The precious metals markets have had an amazing run and although most exploration and mining companies appear to be relatively fairly valued, there are always companies that are trailing the curve. Elysee Development (ELC.V) is an investment issuer: it invests its cash in other companies and acts as an investment holding. The majority of the company’s investees are mining companies and the precious metals component is an integral and dominant part of Elysee’s investment strategy.

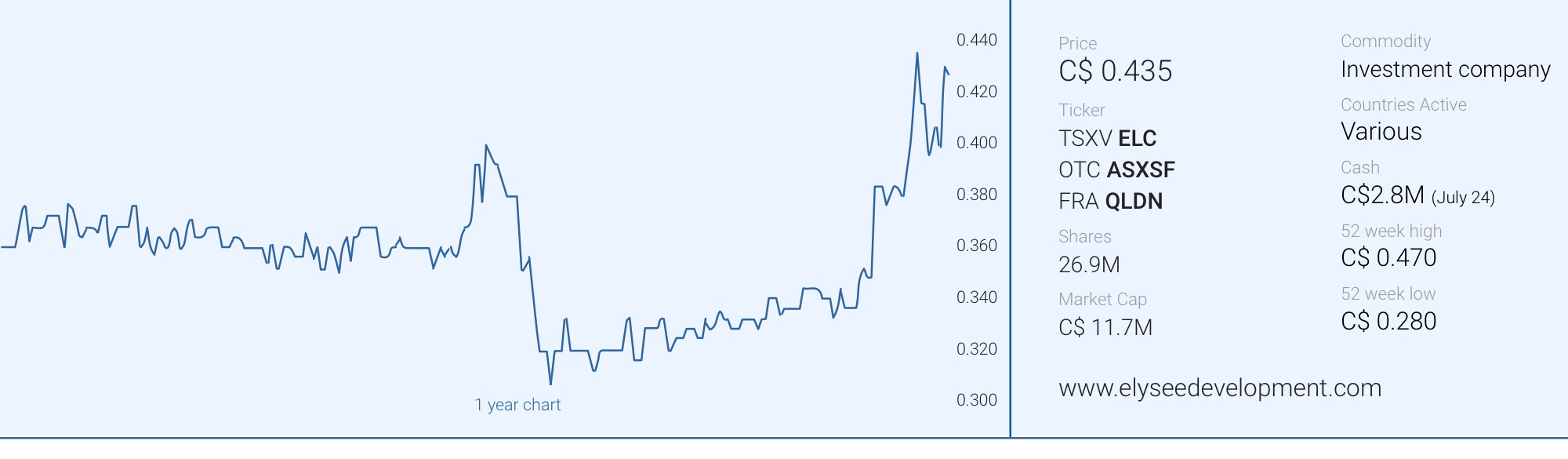

The company is currently trading at a discount of roughly 30% to its Net Asset Value meaning that if the company would sell all its investments and settle all liabilities, there would be in excess of 60 cents per share available for the shareholders. We caught up with Guido Cloetens the CEO and Chairman of Elysee to get a better understanding of where Elysee’s portfolio currently is at, and what his opinion is on the current market circumstances.

The Q2 Results & Investment approach

After a disappointing first quarter where both the general and precious metals markets collapsed due to COVID-19, you just reported a stellar second quarter with an EPS of approximately 18 cents per share. How did you deal with the panicky reaction in March? Were you just holding onto the positions, or did you add to existing positions on the way down?

It would have been foolish to sell in a panic, especially since COVID-19 created a situation that’s positive for precious metals. That’s where our experience comes in.

We effectively bought more shares in existing positions such as Battle North Gold (BNAU.V), Corvus Gold (KOR.TO, KOR), Cartier Resources (ECR.V) and Dundee Precious Metals (DPM.TO) among others. In the second quarter Elysee participated in numerous private placements like for example Reyna Silver Corp. (RSLV.V), New Placer Dome Gold (NGLD.V), Freeman Gold Corp (FMAN.C).

With approximately 60% of our equity portfolio invested in gold & silver mining companies (as of June 30) I think we are well positioned for the current gold rally. We also remain financially strong, with over $2.8-million in cash currently available for investment purposes as of July 24.

We noticed the majority of the net investment income in Q2 was related to unrealized gains (C$4.72M) and only a limited amount of realized gains (C$0.16M).

Correct, but the opposite is true for Q1 when Elysee had over C$4 million in unrealized losses, so we compensated those Q1 losses.

That seemingly small amount of realized gains in Q2 hides a lot of activity. We realized gains on some positions but at the same time we cleaned up our portfolio so to speak and took some losses. We sold a lot of small positions, laggards or positions with losses in which we lost faith. We felt this was the opportune time to do so as the proceeds from selling these superfluous investments could immediately be redeployed in other investments to take full advantage of the improving market circumstances.

Did you invest in any private companies recently?

We invested approximately C$200,000 in a newly established private gold royalty company that just acquired a cash flowing royalty based on the production of Northern Vortex’s (NEE.V) Moss mine in Arizona. Luckily the purchase price was fixed before the major move in the gold price.

Earlier this year we invested in Electric Royalties Ltd. (ELEC.V) a company that acquires royalties in projects and commodities that will benefit from the drive towards electrification. Elysee recently also participated in the financing round concurrent with the IPO.

Is it safe to assume you locked in some gains during the recent market spike?

Yes. We have been active sellers in July and August. It doesn’t mean that we don’t believe in a continuation of the bull market for gold and silver but the market seemed overheated. We prefer to build up our cash position when the market is perhaps getting a bit ahead of itself so we can take advantage of a market correction or when new opportunities present themselves. It’s never wrong to take some cash off the table.

