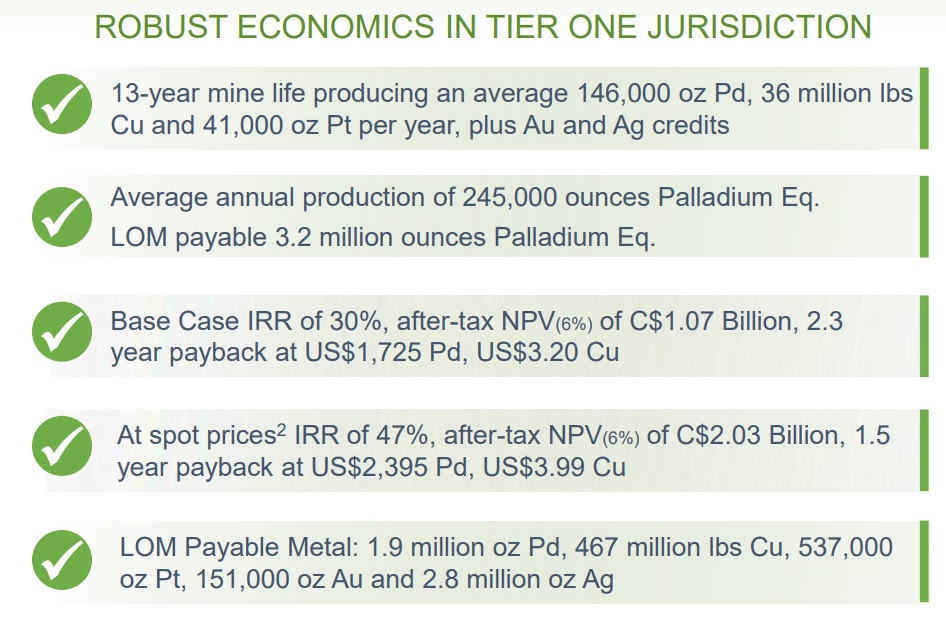

Generation Mining (GENM.TO) will be in the spotlights next week as the deadline for Sibanye-Stillwater (SBSW) to decide whether or not it wants to earn a majority stake in the Marathon PGM project. Right now, SBSW has a stake of slightly under 20% (19.3% to be precise) and has the option to bump that to 51% by covering 31% of the initial capex of the project and contribute their 51% stake of the remaining 69% capex. This means Generation Mining would end up owning 49% of the project but would only have to contribute 33.8% of the capex (which would keep the dilution limited).

The clock started ticking for Sibanye in April, and the 90 day exercise period is coming to an end on July 22nd, Thursday. This means there are three options: SBSW will either exercise the right to back in to a total stake of 51% by covering about 2/3rds of the capex and by writing a cheque to Generation Mining to make up for the project dilution from 20% to 19.3% in the past few months as SBSW hasn’t contributed to the recent exploration activities.

The second option is SBSW walking away from the project. It has mentioned before it’s more interested in platinum than in palladium (although in a recent update, Sibanye confirmed it’s looking at Palladium as a potential substitute for Rhodium) and as it has been diluting its stake down to 19.3%, it’s not unreasonable to assume they will walk. If that happens, Generation Mining should try to purchase the remaining project stake from Sibanye-Stillwater as it will be easier to market and develop a project if it has full ownership.

A third option is SBSW launching an offer to acquire Generation Mining as a whole. In some cases this could make sense as it could be cheaper to pay a few hundred million to acquire the entire project rather than messing around with earn-ins and still having a 49% partner in the project.

It could really go either way. But perhaps the recent unrest in South Africa is reminding Sibanye it’s perhaps not a bad idea to increase its exposure to foreign projects. And for what it’s worth, our preferred outcome would be an outright sale (at an acceptable price, we wouldn’t be interested in accepting a 20% premium), followed by Sibanye walking and GENM acquiring full ownership (again, at an acceptable price). But whatever the outcome will be, at least it will provide Generation Mining with a clean path forward at Marathon.

All cards will have to be put on the table this week, and we’ll likely know more by the weekend.

Disclosure: The author has a long position in Generation Mining. Generation Mining is a sponsor of the website. Please read our disclaimer.