Despite copper trading at in excess of $4.5 per pound and zinc trading close to $2/pound, the market still doesn’t seem to care about Kutcho Copper (KC.V). The company recently released a feasibility study on its flagship Kutcho copper-zinc project but the share price has slid by about 40% in the past few months despite the prices of the main metals of the deposit moving in the right direction.

While the feasibility study now provides a reliable look under the hood, Kutcho Copper also made progress on cleaning up its balance sheet where the loan payable to Wheaton Precious Metals (WPM, WPM.TO) was slowly suffocating the company as it would for sure have been an issue that would have to be dealt with before moving to the construction financing stage. And that’s exactly what Kutcho Copper did. It renegotiated the agreement with Wheaton Precious Metals which walked away with more ounces of gold and silver to be delivered under the streaming deal. But it also means a portion of the execution risk now lies with Wheaton Precious. If the project doesn’t go ahead, WPM will lose quite a bit of money on this deal.

A part of the weakness we currently see in the share price could be explained by the warrant overhang. About 9.5M warrants with an exercise price of C$0.30 are expiring on June 6, followed by an additional 4.8M warrants with the same exercise price expiring on September 23, 2022. Kutcho Copper will receive in excess of C$4M if all warrants are exercised and that’s a nice secondary cash inflow.

The feasibility study

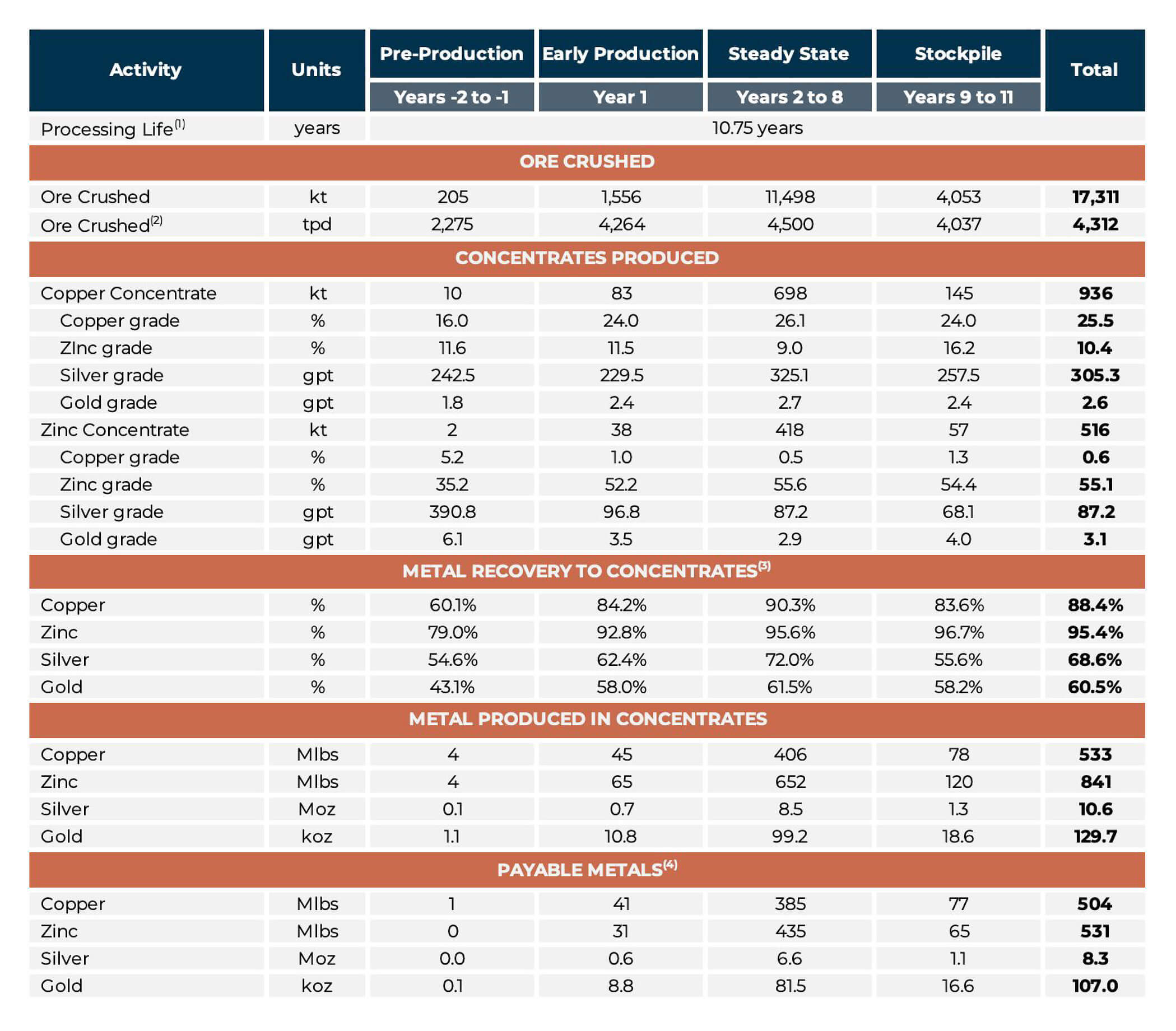

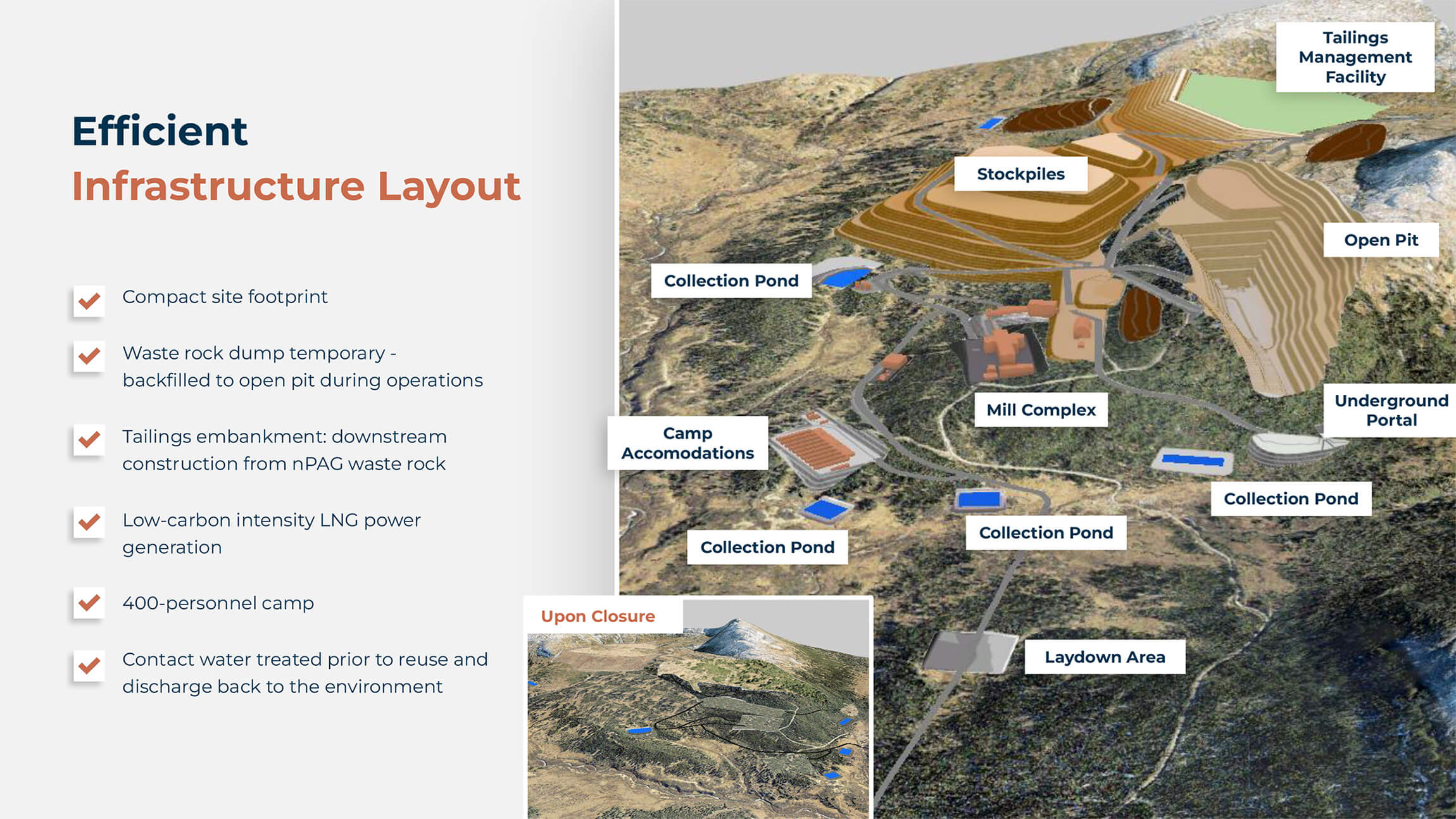

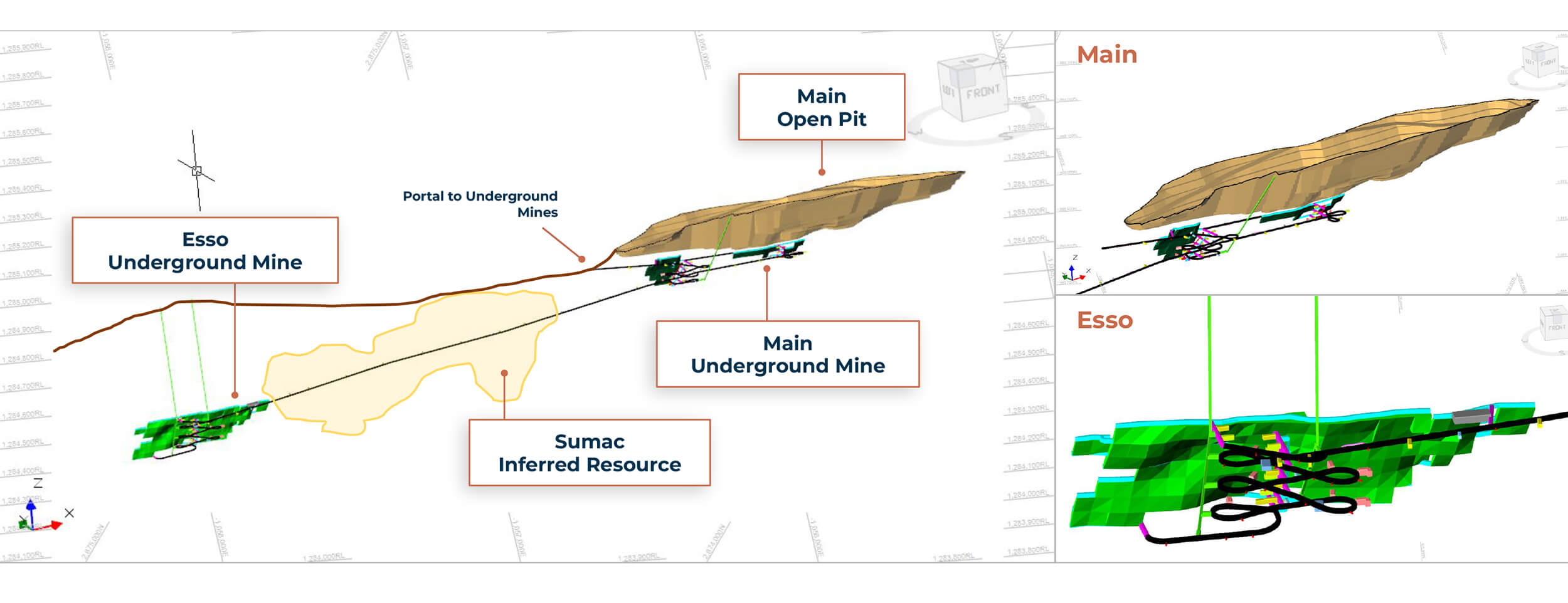

The feasibility on the Kutcho copper project now incorporates an open-pit stage as well as an underground production stage. The total payable production over the 11-year mine life will be 504 million pounds of copper and 531 million pounds of zinc. The anticipated gold and silver production are respectively 107,000 ounces and 8.3 million ounces but as Wheaton Precious Metals has the streaming rights on those metals, investors in Kutcho Copper should focus on the payable amounts of copper and zinc.

