Now the Mexican presidential elections are over and president-elect Sheinbaum is releasing names for her cabinet, it will be interesting to see if there will be (another) shift on how the mining sector is approached. Mining is an important contributor to Mexico’s GDP and employment numbers, and Sheinbaum seems to be determined not to be seen as a hand puppet of the current president.

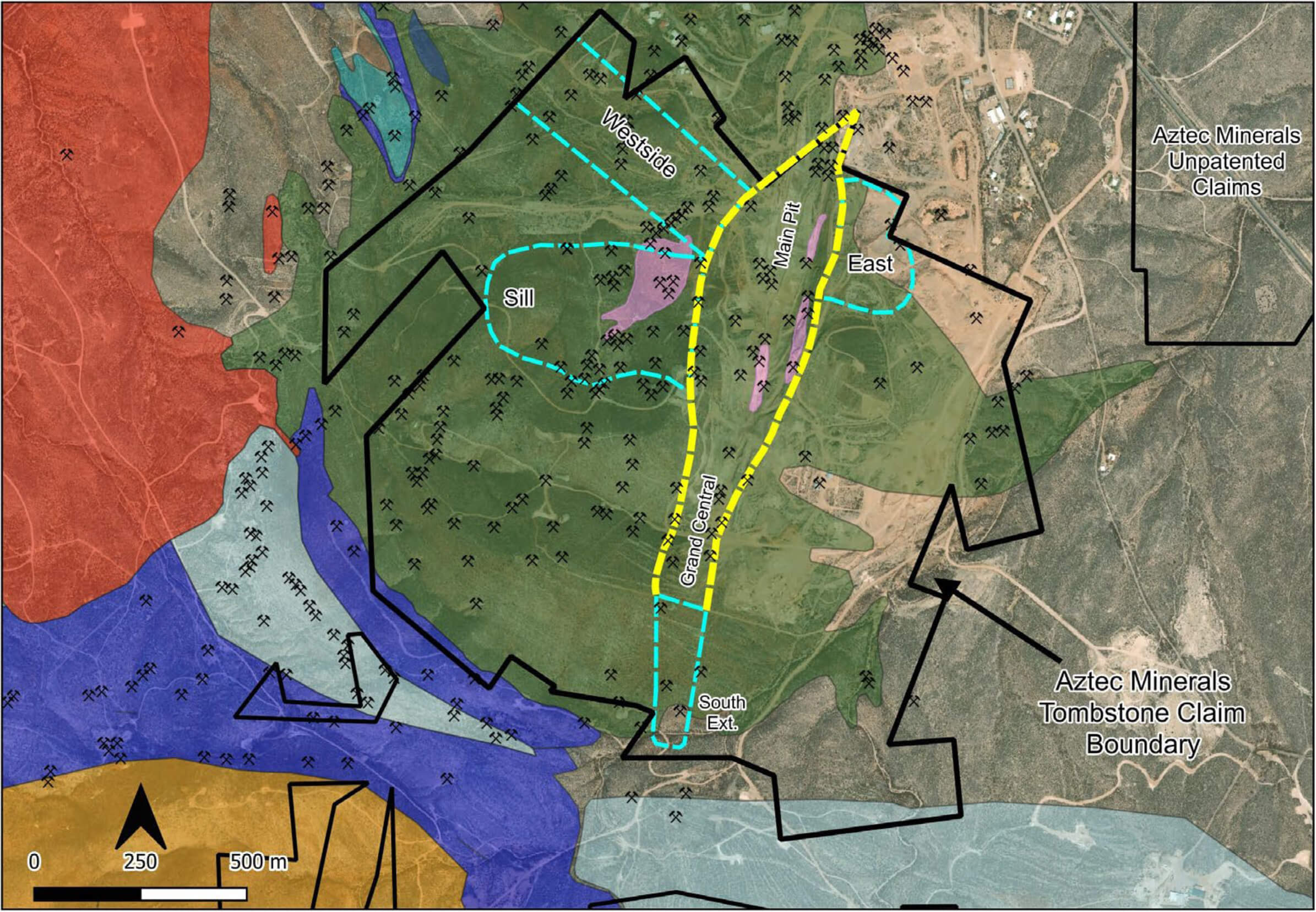

Aztec Minerals (AZT.V) owns the promising Cervantes project in Mexico’s Sonora state, but its shareholders and investors seem to have given the company the mandate to refocus on the 75%- owned Tombstone project in Arizona while waiting for the dust in Mexico to settle.

