program and the Company is in strong financial shape to avoid dilution within the current market environment while also fundamentally advance our assets further through exploration.

Our main objective in 2019 is to test the district-scale potential of the Nash Creek Project where only 2 km of a 20 km long trend has been systematically tested. Through our exploration efforts in 2017 and 2018 it has become clear that the use of Induced Polarization surveys (IP) is the most effective method to explore the project. In late-2018, we made a major investment to complete a district-scale ground survey that fully covers the 20 km long trend with several high-grade mineral occurrences. The survey, which is still ongoing, spans more than 170 line kilometres and is designed to achieve significant depth penetration.

We are excited to complete this IP program and anticipate several targets will be drill-tested in 2019. With nearly all IP targets that have been drilled by the Company explained by mineralization or alteration associated with mineralization, this is a tool that could allow for rapid exploration success with a significant drill campaign that has been allocated as part of a fully-funded exploration program.

Additionally, we are also looking closely at completing an IP survey at our Pine Bay Project in the Flin Flon Mining District of Manitoba in early-2019. The Pine Bay Project is one of the most exciting projects in the Flin Flon district as high-grade mineralization is associated with arguably the largest alteration zone within the camp and is located close to HudBay’s 777 Mine. Typically, there is a correlation between the size of an alteration zone and the size of VMS deposit it is associated with.

Our previous drilling at the project highlighted this potential with a discovery hole that intersected 10.3m of 6.0% Zn, 1.8 g/t Au, 60.4 g/t Ag, 0.7% Cu and 0.4% Pb; however, the pyrite-rich mineralization is lowly conductive and traditional borehole electromagnetic surveys appear to be ineffective. An IP survey, which has never been completed before on the project, is typically very good at identifying lowly conductive pyrite and we believe a survey could be a low-risk/high upside opportunity to unlock the potential of the project.

What’s your near-term and longer-term outlook for your main commodity?

Our primary commodity is zinc, although gold, silver, copper and lead are common by-products. We view the near-term outlook for zinc as being relatively rangebound until the United States and China conclude their ongoing trade negotiations, which we expect in 2019. China is the world’s largest consumer of zinc, along with other base metals, so the impacts of tariffs and negotiating rhetoric has negatively impacted sentiment in the market overall.

The reality is that the zinc market remains in a supply-demand deficit today and inventory levels have declined to critically low levels based on this supply deficit. In fact, inventory levels are even lower than in early-2018 when zinc was trading around $1.60 per pound compared to a current price of around $1.20 per pound. We believe long-term the zinc market will remain strong as there is limited new supply projected to come online and most of the projected increase in supply is sourced from existing mines, which could be unstainable longer term at current price levels.

Zinc is typically a challenging commodity to explore for as it does not provide an easy geophysical target for drill targeting and with nearly all mines being underground, drill holes have to be completed to deeper depths and underground development requires more capital and planning than a typical open pit operation which is the norm for other base metals.

These are all factors that underpin the zinc market longer-term compared to other commodities. We believe our Nash Creek Project is a great way for our shareholders to have exposure to the zinc market with its strategic location as an open pit project within a major Canadian mining jurisdiction, attractive economics and district-scale exploration potential that we look forward to unlocking in 2019.

Cypress Development (CYP.V) has also been hit by the fears of an oversupply on the lithium market, but as Orocobre (ORE.AX, ORL.TO) just announced it sold lithium carbonate at a price of in excess of $10,500/t, these fears may be overblown. The weaker share price does not reflect the excellent progress made by the company this year as it completed a maiden resource estimate and a Preliminary Economic Assessment. In our previous report (see here), we also discussed the merits of the project at a lower lithium price, and the conclusion was clear: even at a lithium carbonate price of $9,000/t (25% lower than the current price), Cypress’ Clayton Valley Lithium project would still be economic with an after-tax NPV8% of approximately US$600M.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Cypress advanced the Clayton Valley Lithium project in 2018 as the company published a maiden resource estimate in Q2 followed by a Preliminary Economic Assessment in Q3. The PEA suggested the Clayton Valley project could have robust economics with an after-tax NPV8% of nearly US$1.45B and an Internal Rate of Return of ~33% using a Lithium Carbonate price of US$13,000/t. The mine plan in the PEA calls for an annual production rate of just over 24,000 tonnes of lithium carbonate over a 40-year mine life. The company expects to follow up on these scoping level economics in an upcoming prefeasibility study.

The company recently raised C$2.0M at C$0.22/share (which is more than 20% higher than the current share price) to continue to fund project next steps including further metallurgical study, infill drilling, and a prefeasibility study in the first half of next year.

What will 2019 bring? What will you be working on and what budget do you have in mind?

The company is currently conducting follow-up metallurgical test work to optimize the recovery of lithium from the mineralized rock. Cypress expects to publish results of this test work early in the new year and believes this could be an important milestone as a detailed flow sheet will also help in discussions with potential partners and offtake parties.

2019 will be a busy year for Cypress, as the company expects to apply the metallurgical test work related to the economics of the project in the publication of a pre-feasibility study in the first half of 2019. The PFS will also include the results of an up to 1,500 meter infill drill program (which should start early in 2019).