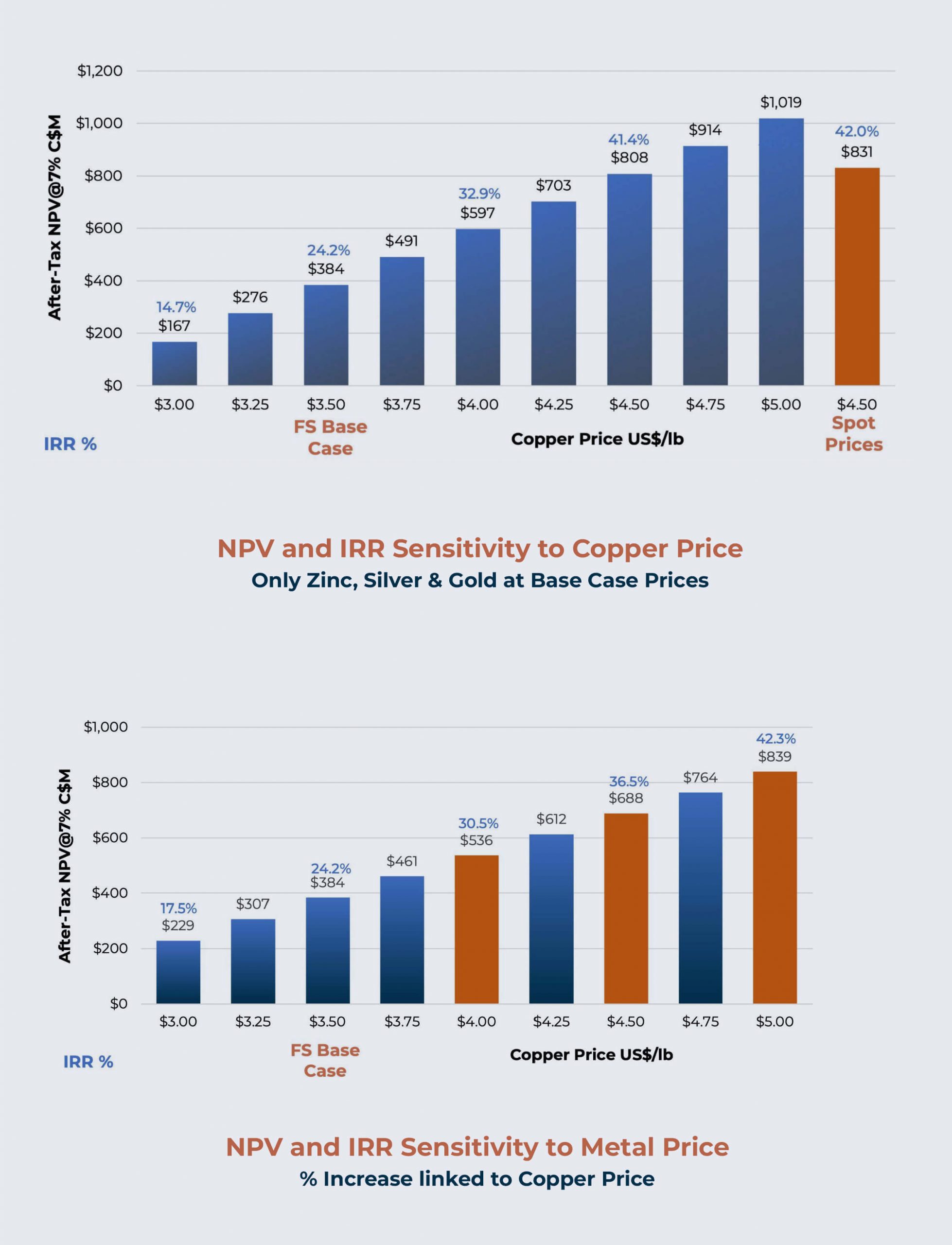

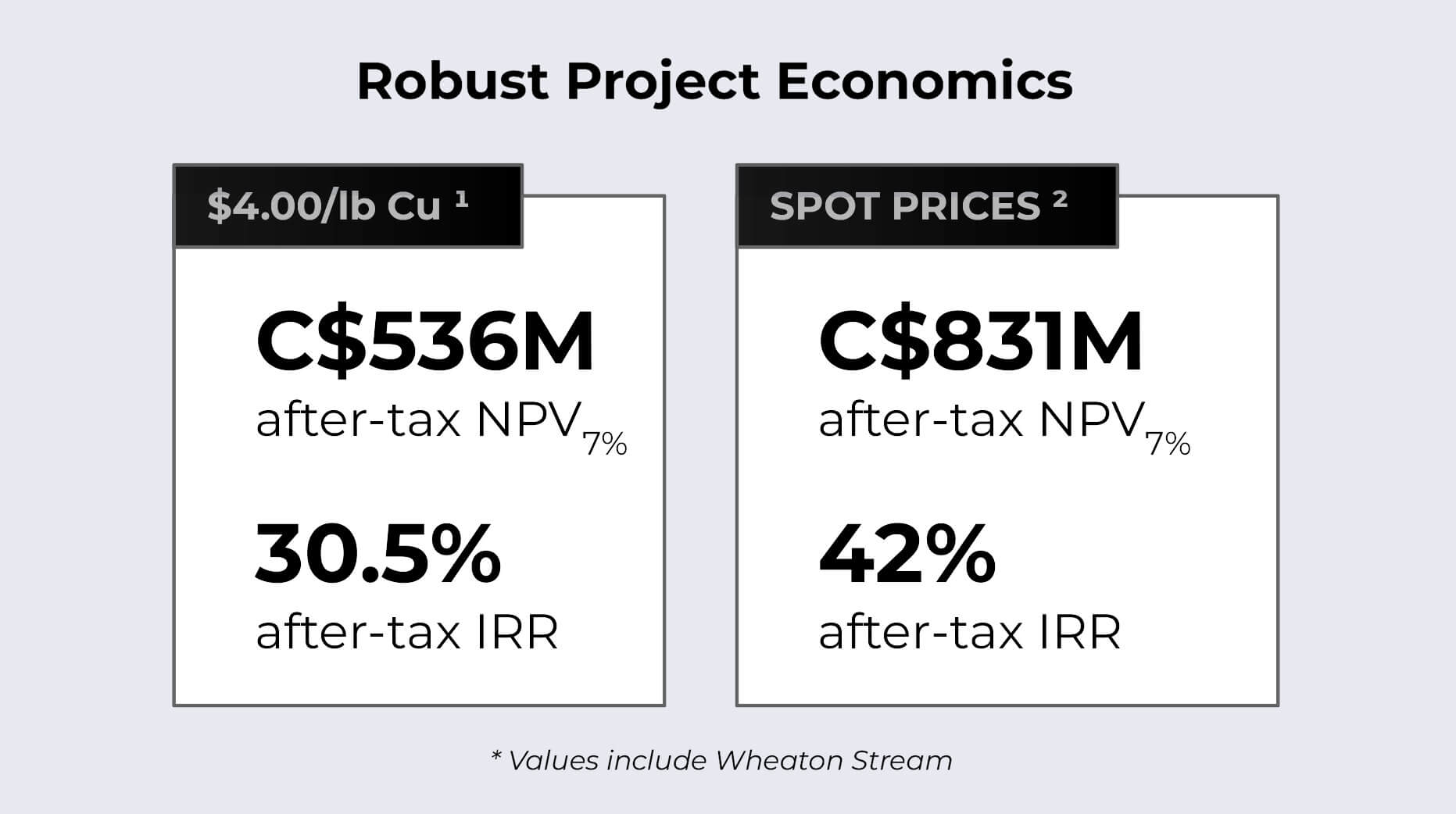

The anticipated AISC is estimated at US$1.80 per pound of copper-equivalent and using a copper price of US$3.5/pound and a zinc price of $1.15 per pound, the after-tax NPV7% was estimated at C$461M, taking the initial capex of C$483M into consideration. The sensitivity analysis is pretty important for this project as a copper price of $4.50 per pound and a zinc price of $1.57 per pound would boost the after-tax NPV7% to C$931M.

Of course we cannot ignore the impact of the gold and silver stream on the project as Kutcho Copper has entered into an agreement with Wheaton Precious Metals whereby the latter is entitled to 100% of the gold and silver production. But one of the slides in Kutcho Copper’s presentation contains an interesting overview including the full impact of the precious metals streams. Applying a copper price of $4/pound (and $1.15 zinc), the after-tax NPV7% would be approximately C$536M. Using the spot prices at the time of the publication of the feasibility study of $4.5 copper and $1.57 zinc, the after-tax NPV7% increases to in excess of C$800M with an after-tax Internal Rate of Return of 42%.