The focus will be on Tombstone this year

As explained in our site visit report Aztec will focus on Tombstone this year. The company felt it didn’t get enough appreciation for its work on Cervantes and one of the elements of feedback it continuously heard from investors was the political uncertainty in Mexico where the rumors about banning open pits didn’t help any company with an open pit project in the country. The new president has been elected and she has started to populate her cabinet. Once the shadow and overhang of AMLO is gone, it will be interesting to see what steps president-elect Sheinbaum decides to take in the sector.

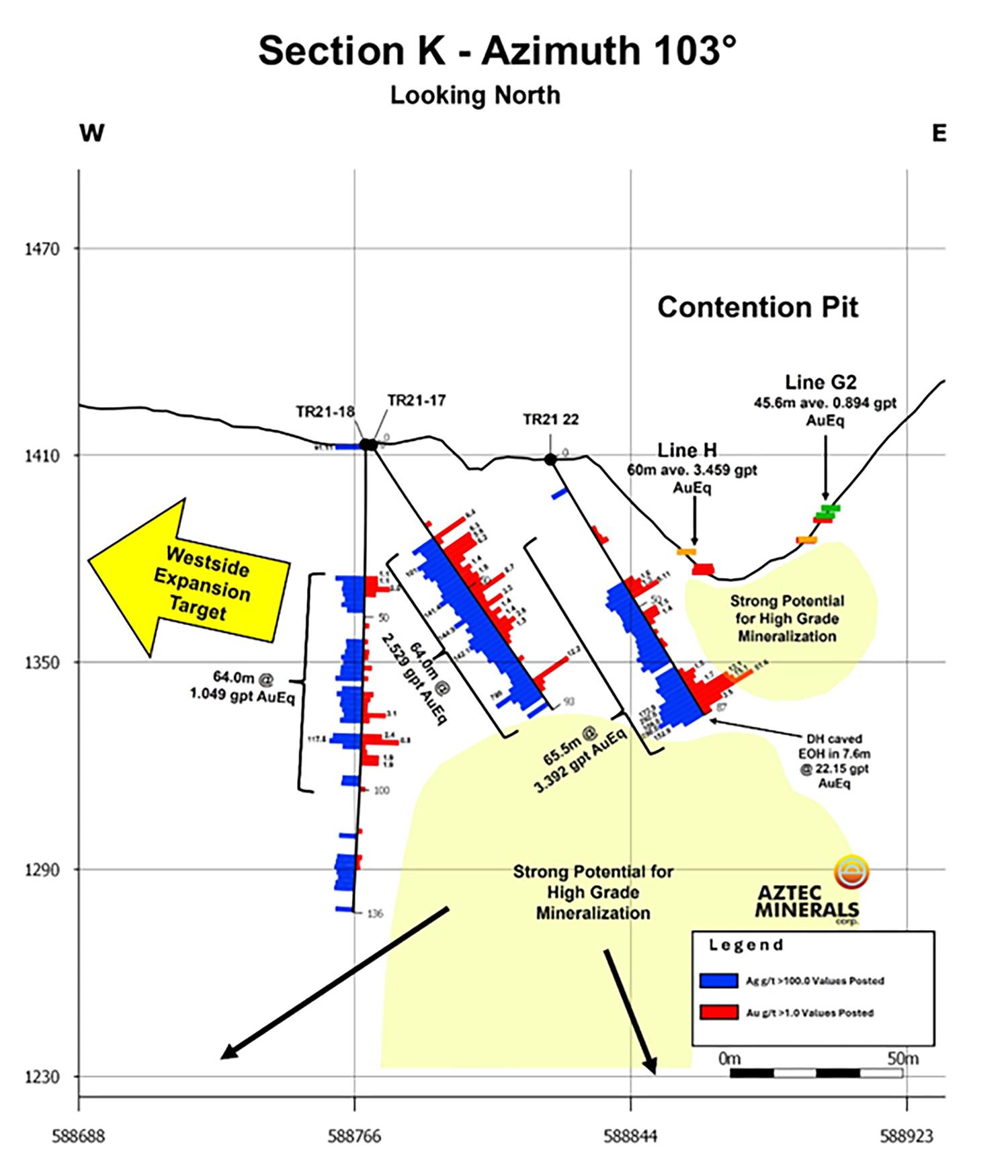

Fortunately Aztec wasn’t solely depending on Mexico as it still owns a 75% stake in the Tombstone gold-silver project in Arizona. We still call it a gold-silver project but there are smoke signals indicating the potential presence of a Carbonate Replacement Deposit type at depth. The main issue obviously is that deep holes are expensive and you can’t expect an exploration success with the first hole or even the first batch of holes.

And that’s why Aztec Minerals is now re-focusing on the near-surface gold and silver mineralization at Tombstone, where it has defined several high-priority drill targets. A successful drill program could result in a maiden resource calculation at Tombstone but the company will likely only entertain that once it has a pretty good hunch it has reached the desired critical mass. A premature resource calculation could potentially ‘kill’ a project as the market tends to be very backward-looking.