What’s your near-term and longer-term outlook for your main commodity?

The sentiment surrounding the lithium sector has been relatively weak over the past few quarters. Although the market was expecting the lithium sector to go into an oversupply-situation, lithium prices have remained strong owing to solid demand from battery manufacturers. With a lithium carbonate price of in excess of US$10,000/t and lower fears for an oversupplied lithium market, we would expect the appetite for lithium companies and projects to come back in 2019.

It looks like 2018 will be another excellent year for Elysee Development Corp. (ELC.V). The net income in the first nine months of the year already came in at C$1.2M (C$0.06/share) which is an excellent achievement for a company whose share price is trading in the mid-30’s. Elysee also raised C$1.7M in a no-warrant financing at C$0.35 which has helped to boost the current cash position to approximately C$4M.

Elysee’s share buyback program is still ongoing and Elysee has been repurchasing stock below the most recent issue price which further enhances the NAV/share, which stood at C$0.56/share as of the end of August. The company recently announced a (relatively) large investment in US Vanadium LLC where it acquired a strategic 19% stake. We had a chat with Guido Cloetens, Chairman and CEO of Elysee Development.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Despite the volatility Elysee managed to outperform the stock markets and the mining sector in general, and we are obviously very happy with this performance.

We continued to focus on our core positions like Largo Resources (LGO.TO) and Kirkland Lake Gold (KL.TO, KL). We also liquidated many smaller non-performing investments to boost our cash position, enabling us to take advantage of investment opportunities. We have been cautious this year and have made several investments in private convertible debentures which has the advantage that it reduces volatility, provides a fixed income but still has exposure to the equity side.

What will 2019 bring? What will you be working on and what budget do you have in mind?

We recently announced an important investment in US Vanadium LLC (USV) which is a private venture. USV through its contacts is able to secure/buy vanadium concentrates at a big discount and processes them into refined vanadium products such as V2O5, V2O3 etc.

This investment is being funded mainly by the partial sale of our very successful investment in Largo Resources. The idea is to reduce our exposure to the volatile price of Vanadium but still profit from the increasing demand for the metal.

What’s your near-term and longer-term outlook for your main commodity?

Despite the successful inroads into Vanadium and other commodities our main focus is still on Gold and Silver. We believe that precious metals will perform well in 2019 now that equity markets in general are under pressure due to rising interest rates, geopolitical and trade tensions and a falling consumer confidence in different parts of the world.

I don’t like setting specific targets for the price of gold or silver. I believe it is much more important to seek out mining companies that are blessed with a management with a proven track record. One should approach mining companies like other companies. A good product by itself doesn’t suffice, one has to be able to produce it and sell it in the most profitable way.

Great Bear Resources (GBR.V) had an amazing year as it started the year at around C$0.40/share but reached a 52-week high of C$3.50 on the back of what appears to be a mega-discovery in Ontario’s Red Lake gold district. GBR intersected 7 meters at almost 69 g/t gold as well as 16.35 meters at 26.91 g/t. These weren’t ‘lucky shots’ as Great Bear’s more recent drill results confirmed the widespread presence of high-grade gold mineralization, which it has now chased to a depth of up to 365 meters.

Great Bear found a strategic investor in McEwen Mining (MUX.TO, MUX) and Rob McEwen himself, and is ending the year with almost C$15M in cash after completing a C$3.5M flow-through financing in November. Ironically, the company’s cash position per share is now almost as high as the share price at the start of this year.

Great Bear is more than fully funded for its ongoing 30,000-meter drill program, and we should have a much better idea about the scope of the project once the results of this drill program will be analyzed. We sat down with a very happy Chris Taylor who answered our three questions.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Great Bear entered 2018 with an approximately C$10M market cap, and trading at about C$0.39. We are currently finishing 2018 with a market cap of approximately C$75M and trading at about C$2, providing a 7x to 8x return for our investors.

During the year we drilled new high-grade gold discoveries at our Dixie property in Red Lake, Ontario. The market responded positively to these discoveries because the project is located beside a paved highway only 15 minutes drive from other major gold mines, and the gold we found extends right to surface. The lack of external royalties, and the clean 100% ownership of the project enhanced the value of these discoveries and its infrastructure advantages.

Prior to 2018 we had completed a modest 8 hole, 1,000m drill program at our Dixie project. The success of this program, which included a hit of 16 g/t Au over 10 m on the Dixie North Limb Zone, allowed the Company to slowly expand its operations in a careful, non-dilutive manner.

What followed was a 3,000m program which we expanded to 10,000m. As this program was drawing to a close we made a new high-grade gold discovery that included holes grading 7m of 68 g/t Au and 19m of 26 g/t Au at less than 100m depth in a “Hinge Zone” and “South Limb Zone” that had not been the focus of historical work programs. Follow-up drilling has continued to find gold across a wider area, and has followed up with Hinge Zone drilling that included 3.65m of 27 g/t Au extending continuous gold mineralization from surface to 200m depth, and showing great depth extent for this new discovery.

