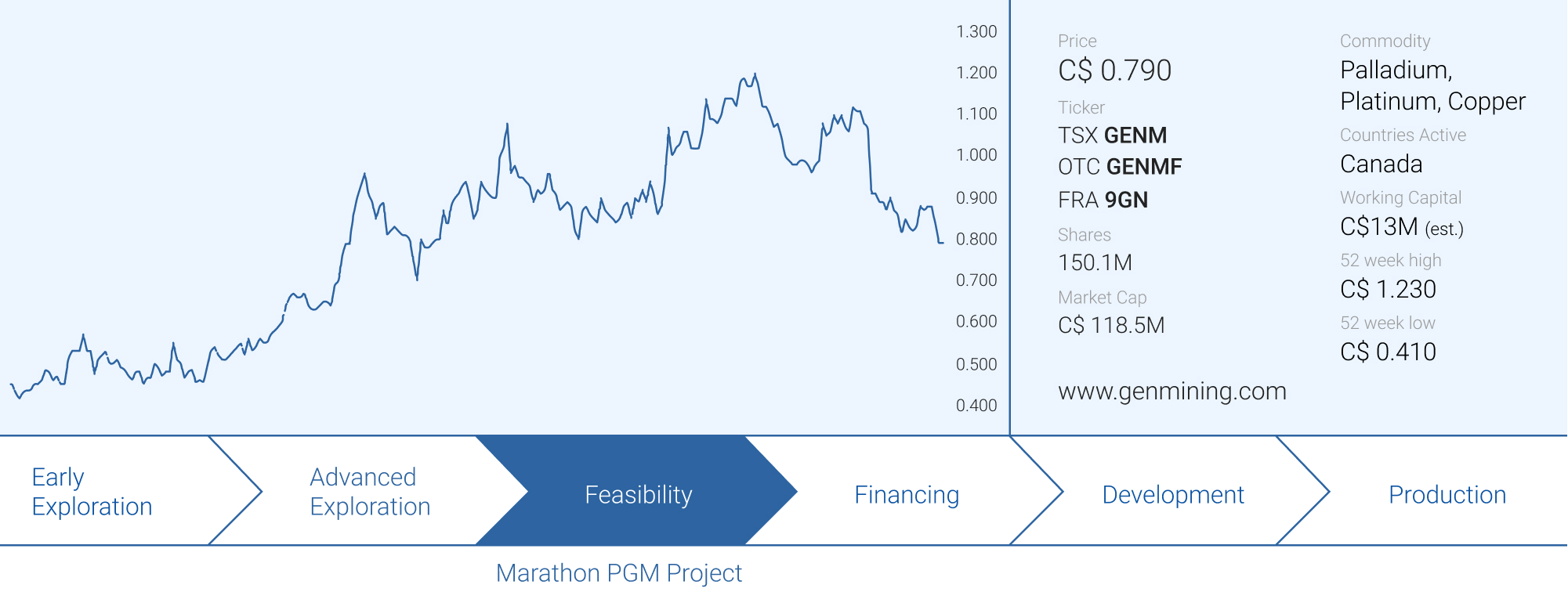

Generation Mining’s (GENM.TO) share price lost approximately 25% on the news Sibanye-Stillwater (SBSW) elected to not earn back into the Marathon PGM project in Ontario. This didn’t really come as a surprise as earning back in by covering 66% of the capex to end up with a stake of just 51% is a sub-optimal and inefficient capital allocation by Sibanye. Additionally, it would be on the hook for 51% of the ongoing expenses at Marathon all the way until a construction decision would be made and the effective capex would be incurred.

Now Generation Mining has clarity on its ownership situation, it can decide on the next steps to move the project to a construction-ready stage, which includes getting all relevant permits to build and operate a mine at Marathon.

Sibanye-Stillwater decided to walk away, why?

Sibanye’s two options that would make the most sense would be to either acquire Generation Mining as a whole as acquiring full ownership would barely have cost more than the earn-in deal looking at it from an attributable NPV point of view (a full acquisition of Generation Mining at an acceptable price and paying 100% of the capex for 100% of the NPV is a better deal in the long run than earning back in to just 51% at the terms provided in the agreement).

