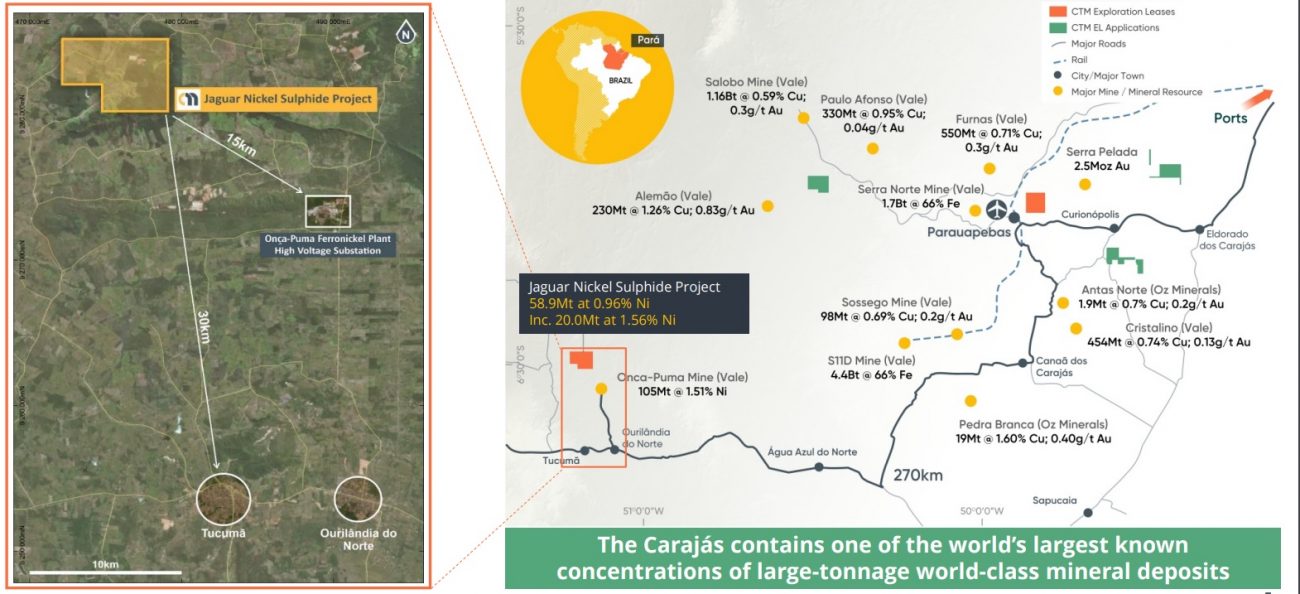

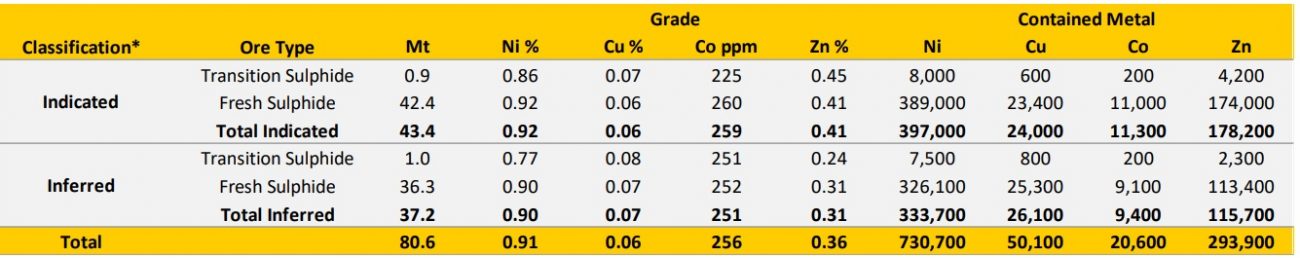

Centaurus Minerals (CTM.AX) has released an updated resource estimate on its Jaguar nickel project in Brazil which now contains 80.6 million tonnes at an average grade of 0.91% nickel for a total nickel content of just over 730,000 tonnes. Additionally, and perhaps even more important, the total indicated resource now contains 43.4 million tonnes at 0.92% nickel for 397,000 tonnes of nickel, which is just under 900 million pounds of the metal. Additionally, there’s about 25,000 tonnes of copper, 11,300 tonnes of cobalt and just under 180,000 tonnes of zinc in the indicated resource category and those could all be valuable by-products to reduce the net operating costs per pound of nickel (although we aren’t sure what the payability levels are of these metals in a nickel concentrate, as Centaurus is still planning on producing just a single concentrate, and Vale (VALE) still has the first rights on marketing the nickel concentrate).

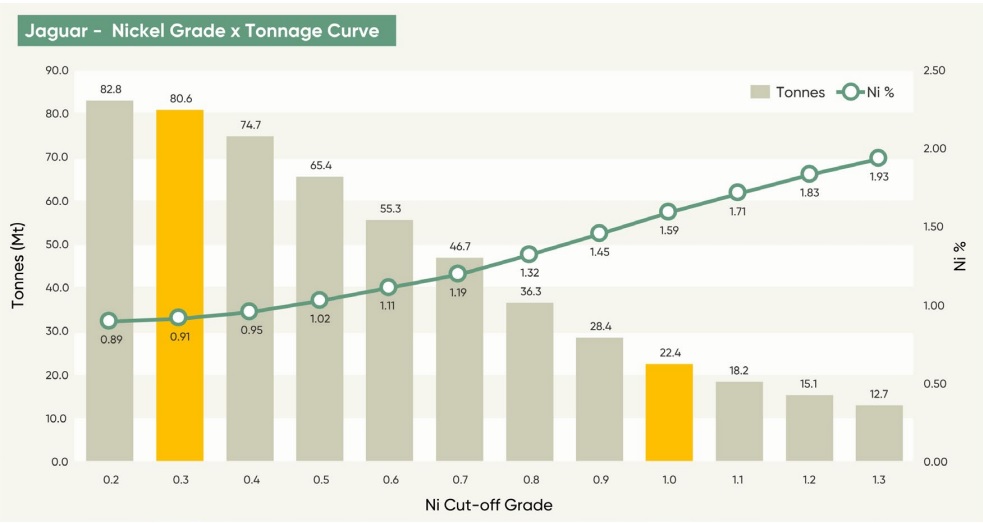

The indicated resource will continue to grow and that will be important for the feasibility study which will be completed in 2022. That feasibility study should be pretty good considering A) the grade is good and B) about 70% of the total resource base is located within 200 meters from surface. The scoping study, which was completed in March 2021, was based on a total resource of 59 million tonnes of which around 32 million tonnes ended up in the mine plan. The scoping study envisaged a 10 year mine life for a total production of approximately 203,000 tonnes of nickel (for an average production rate of 20,000 tonnes per year) at a C1 cash cost of US$2.41 per pound and an AISC of less than US$3/pound.

The initial capex was estimated at just US$178M which resulted in a payback period of just 1.9 years thanks to an average annual pre-tax free cash flow of in excess of US$109M using a base case nickel price of US$7.5 per pound. The after-tax NPV8% was estimated at US$453M at that nickel price, but this jumps to US$626M using $8.25 as the nickel price throughout the mine life.

Disclosure: The author has no position in Centaurus Metals. Please read our disclaimer.