Last week, Contact Gold (C.V) announced it is selling itself to Orla Mining (OLA.TO, ORLA), the most logical acquiror given Orla’s development-stage Railroad project right next to Contact Gold’s resource-stage Pony Creek exploration project. The transaction appears to be the only viable solution to avoid wiping out Contact’s shareholders through what would no doubt be financings the resulted in the issuance of tens of millions of new shares.

Fortunately, Orla will be paying in stock which means Contact Gold shareholders gain exposure to a gold producer that will produce 115,000 ounces of gold at an AISC of US$925 per ounce (the midpoint of the 2024 guidance). This means the Mexican operations of Orla Mining will likely generate north of US$115M in cash flow in 2024. A substantial portion of the cash will be spent on exploration and project development as Orla is pretty serious about expanding its asset portfolio and actually has the (financial) means to do so. And as the valuations in the junior mining sector remain under severe pressure, we actually hope Orla can make additional accretive acquisitions using its strong share price as currency.

The details of the Orla-bid

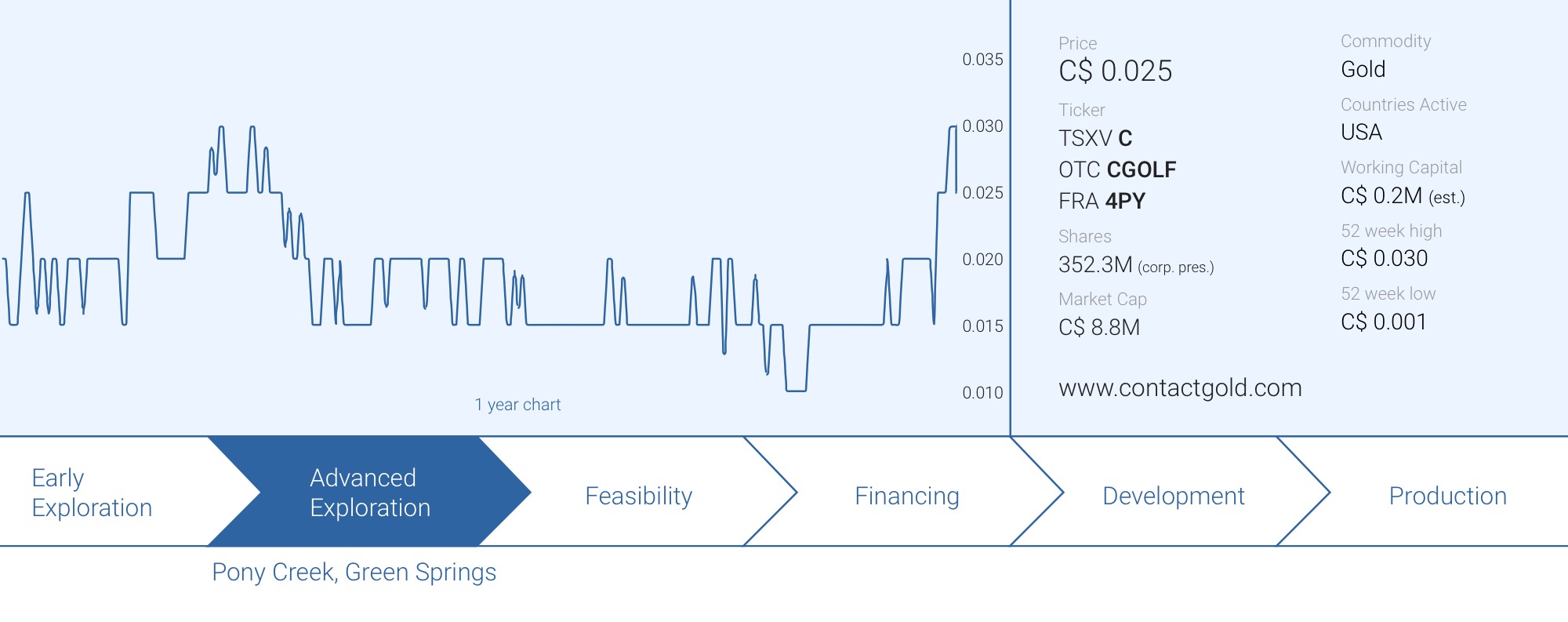

The offer is pretty straightforward. Orla is offering to exchange every share in Contact Gold for 0.0063 shares of Orla. Or in other words, per 10,000 shares of Contact Gold, shareholders would receive 63 shares of Orla Mining. The offered share swap had a value of C$0.03 per share of Contact Gold but it goes without saying the ‘fair value’ will fluctuate based on the Orla Mining share price. At the current Orla share price of C$4.79 (Monday’s closing price), the offer is worth C$0.03 per share of Contact Gold. The order book indicates a bid of C$0.025 and although there is no guarantee anyone can buy the Contact stock at C$0.025 as there is a 20% difference between bid and ask, but if some lucky souls are able to buy Contact stock at C$0.025, they would be buying Orla Mining at a discount as C$0.025 / 0.0063 = C$3.97. But as you can imagine, very few Contact shareholders are willing to sell at C$0.025 right now so the calculation above should be seen as a ‘theoretical’ math exercise.

