After the Canadian government blocked the sale of TMAC Resources (TMR.TO) to Shandong Gold, Agnico Eagle Mines (AEM, AEM.TO) stepped up the plate and offered the TMAC shareholders a cash buyout of C$2.20 per share, clearly a superior offer to the C$1.75/share Shandong was offering before the gold price started to move up. A win-win solution for everyone involved: TMAC shareholders got a decent buyout, Shandong Gold was able to sell its position at a profit to Agnico Eagle and the latter can use its extensive expertise operating in Arctic conditions at Hope Bay.

But there’s a fourth winner. Agnico has notified Maverix Metals (MMX, MMX.TO) it will be wiring US$50M to repurchase the 1.5% additional NSR Maverix has acquired on Hope Bay in 2019. As part of the agreement to purchase the additional NSR, a change of control at TMAC would allow the buyer of TMAC to repurchase the royalty, and given the current gold price, killing the extra royalty makes sense for Agnico Eagle.

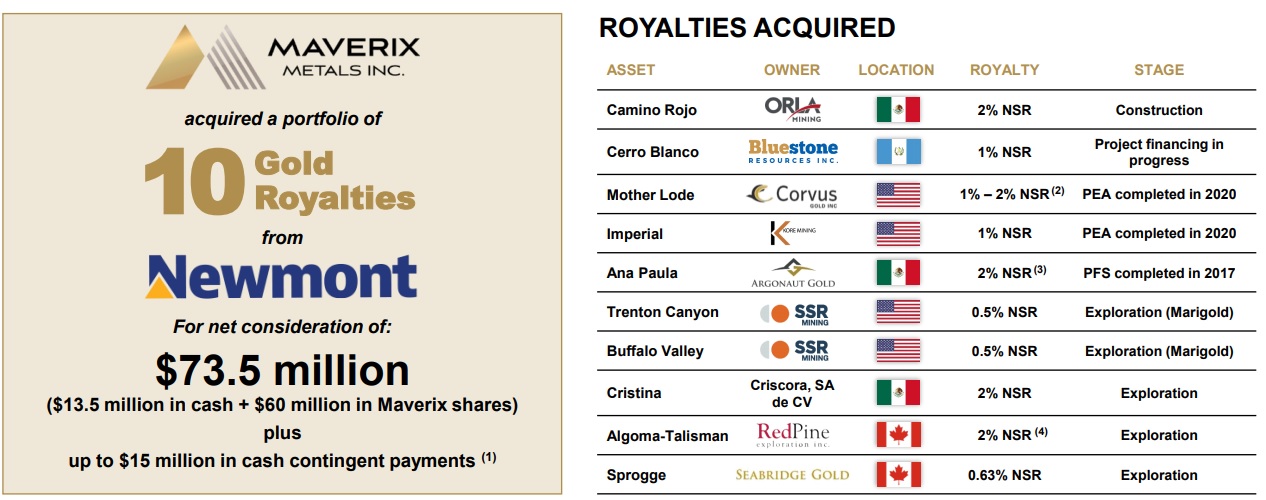

It’s also good news for Maverix. 18 months ago, it paid just US$40M for the additional royalty, received several royalty payments since the purchase and is now selling the additional royalty for a 25% capital gain (on cost, and likely an even bigger gain on the book value). Considering Maverix had a net debt position of just US$7M (as of January 18th, per the company presentation and including the cash consideration paid for the Newmont portfolio), the combination of the incoming cash flows in Q1 2021 and the US$50M payable by Agnico Eagle should result in Maverix posting a strong net cash position at the end of the current quarter, likely around US$50M.

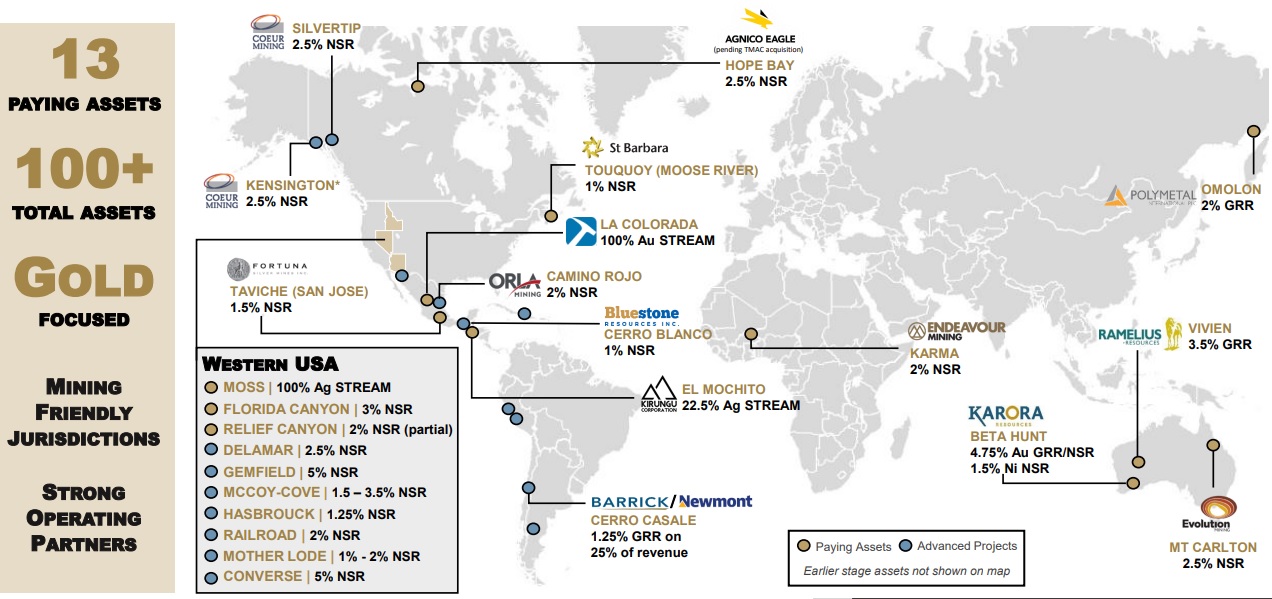

Maverix traditionally reports its full-year financial results in March so we’ll have to wait a little bit longer to see the detailed financial results but we have little doubt Q4 was another strong quarter for the company. Maverix has released a detailed asset update earlier this week and we would recommend to read the entire update (HERE) as it provides an excellent overview of some of the most promising assets in the company’s portfolio. We will provide an extensive update when Maverix metals reports its full-year financials and the 2021 guidance. But at $1800 gold, the current market capitalization of just over US$700M (and an enterprise value of less than US$700M) means the company is now likely priced at less than 20 times its operating cash flow (including interest expenses). With in excess of 100 royalties and streams in the portfolio of which only 13 are actually in production, the best is yet to come for Maverix.

Disclosure: The author has a long position in Maverix Metals. Maverix is a sponsor of the website. Please read our disclaimer.