So looking at the situation from that perspective, the earn-in agreement likely was the worst of the three options Sibanye-Stillwater had. Acquiring full ownership of Generation Mining would have made more sense, but then two additional issues would come up. First of all, SBSW has no activities in Canada whatsoever. It’s not producing, it’s not exploring, it simply has no activities in the country and doesn’t have a team that’s readily available to pick up where the Generation Mining team would leave. Having no team in place would likely have caused headaches in the SBSW head offices as they would have had to either try to keep almost the entire Generation team on, or rapidly hire people that are knowledgeable enough to advance a project.

The second issue is related to this: SBSW has zero experience with the permitting processes in Canada and would have had to start from scratch (or again, hope that the key players of the Generation Mining team would stay on). So while acquiring Generation Mining to regain full ownership of the project likely made the most sense, it’s understandable SBSW wanted to see the project getting de-risked a little bit more. Especially because Sibanye isn’t really a mine builder: its M&A history appears to be focusing on production stories.

While a fast takeover by Sibanye would have been the cleanest and fastest solution for the Generation Mining shareholders, the wait-and-see method applied by Sibanye also makes sense. For now, the company still has a stake in the Marathon PGM project but that stake is decreasing as Generation is solely funding all expenditures so far. Sibanye currently has a stake of approximately 19% in the project and has not contributed to the expenditures since Generation Mining earned its 80% stake. So we can reasonably expect Sibanye to get diluted down on its project ownership unless SBSW decides to catch up on the past exploration expenditures and continues to fund 20% of all expenditures going forward. No definitive decision has been made and we would expect to see some clarity on this soon. But for now, it’s starting to look like Sibanye will just let Generation Mining advance the project by itself while its interest in the Marathon PGM project gets diluted.

No time to waste, and Generation Mining will continue the permitting process by itself

The positive thing about knowing the final decision of Sibanye to not earn back in to 51% is that Generation Mining can now complete its planning phase to get the project through permitting and financing.

