It took the labs a while but they finally returned the assay results of two holes to Equity Metals (EQTY.V). Equity drilled these holes in 2020 on the No3 Vein and the main purpose for these two holes was to double check the historical records as the verification holes were aimed at confirming the grades and intervals of the existing block model used for the resource.

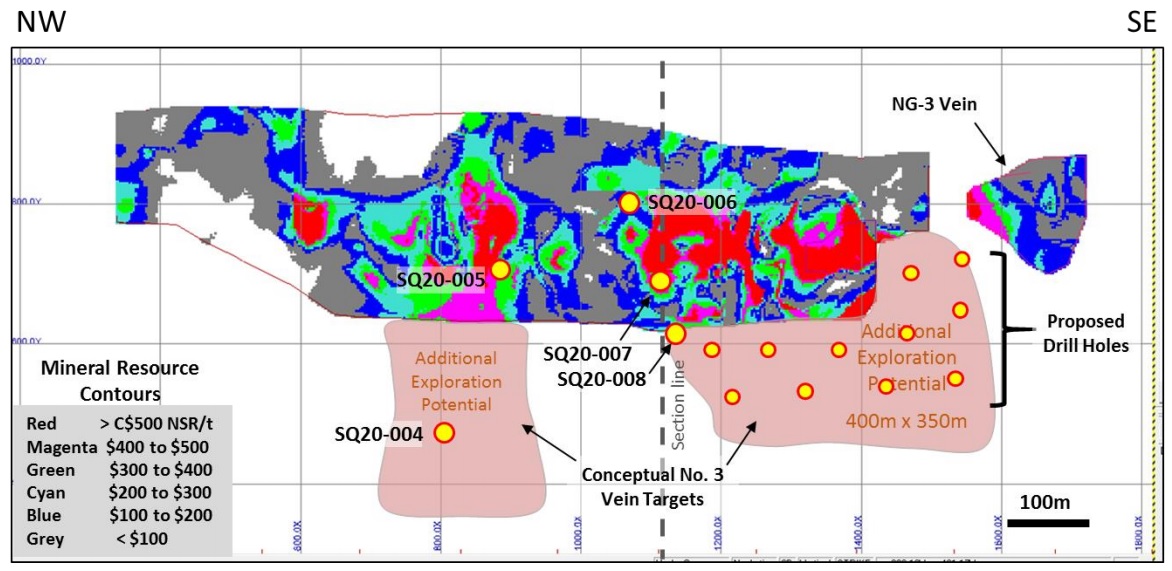

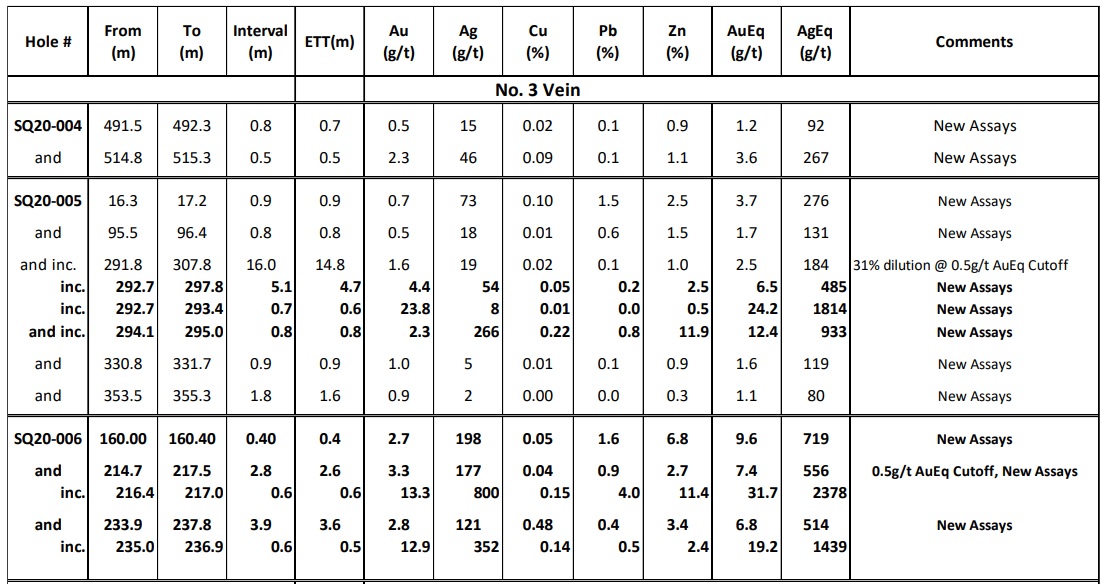

As you can see below, holes 5 and 6 both contained the same type of mineralization as in the resource and with 4.7 meters containing 485 g/t silver-equivalent (although we should probably use the 6.5 g/t gold-equivalent grade given the grade of silver represents just over 11% of the equivalent grade) including shorter but higher grade intervals, hole 5 clearly was a success.

Hole 6 was also successful as it confirmed the presence of two mineralized zones with an interval of 556 g/t silver-equivalent over 2.6 meters true width and 3.6 meters of 514 g/t silver-equivalent just a little bit further down hole.

As these were verification holes, the grades aren’t unexpected but it’s encouraging to see that while the results in hole 5 were in line with the expectations, the grades in hole 6 were higher than what has been inserted in the block model, and that’s obviously good news. However, the main takeaway shouldn’t be the higher grade but the fact these two holes confirm the continuity of the mineralization and add more credibility to the current resource which contains 244,000 gold-equivalent ounces in the indicated resource category and an additional 193,000 gold-equivalent ounces in the inferred resource category.

Assay results for two additional holes (7 and 8 which also tested the No3 Vein target) still have to be released but this shouldn’t take much longer. Equity Metals is planning to start a Phase III drill program by the end of this month and this time the company will try to step out from the currently known high-grade zones. Once the results of the next few holes are in, we will catch up with the Equity Metals management to discuss the past results and the expectations for the upcoming drill program.

Disclosure: The author has a long position in Equity but took some profits in the last months to exercise warrants. Equity is a sponsor of the website. Please read our disclaimer.