In short, the gold zones at our Dixie property appear to match the size, grade and potential depth extent of many of the gold zones that have been, and are currently being mined by larger companies in the district, including Goldcorp (G.TO, GG).

The Company has also been successful raising money to fund our work. Within 48 hours of the release of the first Hinge Zone results, the Company had announced a $10 million financing including almost $6 million from Rob McEwen. Rob McEwen previously grew Goldcorp to a major global gold producer based on the success of his High Grade Zone discovery at the main Red Lake Gold Mine, and when he saw similar results being issued by Great Bear, but at much shallower depths, he was quick to grasp the potential significance, and was equally quick to become Great Bear’s largest shareholder.

We have subsequently continued to strengthen our treasury in a way that is very respectful of shareholder dilution, with a further $3.5 million bought deal financing with Cormark Securities, which required issuance of only 1M shares.

Ending the year with approximately $15 million in cash, we enter 2019 fully funded for the next two years of work in Red Lake and a 30,000m drill program that will see a constant flow of results over the coming year.

What will 2019 bring? What will you be working on and what budget do you have in mind?

We begin 2019 at the early stages of a 30,000m, C$5.5M drill program that will focus on expanding the Dixie Limb Zone where we made our first high-grade discovery, and significant follow-up to the high-grade discoveries we have drilled at the Hinge Zone and the South Limb Zone. We also expect to add a second drill rig that will allow us to more rapidly drill test our known zones, and drill test new regional targets on our extensive and highly prospective land package.

We do not anticipate the need to finance the Company again in 2019 and have sufficient funds on hand to drill up to 80,000 meters without seeking additional funding from the market.

What’s your near-term and longer-term outlook for your main commodity?

One of the beauties of discovery is that price moves in the underlying commodity price are less important than they are to that of a producer. That being said, we are cognisant that a rising gold price will provide investment support to the sector and make it easier to raise money when we eventually do need to proceed to more advanced exploration programs.

We think the price movements in gold will likely be rangebound at least during the first half of the year as the US interest rate cycle continues to move upwards with a number of additional modest moves. By Q3/4 we could see a more significant move in gold as the rate cycle runs its course. Despite the impression that the gold market has appeared very soft this year, it is improving in Q4 and the gold price is only off slightly from January of 2018. In many ways it has demonstrated its flight to safety status as a preserver of wealth against the increased volatility in other sectors and broader markets in general.

Of additional interest, we have heard from many large market participants that the general lack of interest in resource companies that has suppressed junior exploration company valuations for the better part of a decade is now wearing off. Investment funds for example are seeking to replace positions in aging tech stocks and other recent underperformers, and are looking at resources where “what is old is becoming new again”. This could materially benefit share performance in our sector through 2019.

Improving gold prices and investor sector rotation into commodities are both positive forces that, when combined with our expanding new gold discoveries at Dixie, should enhance an already winning formula for Great Bear.