Zooming in on the recent sampling results

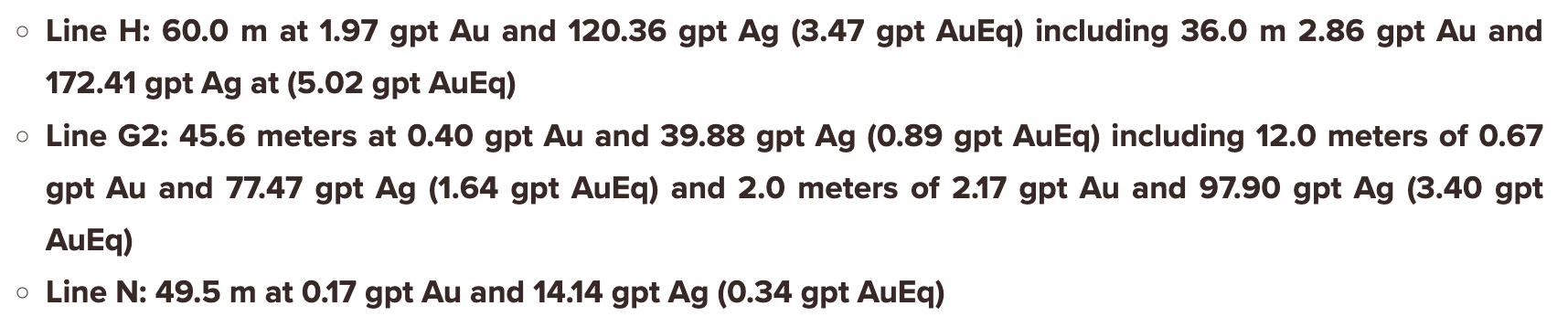

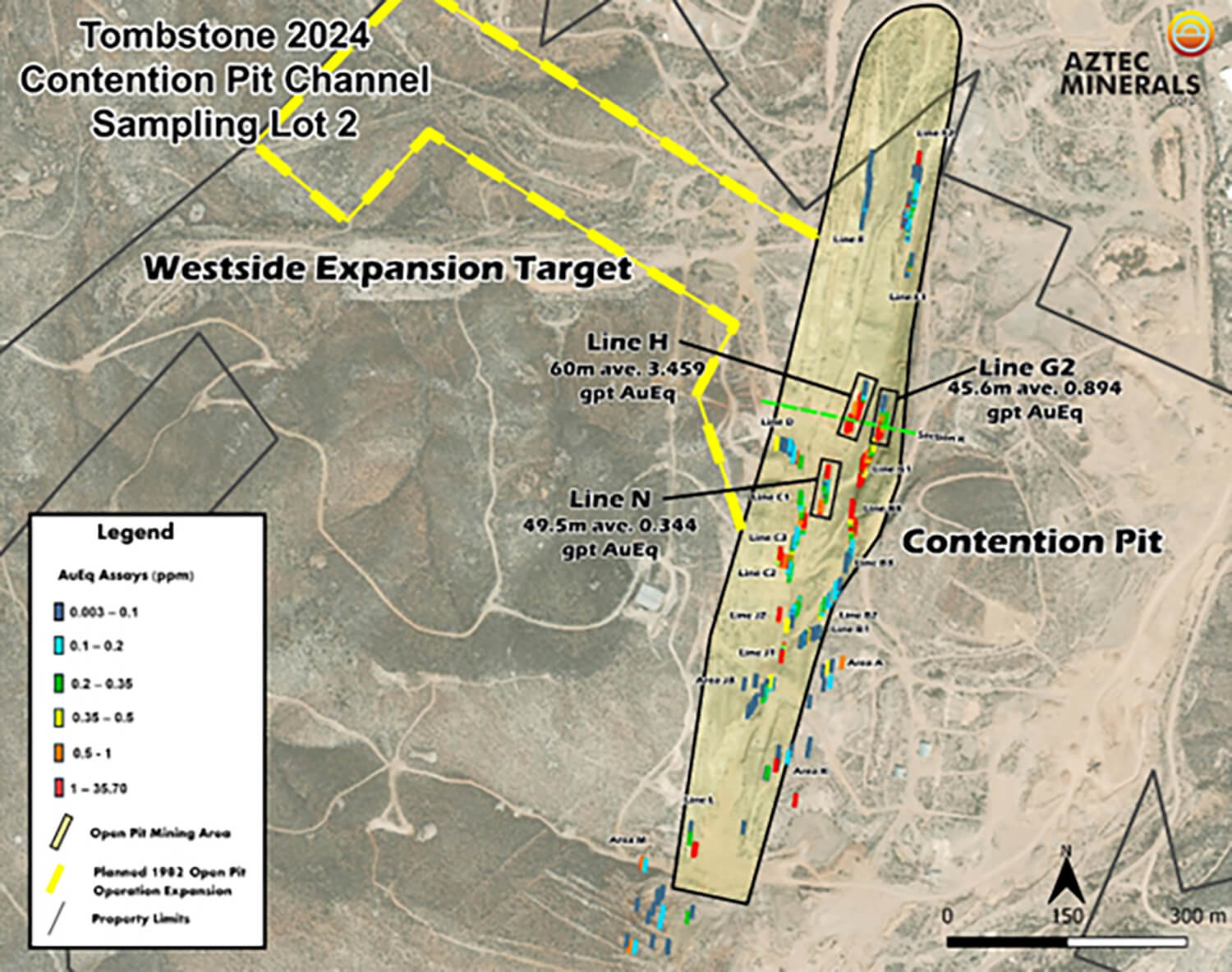

The company has recently completed its 2024 surface sampling program, and has released 2 batches of results, with a 3rd batch expected over the coming weeks. The program was designed to follow up on some of the excellent drill holes completed by the company in the 2020-2023 era. The sampling results should help the company to find, define and refine new drill targets at and around the Contention pit.