In Q1 you had to record C$1.1M in impairment charges, one on your vanadium investment in the USA, and one on the Ravenquest Biomed investment, can you elaborate on those impairment charges?

In Q1 US Vanadium raised money at a price that was lower than the average purchase price recorded in Elysee’s books. Our Board and management tend to be cautious/conservative and as a result we decided to adjust the value of our holdings to the price of the last capital raise.

Ravenquest Biomed was a cannabis producer and wasn’t one of Elysee’s core investments. Elysee held a convertible debenture of Ravenquest which was due at the end of February. However due to serious mismanagement the company was not able to pay its bills and defaulted on the debentures so we impaired the value of the debentures and the interest.

The write-off of Ravenquest and the correction of the value of our stake in USV caused a loss of close to C$1.1M. It reminded us to stick to our core business which is precious and base metals mining companies.

Going back to your investment in the private vanadium company. After seeing huge price spikes in the past few years, Vanadium appears to be an out-of-favor metal again. How do you look at this?

In recent months (the) demand for rebar and vanadium in China has increased significantly. Even to the extent that China is no longer a net exporter and that’s unusual. That’s also the reason why prices of V2O5 are substantially higher in China than prices quoted in Europe or the US. However, at these prices it’s unlikely that production in China will increase substantially in the near term so I expect prices for V2O5 in the West will go up. Obviously this is also dependent upon the recovery in the economies of the USA and Europe.

You continue to have one of the lowest overhead expenses in the Canadian Mining scene as your Q2 cash G&A came in below C$80,000. In your press release you mentioned the management and director fees were temporarily lowered as of April 1st. How do you see your G&A expenses evolve over time?

I believe G&A should be in relation to assets under management. Elysee is a small investment issuer and doesn’t go to the market on a regular basis to raise money. That would just be dilutive for the existing shareholders. Creating value for shareholders is truly our main goal. Keep in mind that management and all of our directors are significant shareholders of the company – shares we paid for with cash- so our interests are truly aligned with smaller shareholders.

The only time we raised money since becoming an investment issuer was in October 2018 and that was for a very specific purpose as it allowed us to pursue our investment in US Vanadium.

After the significant loss in Q1 the Board decided to temporarily reduce management and director fees. This will be re-evaluated later this year and will be dependent upon the results achieved.

The Dividend

Elysee has been a reliable dividend payer in the past but we noticed that despite the blowout quarter, no interim dividend has been announced. Does this indicate a shift in the dividend policy?

Elysee will continue to pay dividends. There’s no shift in our dividend policy. Being cautious, the Board of Directors decided to postpone the interim dividend due to the volatility in the market and the relatively flat performance in the first semester. We do plan to distribute a final dividend, but that dividend will depend on the financial results and our generated income.

You also have an active share buyback program in place (which you renew every year). Can you elaborate on the strategy behind the repurchase plan?

As you know Elysee’s shares are trading at a significant discount to its Net Asset Value. Normally the discount is at around 30% but sometimes the discount widens to 40% or more. That’s when we put some bids in the market. When something’s worth 100 and you can buy it at 60 it’s a pretty good deal I’d think. Sometimes buying back stock is the best investment you can make considering it has a direct and meaningful impact on the NAV of the remaining shares.

How do you explain this big discount to NAV?

Good question. I guess investors don’t always understand our business model. The goal is a sustainable growth of the NAV and the regular payment of a dividend. We think longer term and that’s not always exciting in a market that appears to have an attention span of just a few weeks or months.

Another reason is probably the lack of liquidity which in turn is caused by the fact that we have loyal long term shareholders that aren’t too keen on selling at a discount to NAV either.

Outlook

With gold and silver prices rallying, what’s your outlook on these markets? Do you fear we are reaching an ‘overheating stage’? How do you protect the Elysee portfolio against aggressive volatility?

We’ve seen a steep rise of gold and silver prices in July and August. July was an incredible month for exploration companies, developers and (junior) miners. It’s absolutely normal and healthy that there’s profit-taking every now and then but we believe this bull market still has a long way to go.

The best way to protect the portfolio is to take profits when the market is overheated and to buy back after a correction. That’s exactly what we’ve been doing in recent weeks.

While the current focus of the market appears to be on gold and silver, you undoubtedly must have some other favorites in the metals space? Care to share a few of your impressions?

We have positions in several base metal companies. More in particular in zinc and copper. Ultimately I believe that prices of most base metals will appreciate over the next few years and possibly also uranium. At this moment a lot of the liquidity being created by governments and the central banks is flowing to financial assets. However, sooner or later money will also start flowing into the real economy. People will continue building houses and in most countries there’s a desperate need to improve infrastructure. The world needs better and modern infrastructure adapted to new technologies. However, in order to realize that they still will need copper, zinc, steel, iron and energy.

Conclusion

Given Elysee is trading at a substantial discount to its Net Asset Value, the company appears to deserve some more love from Mr. Market. Despite its 30% share price appreciation in the last month or so, the current share price still reflects a discount of more than 30% to the Net Asset Value.

With a portfolio that is predominantly exposed to precious metals, an investment in Elysee could be seen as part of a ‘basket approach’: owning one share in Elysee gives investors exposure to a few dozen companies in different stages of their development curves.

Disclosure: The author has a long position in Elysee Development Corp. Elysee Development Corp. is a sponsor of the website.