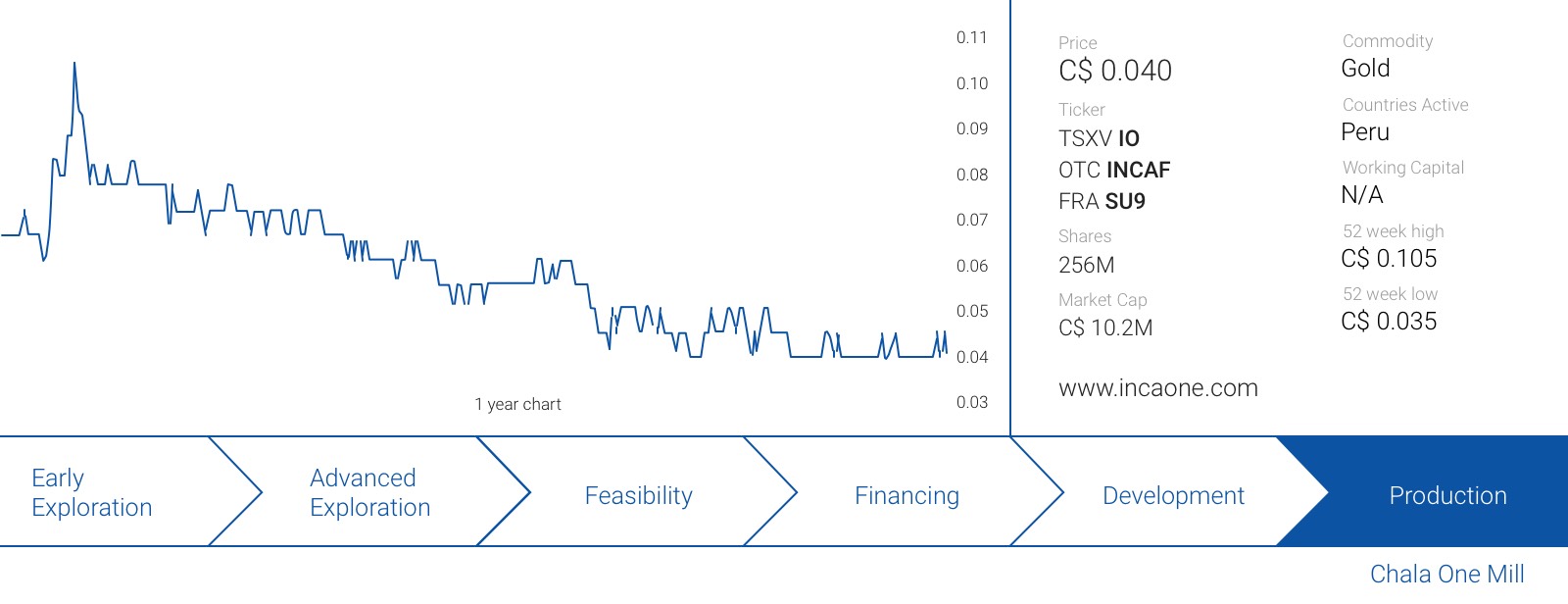

Inca One Gold (IO.V) had a very busy year as the company is ramping up the gold production in Peru after a game-changing deal whereby it acquired the 90.14% stake in the Koricancha mill from Equinox Gold (EQX.V).

The acquisition of the mill increases Inca One’s existing throughput from 100 tonnes per day to 450 tonnes per day, creating the economies of scale the company has been looking for. This had an immediate impact as Inca One has been consistently producing 2,600-3,000 ounces of gold per month lately, and we expect a smooth ramp up to a steady rate of just over 3,000 oz/month throughout 2019. Inca One expected to generate an EBITDA of $100-150/oz a few years back, which would result in a consolidated EBITDA of $3.5-5.5M. These are just our own estimates, and we would expect Inca One to provide some sort of guidance early in the new calendar year.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

At the beginning of this year, we overhauled our financial structure to create more flexibility. We completed a C$2M financing in February which allowed us to achieve full production at our Chala One plant, while we also restructured C$2.4M in short-term debt. 1/3rd was converted into stock while the remaining 2/3rd of the debt was extended for an additional three years.

Additionally, we were able to secure an Advance Payment facility with Ocean Partners which markets our gold output, and this provided an additional C$0.5M in available working capital.

These transactions have helped us to convince investors we were a good fit to acquire the Koricancha plant from Equinox Gold, and this important transaction closed in the third quarter of this year. Economies of scale are important in this sector, and we think we can generate synergy benefits to the tune of US$2M per year after combining the Koricancha and Chala One operations under one management team.

What will 2019 bring? What will you be working on and what budget do you have in mind?

Now we have secured our throughput increase, our main focus will now be on growing our mineral purchases team to continue to establish Inca One as a serious purchaser of the ore of artisanal miners. It’s all about customer loyalty and brand building, and these two elements are an important part of running the business in Peru: we think the best branded companies in this space will never run out of ore supply.

We will also continue to look for cost reductions where possible, but we have no plans to stop growing anytime soon. We continue to look for accretive opportunities to both add mineral supply as well as additional processing capacity.

What’s your near-term and longer-term outlook for your main commodity?

Given the money supply creation since 2008 the prices of precious metals should be much higher. Pick a number. We have all heard the wide range of predictions on what the gold price should be. Also, we still have not seen the real impact of true inflation. This I believe in the long term will end up being reflected in the gold price.