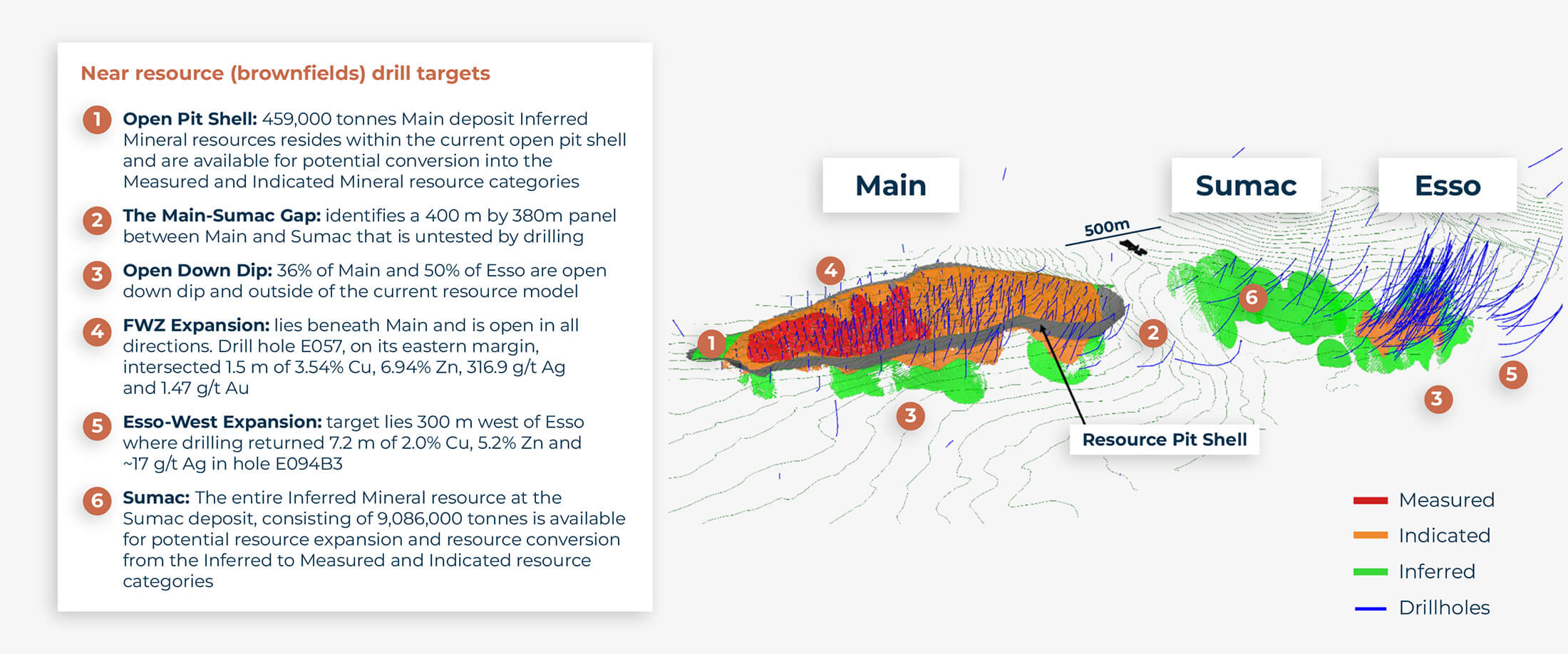

There appears to be upside potential as well. Keep in mind a feasibility study can only take reserves into account and has to ignore the inferred resources. This means there’s almost 13 million tonnes of resources ‘sidelined’ and waiting for conversion into higher resource and reserve categories. It’s not realistic to assume every single tonne will make it to the reserve stage but if we would apply a conversion ratio of 40%, about 5 million tonnes will be added to the mine plan (this would mainly come from the Sumac deposit which is currently excluded from the feasibility study) which would represent about 3-4 years of additional mine life.

