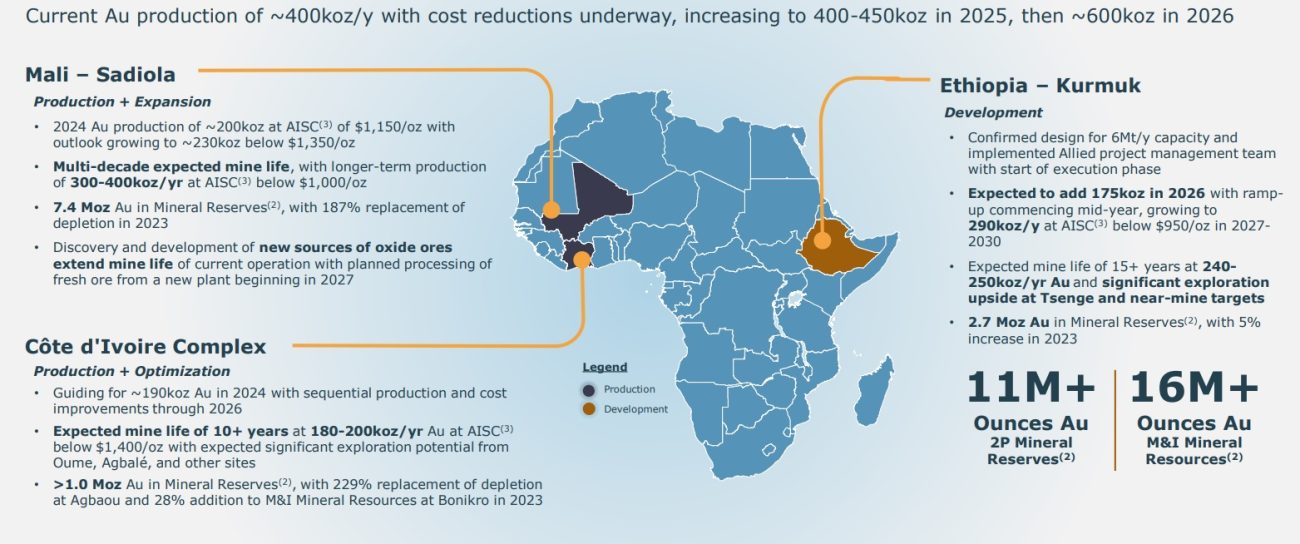

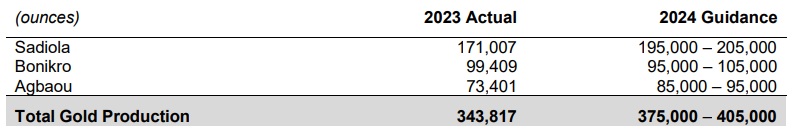

Allied Gold (AAUC.TO) has released its operating results for 2023. The company ended the year on a strong note with a total gold production of almost 95,000 ounces in the final quarter of the year, which pushed the full-year output to just under 344,000 ounces of gold. About half of the gold production came from the Sadiola mine where the company is expecting another production increase in 2024. As you can see below, Allied Gold aims to produce 375,000-405,000 ounces of gold this year thanks to a 15% production increase at Sadiola.

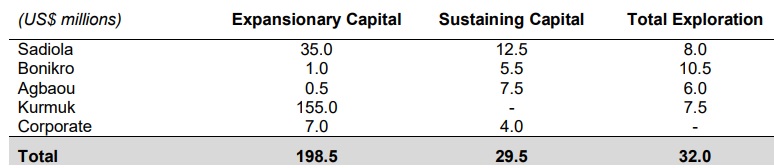

The AISC came in below $1585/oz in 2023 and thanks to the higher production rate, Allied Gold expects the cash cost to come in at $1250/oz while the AISC will fall by approximately 10% to just $1400/oz. This means that at $2000 gold, the anticipated margin on the mine level will be $600/oz or approximately $240M in cash flow. The majority of the cash flow will be used to cover the growth plans as Allied Gold plans to spend $155M in expansion capex on the Kurmuk project in 2024.

This means that, combined with the $38M overhead expenses and $60M in tax expenses, Allied Gold will see a net cash outflow of at least $60M but as this includes an investment in Kurmuk, the sustaining free cash flow is obviously quite a bit higher.

2025 will be an excellent year for Allied Gold as well, as the company will increase the Sadiola production once again, while the AISC will drop to $1150-1250 per produced ounce of gold in 2025. This means the cash flows in 2024 and 2025 will be sufficient to cover the entire capex for Kurmuk which will be fully operational in 2026. This further validates the company’s expectation to produce 600,000 ounces of gold at an AISC of less than $1225/oz in 2026. At $2000 gold, this should result in a net free cash flow of $465M on the mine level (excluding corporate overhead, taxes & interest expenses).

Disclosure: The author has no position in Allied Gold. Please read the disclaimer.