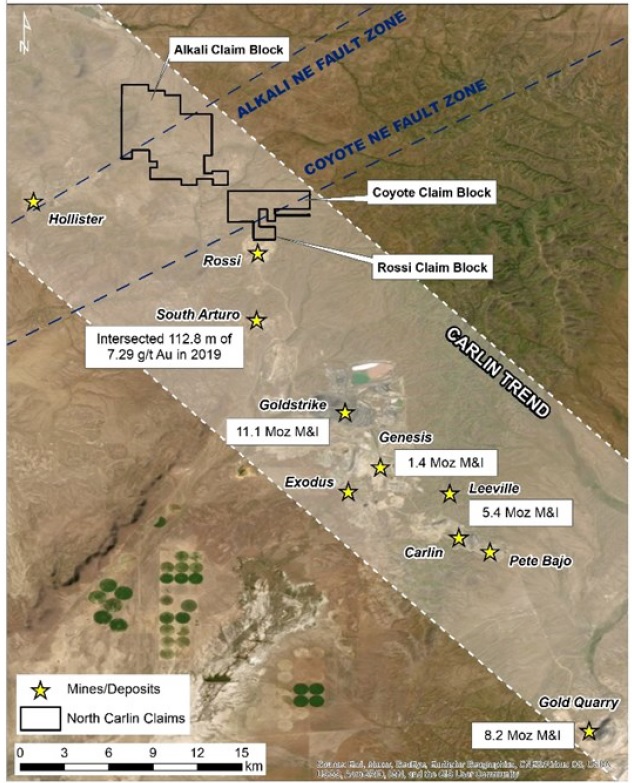

Fremont Gold (FRE.V) has now closed the C$0.05 financing, and the company ended up raising C$2M after upsizing the original C$1M placement. The lead order was provided by Palisades Goldcorp and the proceeds of the financing will be used to start drilling the North Carlin project.

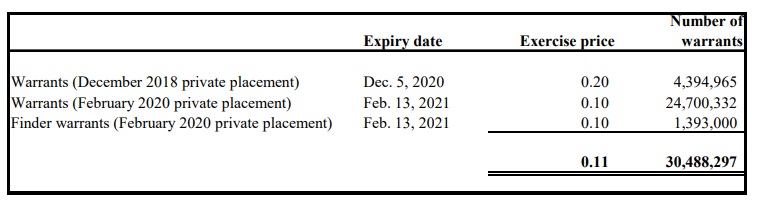

Each unit of the financing consisted of a common share and a full warrant valid for three years, allowing the warrant holder to purchase an additional share of Fremont at C$0.10/share. This means that 20 million shares and 20 million warrants will be issued. In the near term, this will sharply increase Fremont’s fully diluted share count but in the next few weeks and months millions of warrants that are currently out of the money will expire.

While we certainly hope the North Carlin drill program will be successful and Fremont’s share price will be trading over C$0.10/share by February, it’s not a scenario we are banking on and we can assume the 30.5 million existing warrants will disappear which means the current 40 million shares + warrants placement will only increase by 9.5M shares. And if the upcoming drill program results in a discovery at North Carlin, Fremont Gold will be happy to get the C$2.6M in proceeds from warrant exercises from the February 2021 warrants. Win-win.

The C$2M cash injection will fund the upcoming North Carlin drill program where Fremont Gold is planning to drill three holes for a total of 1,500 meters. As this drill program shouldn’t be too expensive (given the limited amount of meters to be drilled), Fremont Gold should be able to end the year with a strong treasury while waiting for the North Carlin assay results which we would expect to be released in January.

Disclosure: The author has a long position in Fremont Gold and has participated in the recent financing. Fremont Gold is a sponsor of the website.