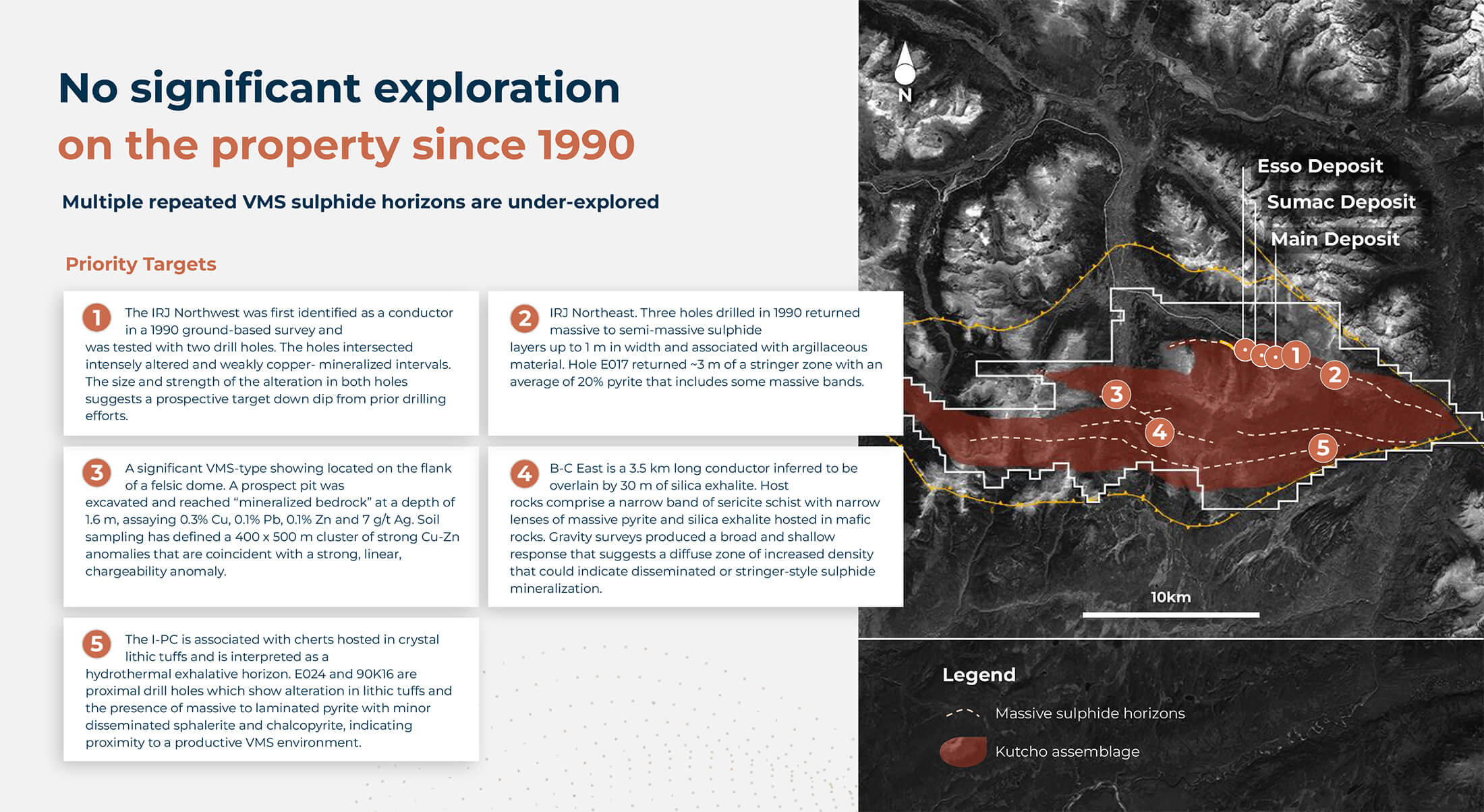

Of course there’s no certainty the mine life will be extended but Kutcho Copper has been focusing on bringing the current measured and indicated resource into a mine plan, while there remains plenty of exploration upside on the entire property.

And that’s just zooming in on the low-hanging fruit adjacent to the already known mineralized deposits. There are other drill targets on the Kutcho Copper project which could be explored using the cash flow from the production phase. At this point it’s probably useless to spend millions of dollars on drilling these exploration targets as Kutcho Copper likely wouldn’t be rewarded for it by the market.

A Q&A with CEO Vince Sorace

The Feasibility Study

The feasibility study was quite interesting as the Kutcho Copper project will produce two of the world’s most sought after base metals these days. With an average of 41 million payable pounds of copper and 31 million payable pounds of zinc and an anticipated AISC of just US$1.80 per pound of copper-equivalent and an anticipated production rate of around 50 million pounds copper-equivalent per year, your margins will be rather attractive. Does the AISC include the negative impact from the streaming agreement with Wheaton Precious Metals? If it doesn’t, would it be fair to assume the AISC including the impact of the streaming deal will be around US$2.25-2.35 considering you’ll lose about US$20-25M in annual revenue due to the streaming deal?

As you notice, we published the AISC on a copper-equivalent basis and not on a by-product basis. This means the WPM streaming deal only impacts revenue, capital and operating costs are not affected. However, the NSR cutoff calculation to generate reserves brings into account the impact of the streaming deal.

In the ‘opportunities’ section of the feasibility study, additional ore sorting optimization is mentioned as a possibility to further enhance the value of the project. Is this something you are currently looking at?

Kutcho Copper is embarking on a test work programme with the objective of optimising the ore sorting circuit. Benefits derived from improved ore sorting parameters include the production of lower volumes of tailings (with a commensurate reduction in the size of tailings management facility). This all relates to a potential reduction in initial and sustaining capital associated with the comminution and flotation circuits. It could also result in higher head grades into the mill and higher metallurgical recoveries.

A relatively large portion of the zinc ends up in the copper concentrate and of the 841 million pounds of zinc you will recover, only 531 million pounds are payable. Is there any upside potential here from trying to recover more payable zinc, or isn’t there anything to do about this?

We conducted a great deal of work on metallurgical performance through 2019 and 2020 ahead of launching the feasibility study itself. All of that focused on maximizing the payable $NSR of the ore. The most significant contributor to value is the copper and we focused very much on maximizing the copper recovery to the copper concentrate. In doing that, you do lose some recovery performance of zinc. In very rough terms we were able to determine that each 1% of improved copper recovery could come at the expense of 5 – 7% zinc recovery and the payable $NSR still improve. The process flow sheet is robust and could be easily adjusted during operations to increase the zinc recovery if zinc prices were to significantly out strip copper prices, for example.

Further evaluation of blending concentrates with other producers to reduce the overall proportion of zinc in the copper concentrate will be undertaken closer to production.

How would an access road agreement with the First Nations impact your initial capex?

The scenarios we are looking at would have the potential to significantly reduce the initial capital cost by having a third party assume this cost. The capital cost reflected in the FS would then be transferred into a toll fee as an operating cost and this would have a positive impact on our NPV as the higher opex would be subject to the annual 7% discount rate.

Regarding the capex, the inflation only really started to accelerate after your feasibility study was published. With a contingency of just over 10% included in your C$483M capex, may we assume you’ll have to work with a higher initial capex than outlined in the study?

The key item to acknowledge here is that there was significant inflation already in the system in 2021 especially in terms of wages, steel, fuel and equipment all associated with building and operating mines, and most of our capital build up and costing was conducted in Q3 of 2021. This inflation was not being properly documented or accounted for in the public arena. As such, we believe that our CAPEX numbers accurately account for the full inflation picture in 2021.