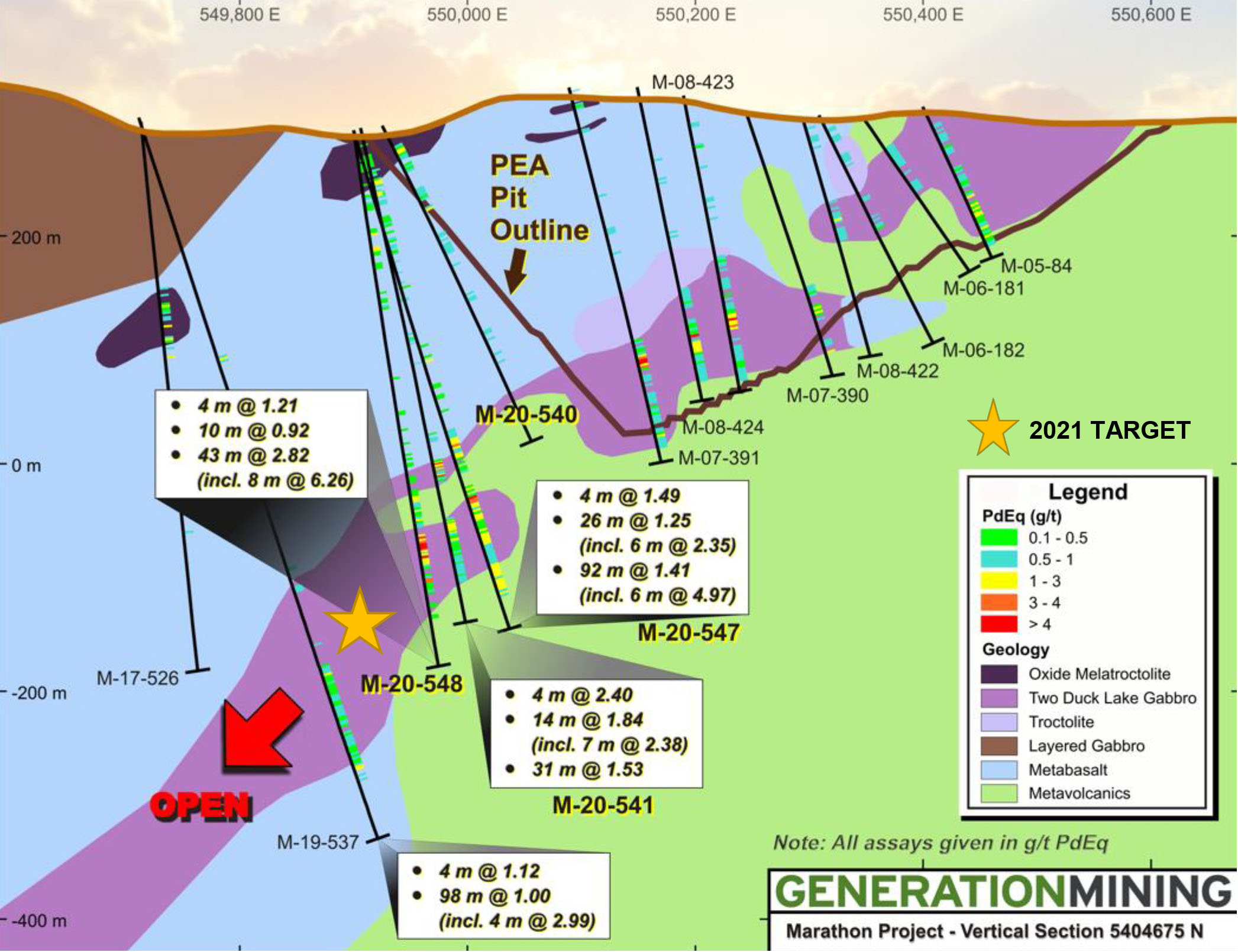

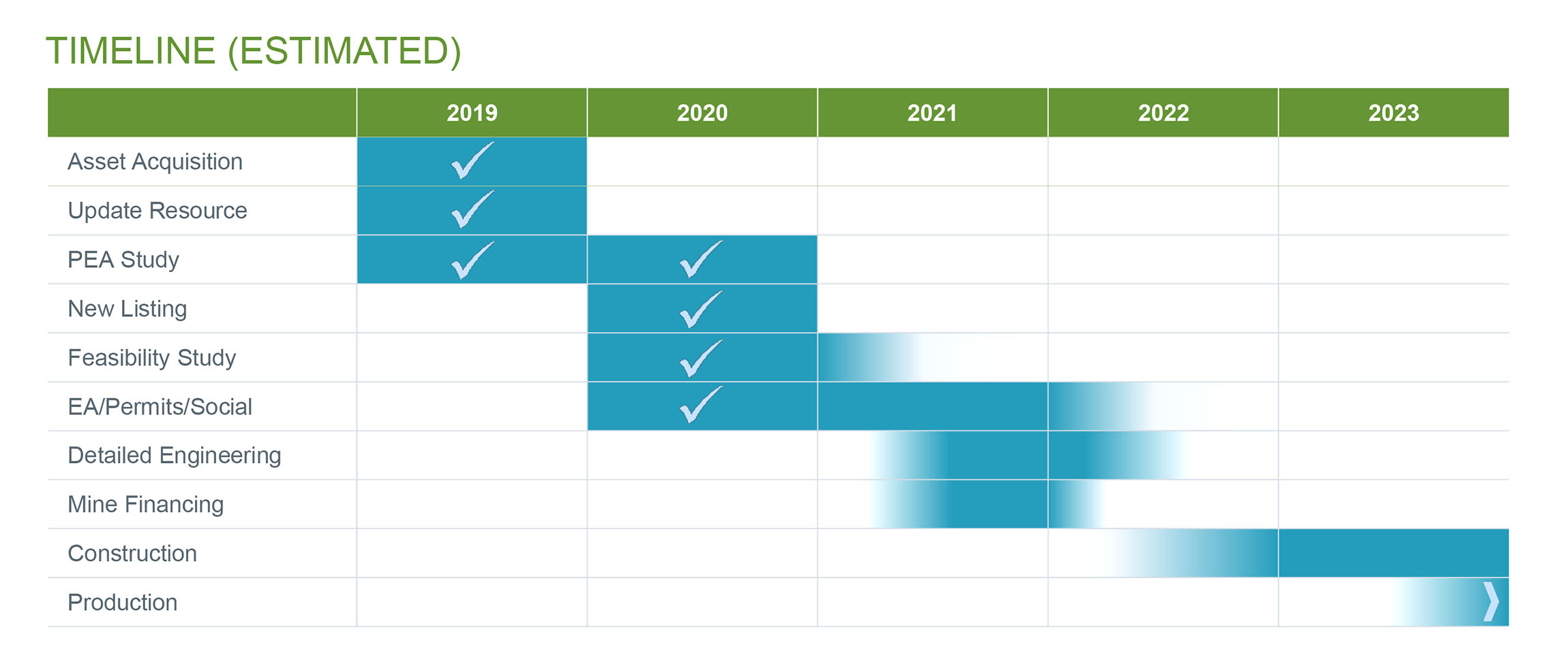

Generation will obviously continue the permitting process, which is anticipated to take another year or so. The approval of the environmental permits is now subject to the approval of a joint panel which was appointed by both the federal and provincial authorities. The initial procedure was started in April so it’s already well underway and while the joint panel has 270 days to formulate a decision, that period could be extended when the panel members ask for additional information. So taking into consideration there will likely be a few requests for additional information (which shouldn’t be anything to get too worried about, it’s pretty standard for a panel to ask the applicant a few additional questions), we should perhaps eye a 10-12 month turnaround period which would bring us to July-August next year. So for now, we are aiming to see the outcome of the panel review sometime in the third quarter of next year.

Once the panel gives the green light, the dossier moves to the desk of the relevant minister for final approval. The minister usually approves the findings of the panel and rarely digresses from the joint panel’s opinion, but this step will also take some time, especially as it will likely land on the