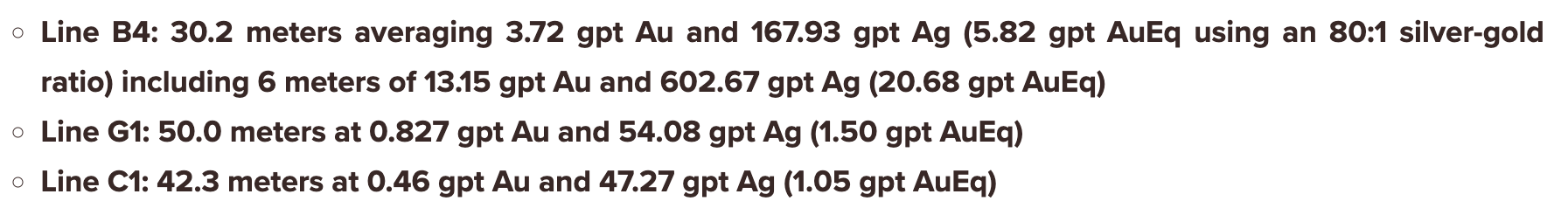

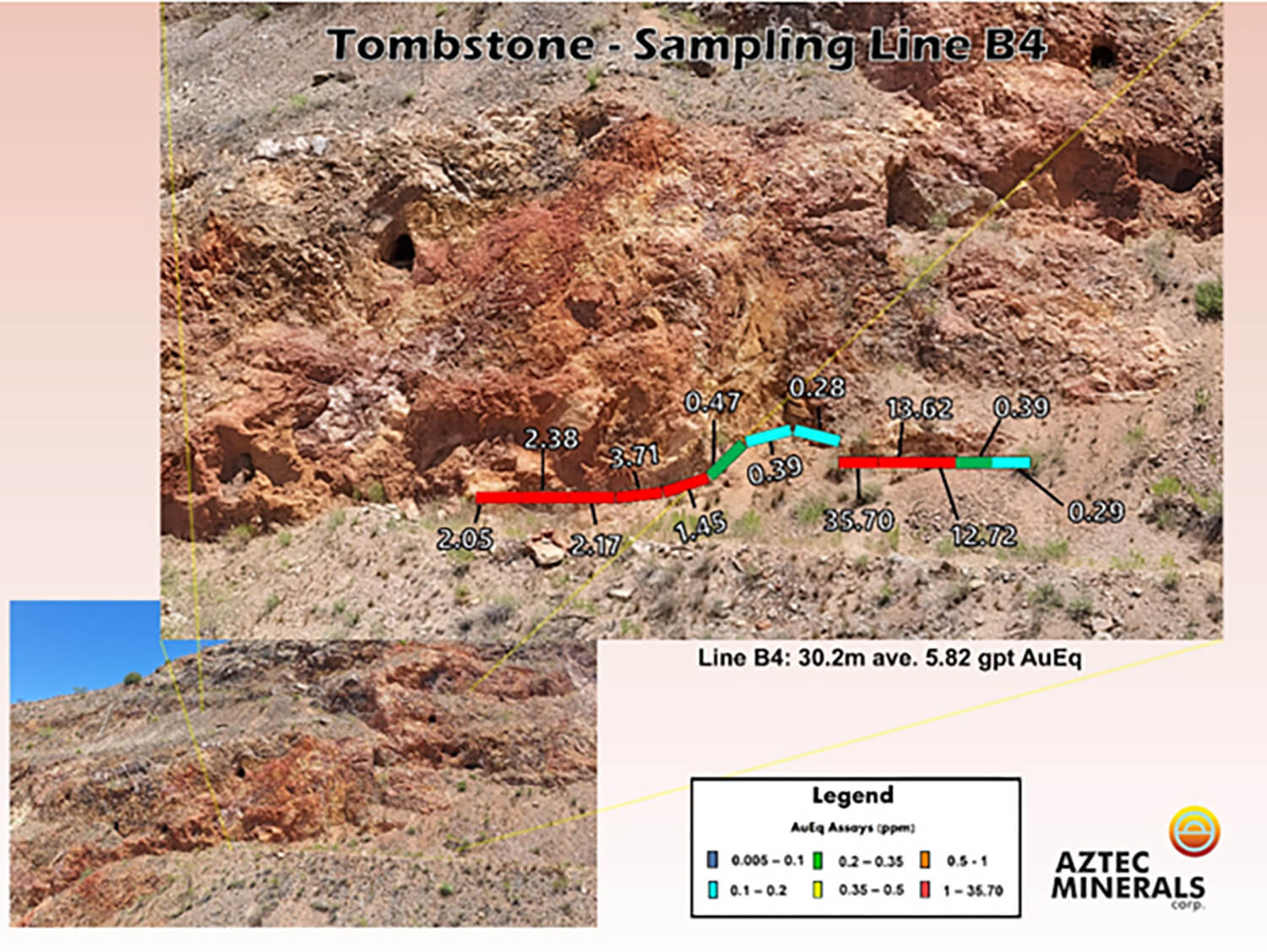

In an initial update, published in the final week of June, Aztec released the sampling results of an area inside the past-producing Contention pit that was earmarked by the previous developers and operators as a high-quality and high-priority pit expansion target. Unfortunately the company doesn’t have access to the drilling data that was used by the previous operator to base its decision on, and the sampling program is a cost-efficient way to get a better and immediate idea of what could be expected in that area. The assay results of three ‘lines’ were highlighted, and are summarized in the bullet points below.

Needless to say line B4 ‘nailed it’. Although it is ‘just’ a sampling result and actual drill results will tell the whole tale, the initial batch of sample results is encouraging as it seems to be confirming the interpretation of the previous operator about that specific area being a high-priority mine expansion target when the mine was still up and running.

Additionally, the location of the sampling results is interesting as well, as some of the high-grade intervals were encountered immediately adjacent to the Westside target.

And about a week after releasing the first assay results from the sampling program, Aztec Minerals released a second batch of assay results. The highlights of the sampling program were once again highlighted in bullet points with the highlights shown below.

It goes without saying Line H provides a remarkable result. Both the long interval with 60 meters at 3.47 g/t gold-equivalent as well as the ‘narrower’ (but still wide) interval of 36 meters containing 5.02 g/t gold-equivalent are impressive.

Sitting down with Simon Dyakowski

Let’s first discuss the results of the sampling program. How were the high-priority targets for the sampling program defined?