If inflation were to keep moving higher over the next two years, then the initial capital will certainly go up. However, commodity prices are also likely to move up as key contributors to inflation itself.

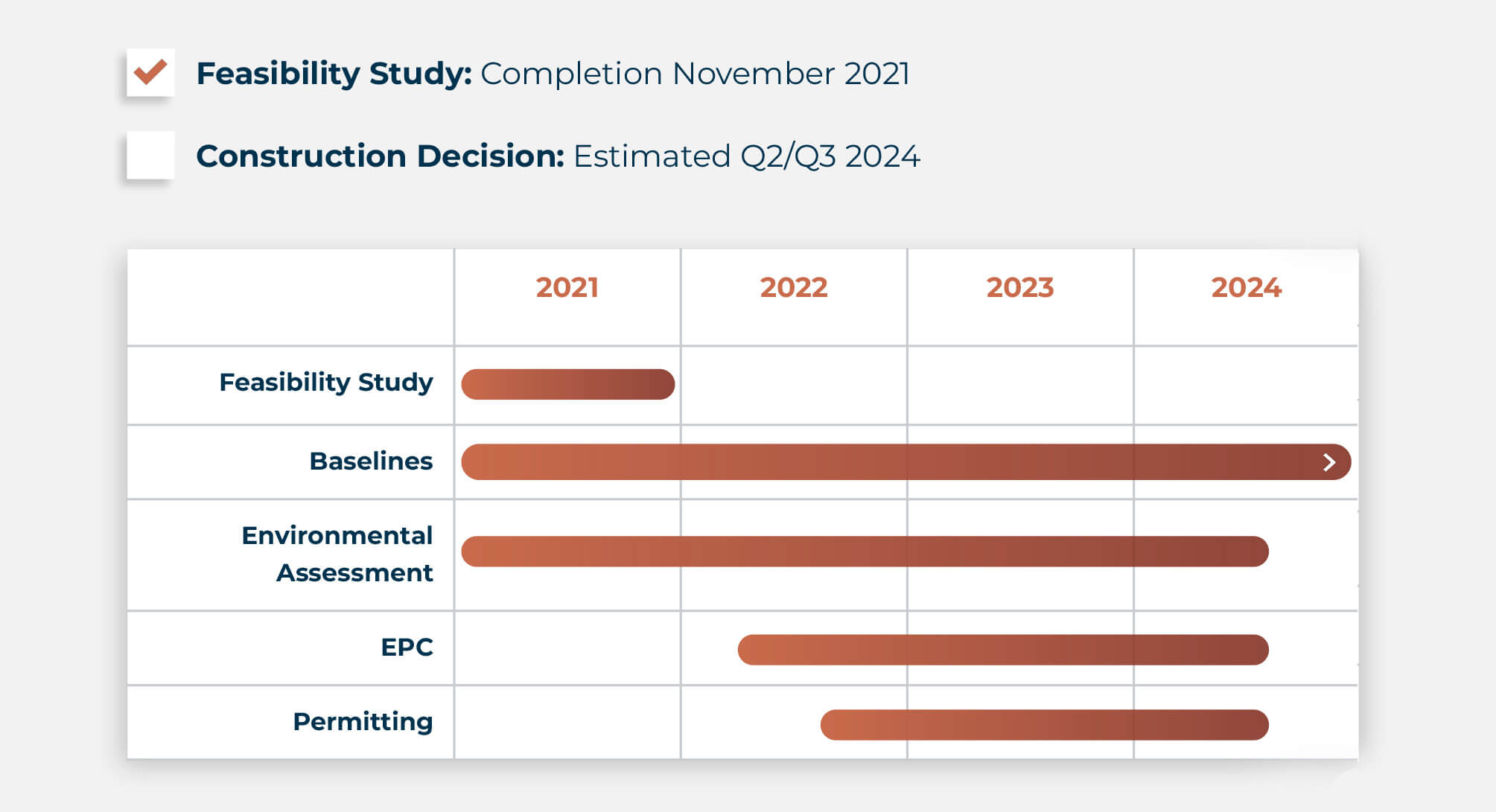

The path forward towards permitting and construction

In July you announced you started the negotiations with the Kaska Nation and Tahltan Nation to work on Economic Participation Agreements. Is there any news to share here?

These negotiations are ongoing, and from our perspective, moving ahead smoothly and expeditiously. The relationships between the Company and Tahltan and Kaska First nations remain strong, as we continue to work together on the project, community efforts and the likes. It is important to note that these are two very pro-mining First Nations groups in B.C., and currently have a number of development stage and operating projects within their territories.

As you have released your feasibility study, you have now entered the ‘boring phase’ of the project as it will take a while to complete the environmental permitting process. Could you perhaps walk us through the process towards getting the permits, and explain what stage we are at right now?

Getting the Kutcho project permitted in B.C. is now a very prescribed process, with well defined timelines and activities structured into the process. We are now ready to formally enter into the Environmental Assessment process “EA” (within next 30 days or so), at which time we will begin things like the consultation process with First Nations and local communities. Once the EA process is complete and approved (which is a big blessing towards the success of the overall permitting), the formal permitting process follows.

Are you fully funded to complete your permitting program?

We have approximately C$4.5M coming in this year through warrant exercises, which will fund a good portion of that. We are also in a number of more strategic discussions with groups, including off-takers, that would provide capital through to and including capital for construction.

Most people seem to be worried about trying to get an open pit mine permitted in British Columbia. What can you say to alleviate those fears?