minister’s desk during the summer months. As we expect the final rubber stamp to take a few additional months, we hope to see the final environmental approval to be issued sometime in the third quarter of next year. As this is the mining sector and delays are quite common, we aren’t holding our breath to see anything before September 2022 and Q4 would be more likely.

The cash needs and potential sources

This brings us to the funding question. Not only will Generation Mining need to cover its normal burn rate through the permitting process, in order to kickstart the construction and development activities upon receiving final approval, it will have to start to order the long-lead items well in advance of actually receiving them. Recent discussions with the company indicate a total required budget of approximately C$40-50M which would cover all costs over the next 12-15 months including permitting and the deposits for long lead items.

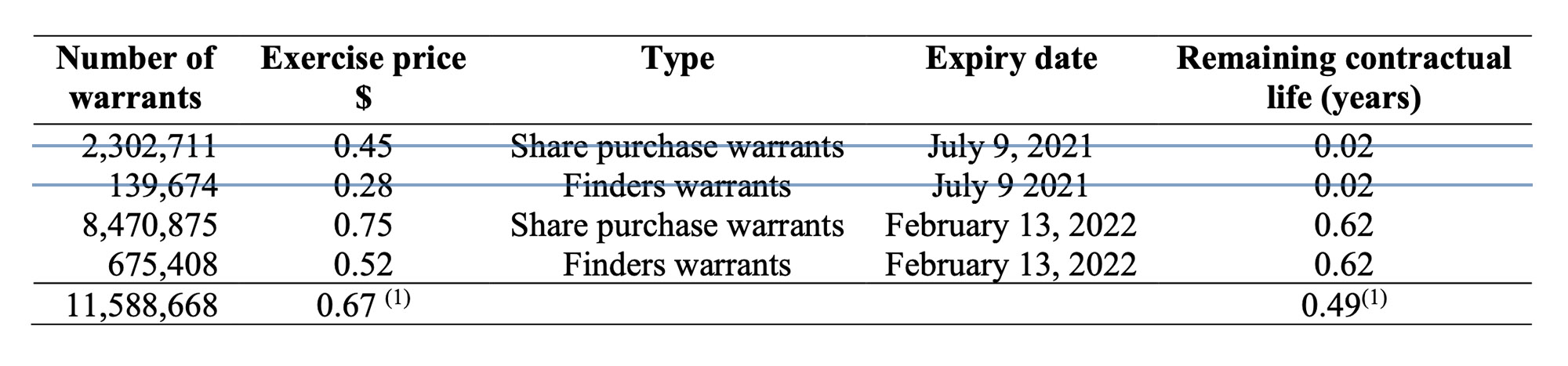

As of the end of June, Generation Mining had approximately C$12M in working capital, but GENM also had a bunch of warrants expiring in July And according to the ‘subsequent events’ portion of the financial results, the remaining 2.47M warrants were exercised, resulting in an additional cash inflow of just under C$1.1M.