The sampling program consisted of two major components: 1) Chip channel sampling in the open pit, and 2) sampling and mapping at a reconnaissance level outside of the Contention open pit zone.

The pit sampling program was necessary to obtain surface data in an area that hosts compelling drilled grades and widths of both Gold and Silver and many drill holes. This is very important information for building our geologic model as many of the mineralized structures that we drilled at depth also appear to outcrop at surface. Now we have the assay and map data to back that up. The combination of surface and drillhole information now allows us to generate targets along strike and down dip of the now-confirmed mineralized structures.

We have mapping and sampling results from numerous outcrops outside of the pit pending. This reconnaissance level investigation is expected to potentially yield additional targets outside of the open pit zone.

Some of the lines you sampled did not return any meaningful assay results. Does that discourage you or was that to be expected?

We were overwhelming encouraged by the sampling results. While Lines B1, B2, and E did not report > 0.1 gpt Au mineralized over their lengths in the Contention Pit area, all were mineralized with gold and silver values.

Some lines returned higher gold and silver values than we had expected, while in some cases the length was also a positive surprise. May we assume the results of the sampling program have met and perhaps exceeded your expectations as well?

The results were impressive and, in some cases, exceeded our best drill results to date at Tombstone. More importantly, we now have a near complete dataset of assays and maps at surface integrated with our geological model. This will assist us in not only targeting of additional zones of mineralization, but also in future resource modelling where there is no longer a gap of knowledge from the pit surface to the down-hole intersections of mineralized structures.