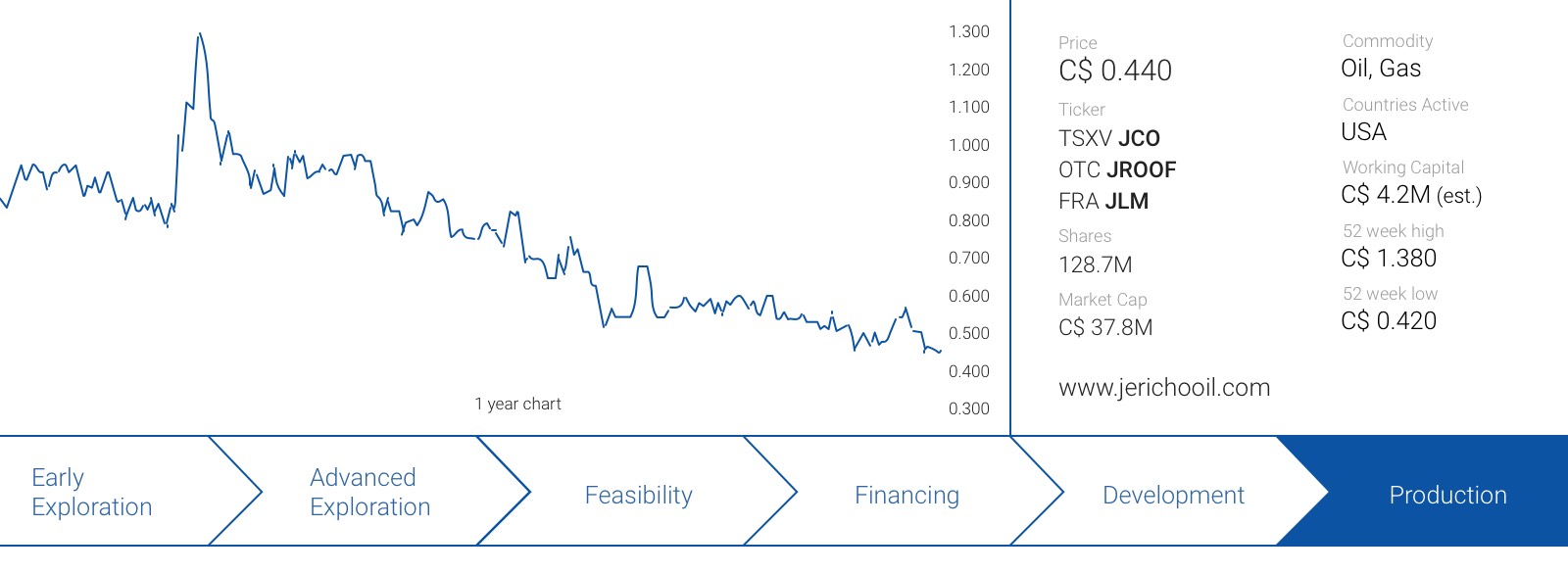

Jericho Oil (JCO.V) has made some major steps forward this year as the company elected to participate – through its 26.5% owned STACK JV – in the drilling of two wells in the Meramec formation (Wardroom and Valkyrie) as well as two wells in the Osage Formation (Trebuchet and Swordspear). Due to the minority working interest of the STACK JV in these wells and Jericho’s minority stake in the STACK JV, the net oil production attributable to Jericho Oil will be relatively small.

That being said, the drilling increases Jericho’s PUD reserves and provides extensive (technical) information gained from drilling these wells will prove to be invaluable for the STACK JV when it will start to drill more wells on its 16,000-acre STACK land package. The oil price has been very weak lately, but both Jericho and the STACK JV have healthy balance sheets that will help them to weather the current storm.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Jericho’s primary goal throughout 2018 was to build and subsequently prove up and develop our position in the STACK Play of Oklahoma, one of the lowest-cost, high-return U.S. shale basins driving long-term net asset value for our shareholders.

To that end, Jericho commenced 2018 with three transactions that allowed the Company to cost-effectively boost its strategic acreage position in the prolific STACK Play, with an interest in nearly 16,000 net acres surrounded by marque operators like Alta Mesa Resources (AMR) and ExxonMobil (XOM).

Once Jericho assembled its contiguous acreage the company set forth on a path to prove up its position through the drill-bit, targeting the principle formations of the 700 foot thick oil-bearing pay. Geographically and geologically, 2018 was a strong success in reaching our goal of de-risking our STACK resource base. We produced strong well results with significant longevity which has given the company great confidence in the entire aerial extent of our acreage position in addition to the deep inventory of future multi-zone development.

Inherent in these successes are the benefits to our shareholder base, which has seen strong production from our STACK play which should, in turn, result in strong growth in our year-end Proved Reserves compared to 2017. Ultimately, 2018 has been an extremely productive year, with clear goals, which has allowed our Company to have ever-increasing confidence in repeatable, multi-zone development of our STACK resource base which, over time, should benefit our shareholder base.

What will 2019 bring? What will you be working on and what budget do you have in mind?

While we have not finalized our 2019 capital budget, our preliminary plans dovetail nicely off our 2018 achievements. Our 2018 experiences, through drilling and participating in both target zone formation wells (the Meramec and Osage), have provided our STACK position the proper catalysts of data to leverage into the Company’s 2019 development program.

Overall, 2019 will see Jericho continue to prove up and exploit its STACK resource with year over year increases in well results, in addition to generating strong cash flows from its existing asset base across Oklahoma to fund much of our capital efficient development.

What’s your near-term and longer-term outlook for your main commodity?

We produce both crude oil and natural gas. Our expectations are for crude oil to remain in a solid average range between $55-70 per barrel with natural gas averaging around $3.00 per mcf. We feel that our organization and low-cost asset base is set up well to deliver shareholder returns in this price regime.