But this is where it gets interesting: there are 10 million warrants expiring in February 2022. 8.5M of those warrants have an exercise price of C$0.75 while the remaining 0.7M warrants have an exercise price of C$0.52. All these warrants are currently in the money and if they would all be exercised, an additional C$6.7M would flow right into the company’s treasury.

The share price will have to continue to trade above C$0.75 for the next six months in order to incentivize the warrant holders to effectively exercise them, but generation Mining will likely be able to fund C$15-17M of the cash requirements from the existing cash position and potential warrant exercises. This means an additional C$30M will be required to see the company through the permitting phase.

The company has lately been hinting at doing a streaming deal, and that would make sense. While Palladium is the main commodity, the Marathon PGM project actually is a polymetallic project and according to the recent feasibility study, the project will also produce just over 150,000 ounces of gold, 537,000 ounces of platinum, 2.8 million ounces of silver and 467 million pounds of copper (on a recovered & payable basis). So casually mentioning a streaming deal isn’t just a marketing trick, but potentially a realistic solution as there have been several examples of large streaming companies entering into a long-term agreement with advanced stage non-producing companies whereby advances on a streaming agreement would be unlocked as the project reaches milestones. It’s also interesting to know Osisko Mining (OSK.TO) is a 4% shareholder of Generation Mining, and is related to Osisko Gold Royalties (OR.TO, OR) which is a household name in the precious metals streaming industry. But we would expect several parties to be interested in a project of this size. And in a recent update, Generation Mining announced it has retained Endeavour Financial as its financial advisor as it works through the potential financing deals to move Marathon forward.

It’s also quite clear the management team would like to avoid any additional share dilution as the CEO and Chairman continued to buy substantial blocks of stock on the open market. Since Sibanye decided to pass on exercising its back-in right at Marathon, CEO Jamie Levy has bought 300,000 shares for C$253,000, Chairman Kerry Knoll opened up his wallet to buy 80,000 shares for just under C$70,000 while director Stephen Reford found some spare change to fund his purchase of 166,400 shares for a total of just under C$150,000.

The main takeaway is that after Sibanye’s decision to walk, key people at Generation Mining spent almost C$475,000 on buying additional stock. CEO Jamie Levy now owns 5.6M shares in total, Chairman Knoll is up to 3.4M shares while director Reford’s filings disclose an ownership of in excess of 0.5M shares. These three gentlemen now control 9.5M shares of Generation Mining and we like to think they aren’t interested in throwing good money after bad money and see a very clear path forward to create value for all shareholders.

And perhaps just to show how meaningful those insider purchases are: Since January 1st, CEO Jamie Levy has now spent in excess of C$435,000 on buying shares of Generation Mining in the open market. That amount is higher than his pre-tax salary and 2020 bonus combined. Putting his money where his mouth is, is the biggest vote of confidence while showing his interests are aligned with the interests of smaller shareholders.

Conclusion

The uncertainty has come to an end, and it looks like Generation Mining will have to advance the Marathon PGM project on its own. And that’s fine as the remaining ownership of Sibanye-Stillwater, which we now estimate at 19% on the project level, will continue to be diluted down and we expect Generation Mining to gain full ownership of the project when all the dust has settled.

Sibanye’s decision to walk away is understandable, and keep in mind the South African company still is the largest corporate shareholder with a 7.3% stake. A percentage we think may increase should Sibanye decide to swap its project stake for an additional equity stake in the company. Reaching full ownership of Marathon PGM would be positive for Generation Mining (as it would for instance making a streaming deal easier if you’d own 100% of a project rather than doing a deal on an ownership stake base), but it obviously all depends on the price tag. As Generation Mining continues to spend money at Marathon, it is effectively eroding Sibanye’s stake.

In any case, the period of uncertainty is now over, and Generation Mining now knows it will have to get the project across the finish line on its own. The permitting process is ongoing and completing the process will be a very important milestone for the project and the company.

Disclosure: The author has a long position in Generation Mining. Generation Mining is a sponsor of the website. Please read the disclaimer.

This was a well written article. Thank you!

Well done on the 3 scenarios. I have yet to see a well thought valuation model following a streaming deal with a modest equity raise. Hope

for a favorable outcome with a rerating in the future