We were surprised to get an email from an Australian message board earlier this week touting Almonty Industries’ (AII.TO, AII.AX) capital raise. While Almonty had indeed previously disclosed it was investigating the possibility to list its shares on the Australian Stock Exchange, it hasn’t provide an update on those plans in the past few weeks as the most recent update on the ASX listed was mentioned in an April 19th update, almost three months ago.

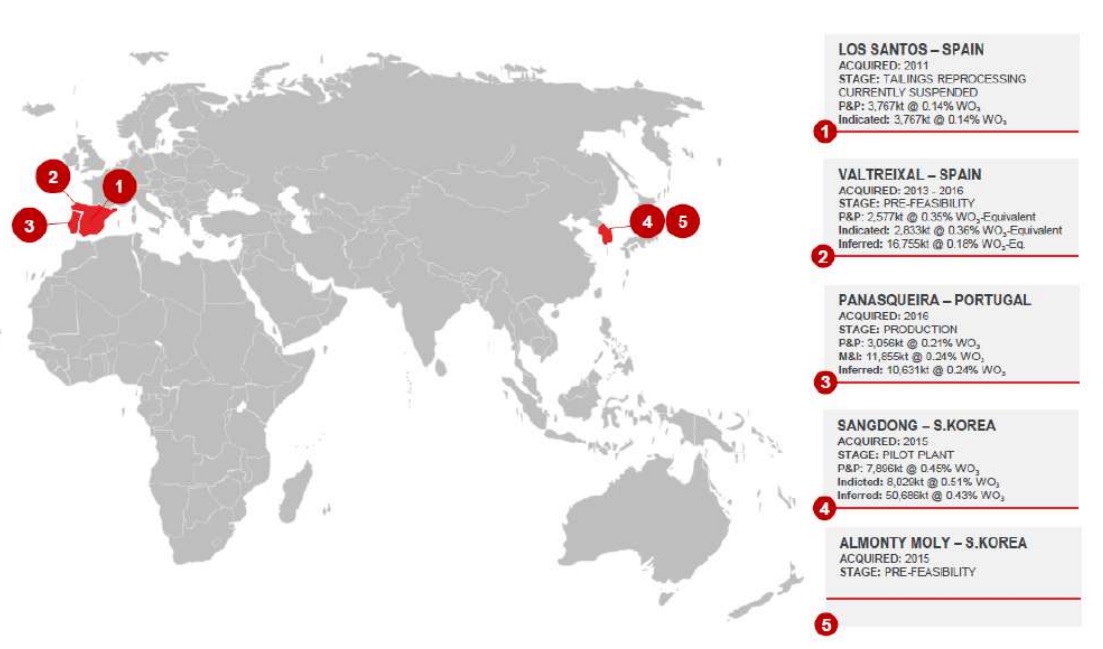

Apparently the company has filed a prospectus on June 8th, seeking to raise A$15-25M by issuing new shares at A$1/share concurrent with its ASX listing. This helps to explain the recent weakness of its Canadian listing as it’s easy enough for larger parties to sell stock on the TSX and recycle the proceeds to participate in the A$1 financing (as 1 Australian Dollar is just C$0.93 right now, a discount of 26% (!) compared to the closing price on June 7th, the day before the prospectus was filed). The prospectus actually is a good read and interested investors should definitely have a look to freshen up their memory of the company, its projects, and the tungsten market in general.

It’s good to see the company is raising a substantial amount of cash as this will help to get the development of the Sangdong tungsten mine across the finish line. But not mentioning any progress on its ASX listing since April 19th and failing to announce a prospectus has actually been lodged on June 8th and failing to disclose the terms of a capital raise seems to indicate a corporate governance problem. Perhaps Almonty wanted to play it safe when it comes to Canadian securities law as the capital raise is focusing on Australian investors. Perhaps it’s an oversight as we noticed several press releases that were filed on SEDAR weren’t uploaded to the company website, including the May 17th press release announcing the company’s quarterly results. In any case, when a company is raising A$25M at a 26% discount, the very least it can do is trying a little bit harder to keep the existing shareholders up to date.

Disclosure: The author has no position in Almonty Industries at this moment. Please read our disclaimer.