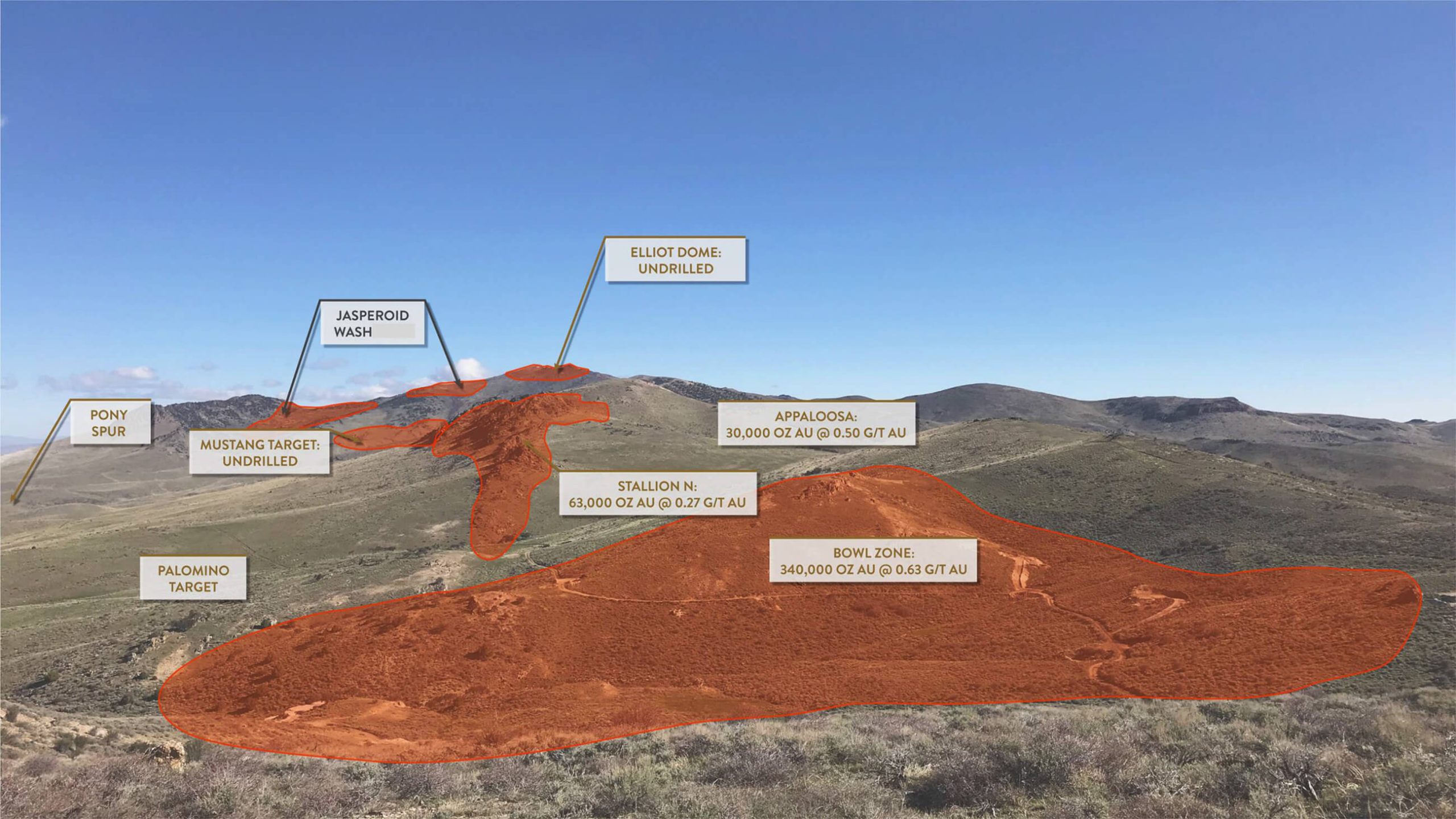

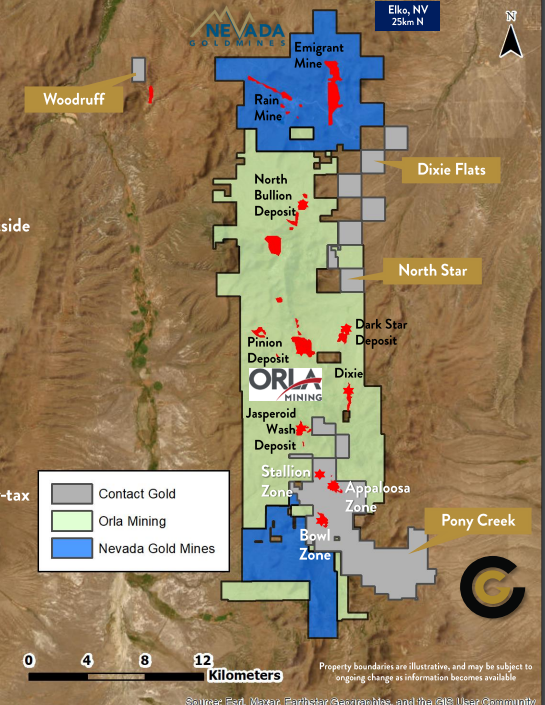

It was also interesting to see how Orla was ‘down-playing’ the acquisition, for a lack of a better word. Rather than ‘adding ounces’ or ‘expanding its asset portfolio’, Orla chose to use the title ‘enhances land position in Nevada’. This appears to imply Orla was only interested in Contact Gold because of the strategic location of the Pony Creek project, which borders Orla’s resource at Jasperoid Wash. That being said, we do think the 433,000 ounces of gold at Pony Creek with an average grade of 0.52 g/t could be a useful addition to Orla Mining’s development plans at Jasperoid Wash and the Railroad project in general. Orla’s CEO did mention at the BMO conference in Florida the company would be drilling Pony Creek this year which further reinforces the interpretation the Pony Creek resource will be added to the Railroad mine plan.

As a reminder, the South Railroad project has an after-tax NPV5% of US$315M at a gold price of $1650/oz (US$486M at $1899 gold), and likely is the next project that will be developed by Orla Mining. Potentially adding 433,000 ounces of gold to the mine plan, the addition of Pony Creek would increase the total amount of ounces in the mine plan by approximately 25%, while the incremental capex to develop the Pony Creek resource would likely be pretty minimal. And just for clarity sake: there currently is no existing economic study on the Pony Creek project, but we would expect Orla Mining to include the resource in an updated economic study (the current study is almost two years old).

Our opinion

It is what it is. Only shareholders who recently acquired their position and those participants in the C$0.015 placement last year which didn’t own shares before that placement will have made money on Contact Gold. We started keeping an eye on Contact Gold when the company came public at C$1.00 per share in 2017 and Contact Gold never traded over that price. By the end of 2017, the year of its going-public transaction, the share price had already lost almost half of its value.

And the ‘salami slicing’ just continued throughout the entire history of the company, all the way until the bitter end. Trading at C$0.015 before the offer came in, Contact Gold’s management had to make a choice. Either you graciously look for an exit, or you issue another 100 million shares at a cent to keep the company going. Although Centerra Gold (CGAU, CG.TO) is spending its cash on the Green Springs project, the other (non-Green Springs) costs and G&A expenses obviously just keep on running. Is issuing 100 million shares at a cent a viable solution? Probably not.

We support the deal, mainly because we like what Orla Mining is doing and planning on doing in the near-term future. The shareholder vote has been scheduled for April 23rd and there’s very little doubt this deal will go ahead. Unless a third party comes out of the woodwork but those chances are pretty slim.

Disclosure: The author has a long position in Contact Gold. Contact Gold is a sponsor of the website. Please read our disclaimer.