This is an unfounded fear. A number of open pit mines have been successfully permitted in recent years in British Columbia including Red Chris in 2012. We also see Skeena Resources (SKE.V) successfully marching down the path towards obtaining an EA Certificate for the proposed open pit at Eskay. The key to success is in designing a robust project that properly mitigates environmental concerns. We believe that the design we have for Kutcho where we are doing things such as re-filling the open pit and capping it, are exactly what regulators, First Nations and communities are looking for in terms of developing a mining project.

The deal with Wheaton PM

Another issue investors had with Kutcho Copper was the debt owed to Wheaton Precious Metals. Of course, the money provided by WPM was instrumental for Kutcho to secure the project as without the cash, you wouldn’t even have been able to acquire the Kutcho project. Debt on the balance sheet of a non-revenue company is frowned upon, and we were glad to see you were able to negotiate a deal with Wheaton Precious Metals. So the total amount of C$38.4M owed to Wheaton was wiped out by issuing US$7.5M in common shares of Kutcho while removing the stream reduction as part of the original streaming agreement with Wheaton PM.

So while on a monetary basis you aren’t much better off as the combination of the payment in stock, the elimination of the stream reduction and the waiver to make the US$20M additional payment in case of a higher throughput makes it look like Wheaton has the better deal on a pro forma ‘dollar’ value. However, our interpretation is that Kutcho comes out ahead as you have basically moved the entire permitting risk and operating risk to Wheaton Precious Metals: WPM will make more money on the gold and silver stream, but ONLY if the project actually goes into production. Is that a view you could agree with?

Correct, and yes, agreed. In addition, we are now saving over C$3.5M per year in interest payments – which would have been close to another C$10M in debt if we continued through the end of the term of the loan. This also clears up the balance sheet which is conducive and we believe required to other opportunities we may pursue, such as M&A opportunities or other. We believe it was a fair valued transaction, and as you mentioned, Wheaton has now taken all the risk on the project, which should speak loudly to their confidence levels.

Wheaton PM now owns just over 17.6M shares in Kutcho Copper, for a total stake of in excess of 15%. Does Wheaton have any investor rights agreement? Will they appoint a director to your board?

No, they have no investor rights and do not intend to appoint a board member. Nor do they intend to sell any of their shares in the near future, they are long term shareholders.

There’s not just the good deal with Wheaton PM as you have been working diligently to remove some other overhangs as well. In the second semester of last year you started the process to buy back the royalty owned by Sumitomo, and you have terminated the right of first refusal of Sumitomo to purchase the concentrates. It looks like the market doesn’t realize the importance of not having your hands tied up to a specific concentrate buyer. Could you elaborate on how making the project and its output ‘less encumbered’ is helping Kutcho Copper in the long run?

We viewed the buyback as a highly accretive transaction to the Company. It provided economic benefit and termination of the ROFR gives the Company full flexibility to engage freely in strategic discussions with respect to offtake and offtake financing arrangements. This will provide a more competitive environment for concentrate offtake terms given that offtake for 100% of the concentrate is now available for negotiation. This will be an important part in raising development capital to build the project.

The share price

The share price has been pretty weak lately despite the strong copper price and very strong zinc price. Is this solely caused by the warrant exercises ahead of the June expiry date?

Yes, we believe there has been selling in the market due to warrant exercising, although a majority of the warrants are held by people close to the company who will not be selling to exercise, we are still seeing this lull in the share price due to those who are.

A difficult question but with a market cap of about C$70M you are trading at less than 0.10 times your after-tax NPV7% at spot prices and just 0.15 times the NPV using $3.50 copper and $1.15 zinc. What do you think the market needs to see before valuing you accordingly? Even 0.25 times NAV, which is not outrageous for a feasibility stage company would put you at a fair value of C$1.50 per share using the midpoint between the base case and ‘spot’ case NPV in the feasibility study.

As mentioned above, I think we are seeing some pressure on the share price due to warrant exercising, and when this is complete, we should see the share price rebound. I agree, we are trading at exceptionally low valuations given the economics and the integrity of the feasibility study/project and being in such a safe mining friendly jurisdiction such as British Columbia, Canada. I believe upcoming events that should help drive valuations (even above a .25 PNAV multiple) as we continue to de-risk towards a construction decision include:

- Demonstrating further progress with the First Nations and the economic participation agreements currently in negotiation

- Moving further through the EA process, closer to completion and into the final stages of permitting

- Successful engineering enhancements and possible road participation agreements that could have a vey good impact regarding capital reduction

- Lock in a strategic deal to provide for required CAPEX

- Sustained Copper prices between $4 – $4.50 and Zinc above $1.50 (which I believe is possible – and most likely higher Copper prices to come)

Conclusion

Kutcho Copper has ticked all the boxes it needed to tick in the past two years as the company renegotiated its deal with Wheaton Precious Metals resulting in a much-improved balance sheet. The ROFR on the offtake of the copper and zinc concentrate was dealt with and Kutcho Copper published a positive feasibility study on its flagship asset.

The company is now entering the permitting phase which is generally seen as the main hurdle. CEO Sorace doesn’t seem to be too worried about getting an open pit mine permitted in British Columbia and if he is right, the current valuation of 0.13 times the after-tax NPV7% (using $4 copper, $1.15 zinc and including all the side effects of the gold and silver stream) appears to be too low.

Disclosure: The author has a long position in Kutcho Copper. Kutcho currently is not a sponsor of the website but has been in previous years. Please read our terms & conditions.

Excellent overview and in depth.