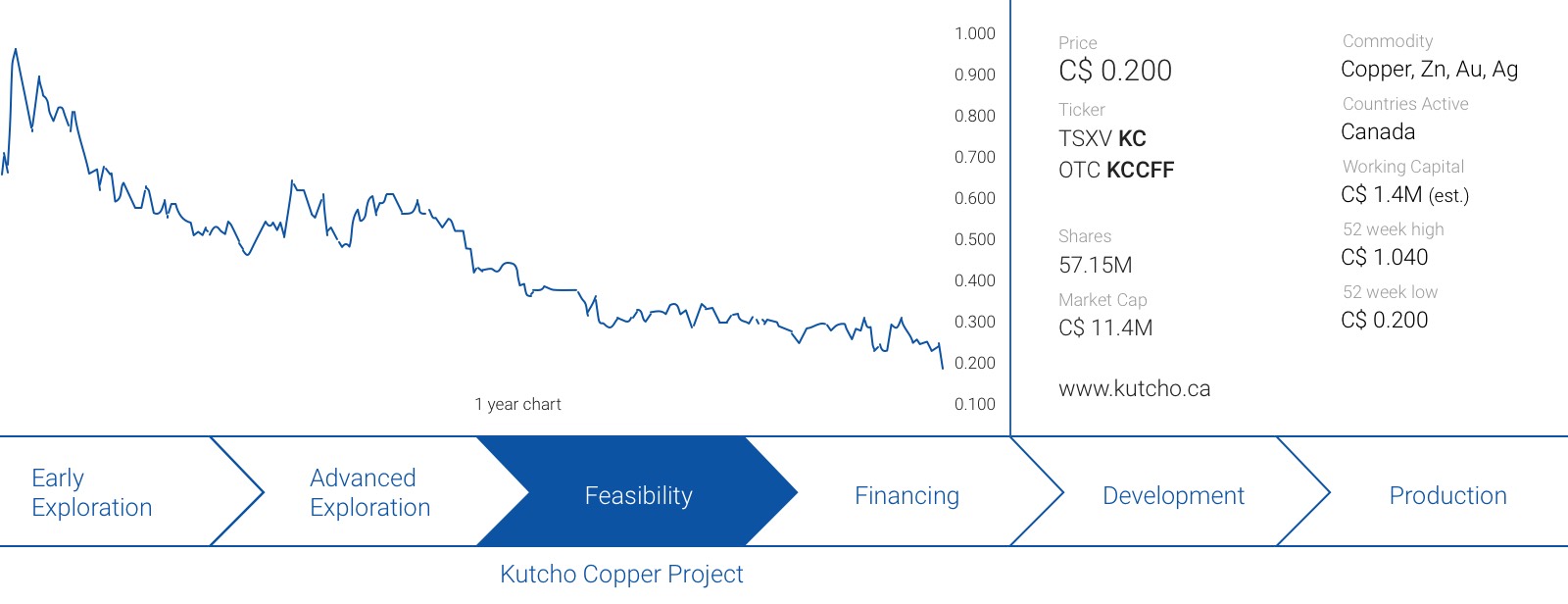

Kutcho Copper (KC.V) has been very active in 2018 as the company has spent approximately C$10M on exploration activities between May 1st and the end of October. Kutcho completed almost 11,000 meters of drilling during the 2018 field season and remains on track to complete a full feasibility study in the second quarter of 2019.

Most of the drilling was geotechnical drilling at Esso and the Main deposits, but the 3,850 meters that were completed as part of the resource infill and expansion drill program yielded some interesting results with high-grade copper values outside of the current resource outline. We sat down with Vince Sorace, President and CEO of Kutcho Copper.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

We had a very busy 2018 as we aggressively explored our namesake Kutcho Copper project in British Columbia. We had a few clear goals in mind before the start of this drill program. A first goal was to convert some of the inferred resources (5.8 million tonnes at an average grade of approximately 1.8% CuEq of which 1Mt at 2.21% CuEq is located at the Main zone with an additional 4.8 million tonnes at 1.7% CuEq at the Sumac zone) into the measured and indicated categories, which would allow us to add additional tonnes to the mine plan.

So we started 2018 with a good game plan, and we feel the exploration plans have definitely added value to the project as a whole as we were able to confirm the grades in the existing resources but also successfully tested the rocks below the current resource outline. At Esso, for instance, we encountered 11.5 meters at 1.9% copper-equivalent, including a higher grade interval of 1.5 meters at 6.6% copper-equivalent in a new stringer zone outside of the resource envelope.

We also drilled some holes that confirmed the known mineralization at the deposits, and the core of those holes will now be used to further fine-tune our metallurgical test program, and we expect to see the results of the met work relatively soon.

On the financial front, we completed a C$4.14M flow-through offering in August when we issued 9.2 million FT shares at C$0.45 per share, but we also received two US$3.5M (C$4.5M) payments from Wheaton Precious Metals (WPM.TO, WPM) as part of our streaming agreement. Wheaton will provide US$65M in cash as part of a streaming agreement, but also provided C$24M in convertible debt and equity investments. We’re glad to have a strong partner as their commitment to wire us US$58M to be spent on development capital throughout the construction phase will be an important part of our financing mix.

What’s your near-term and longer-term outlook for your main commodity?

The copper price has been quite volatile this year as the price per pound remained firmly above US$3 in the first half of the year. Weakness on the metal markets throughout the summer (fueled by the trade wars and the lack of visibility of the demand from China), but the underlying fundamentals remain very strong.

The continuing ‘electrification revolution’ will keep the demand for copper at an elevated level, and the supply side may not be able to accommodate the demand. After all, even at $2.75 per pound, the incentive for copper companies to bring new projects online is pretty marginal given the expensive cost of capital and the regulatory hoops one has to jump through these days. That’s why we feel our high-grade polymetallic underground project is in an excellent position to be developed as part of the ‘supply solution’.

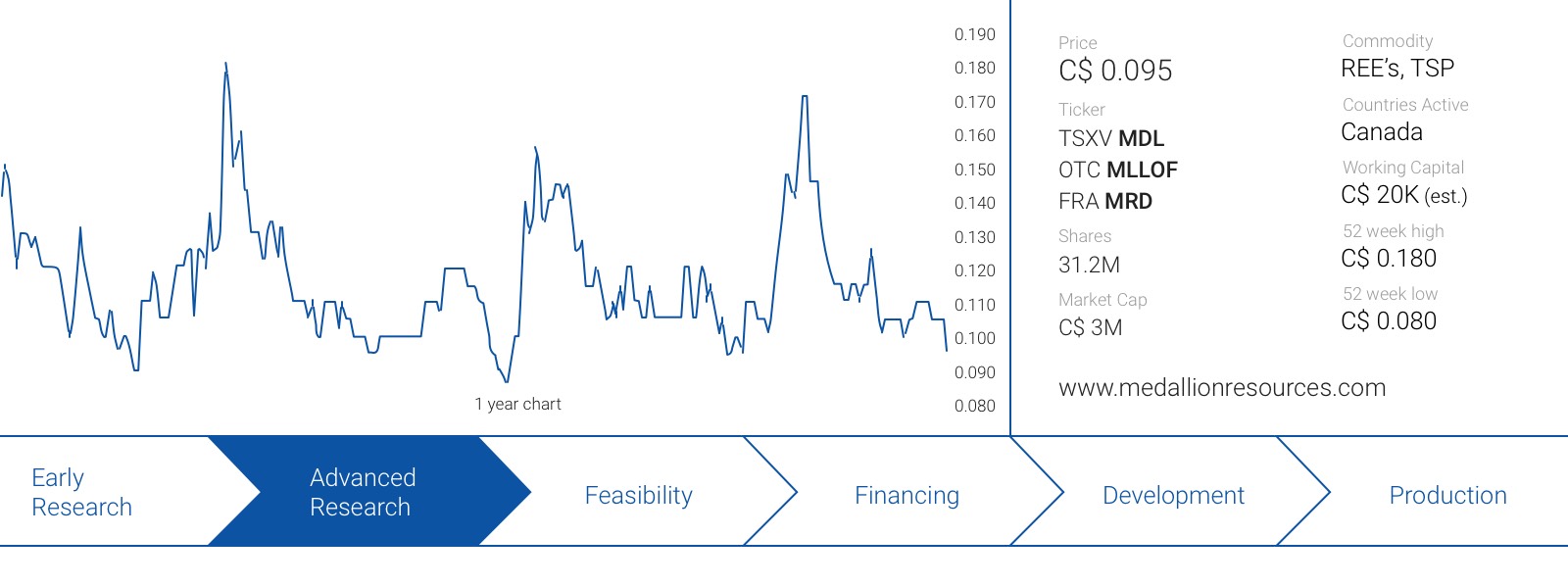

The REE sector is coming back to life, and Medallion Resources (MDL.V) could be one of the companies harvesting the rewards after it continued to invest in test work to determine if it can process monazite to recover Rare Earth Elements. Medallion’s test work indicates its REE concentrate contains high values of Praseodymium and Neodymium, two sought-after elements in the magnet space.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Medallion made significant progress on developing its process flow-sheet to extract a rare earth concentrate from monazite sand. The test product passed with flying colours from our commercial partner Rare Earth Salts.

What will 2019 bring? What will you be working on and what budget do you have in mind?

We look forward to completing our process flow-sheet so that we can get preliminary engineering costs on a commercial plant. Also, we look forward to entering into commercial agreements for monazite sand. Rare Earth Salts is also working to sign-up long-term customer agreements for rare earth oxides to be supplied by our feedstock.

What’s your near-term and longer-term outlook for your main commodity?

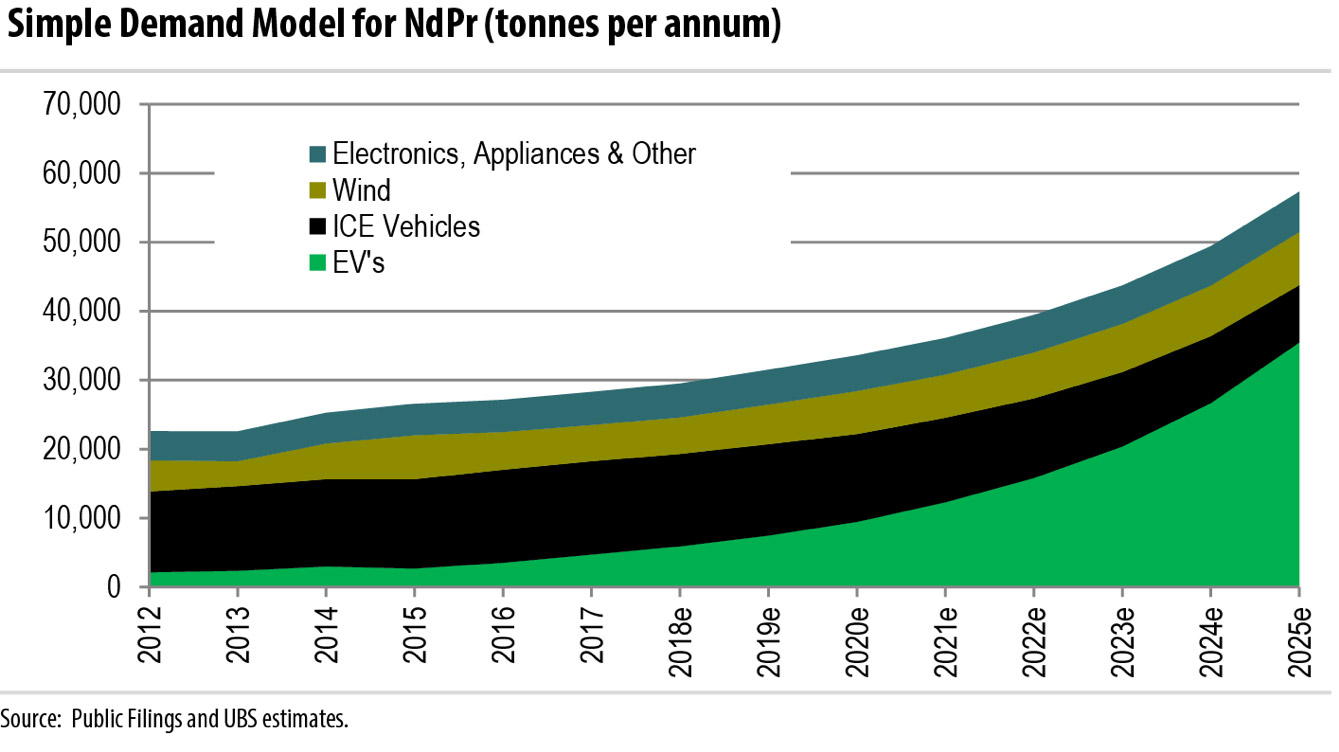

The long term is looking very positive as the “magnet metals” NdPr, which are required in large quantities in EVs, hybrid cars and wind generators are all expected to be in a long-term growth phase as per the UBS chart below:

The Chinese have capped production and non of the proposed hard rock mines can get to production within 5 years.

We expect a stronger uranium market in 2019, and Skyharbour Resources (SYH.V) could be an interesting way to gain exposure to the sector. A rising tide will lift all boats and although uranium exploration companies have been slaughtered since Fukushima (only a handful exploration companies were able to survive), we do expect to see renewed interest in the sector.

Could you review 2018 for us? What did you work on, and what did the company achieve in the past 12 months?

Skyharbour had a successful year on the exploration front as the Winter 2018 drill program (which was completed in Q1) encountered more high-grade uranium mineralization at the Maverick zone with 3.5 meters of 2.07% U3O8 and 6.3 meters of 1.01% U308 at relatively shallow depths (265-275 meters down hole). This exploration program allowed us to accelerate the earn-in into the Moore Uranium project and the company has now earned in 100%.

We recently announced the assay results from the Fall 2018 drill program at the Moore Uranium project, which consisted of 3,800 meters in 8 holes. Four holes were exploratory holes which encountered altered lithology, while the other four holes were drill-testing the Maverick Main zone. Of those 4, 2 encountered high-grade uranium mineralization with 15.2 meters of 0.56% U3O8 (including 1.8 meters of 3.11% U308) and 7.8 meters containing 1.33% U308 (including 1.5 meters at 2.91%).

In that hole, which was drilled on the western side of the project, high-grade cobalt and nickel mineralization was discovered over the entire 7.8 meters with a grade of 0.44% Cobalt and 1.62% Nickel. We expect to follow up on this discovery in 2019.

What will 2019 bring? What will you be working on and what budget do you have in mind?

We’re designing a 3,000 meter Winter drill program at Moore Lake where unconformity targets and basement targets along the Maverick corridor will be tested. This will help get a better understanding of the uranium mineralization at Maverick, and should allow for greater efficiency in future drill programs targeting resource expansion.

Additionally, our two joint venture partners, Orano and Azincourt Energy (AAZ.V) are also gearing up for a busy winter season. We are particularly pleased with Orano’s commitment to spend C$2.2M on the Preston uranium property, which will include almost 5,000 meters of drilling. News flow is expected on all three fronts.

What’s your near-term and longer-term outlook for your main commodity?

The uranium market has been improving in 2018 as more analysts are agreeing this could be a sustained upswing considering the fundamentals of the uranium market are probably as strong as the pre-Fukushima era. The global uranium production will decrease to 135 million pounds in 2018 on the back of mine closures, while the demand continues to increase to approximately 192 million pounds. Add the fact the Russian-US relations have cooled down (which reduces the likelihood of the restart of the Russian nuclear warhead uranium supply), and it remains very questionable how the world demand will be met once the sales on the spot market will be gone.

That spot market is already tightening, and the spot uranium price has reached $28.50 per pounds. That’s a good start, but this price is still substantially below the prices needed to sanction the development of new projects or even to re-open projects that are currently on care and maintenance.

Long story short: it’s a basic principle of supply and demand. The demand is there and won’t decrease anytime soon, but in order for the supply increase to be able to meet the demand, a higher uranium price is needed to incentivize producers and developers of uranium projects.

Disclosure: All companies mentioned are sponsors of the website, and we have a long position. Please read the disclaimer