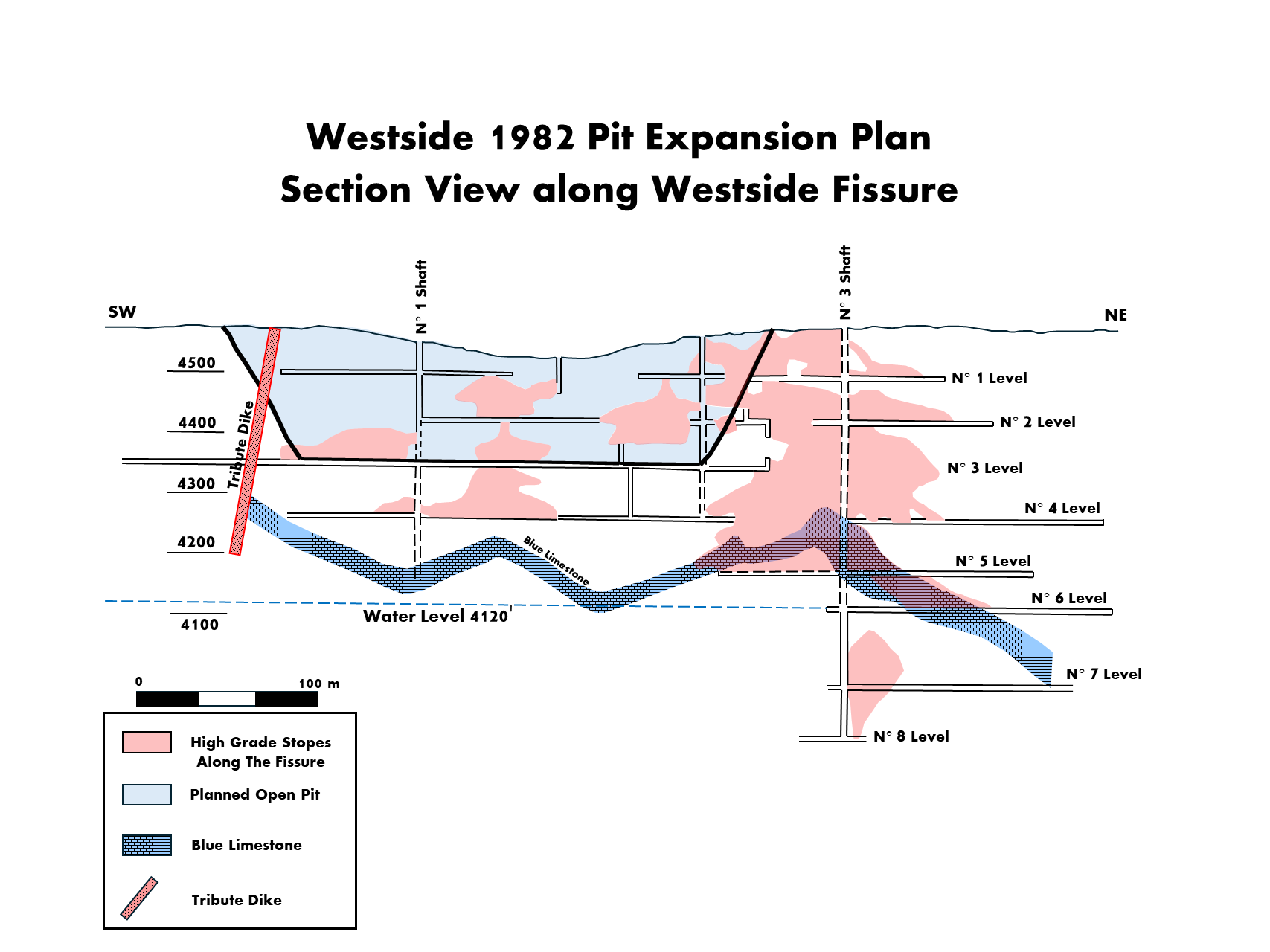

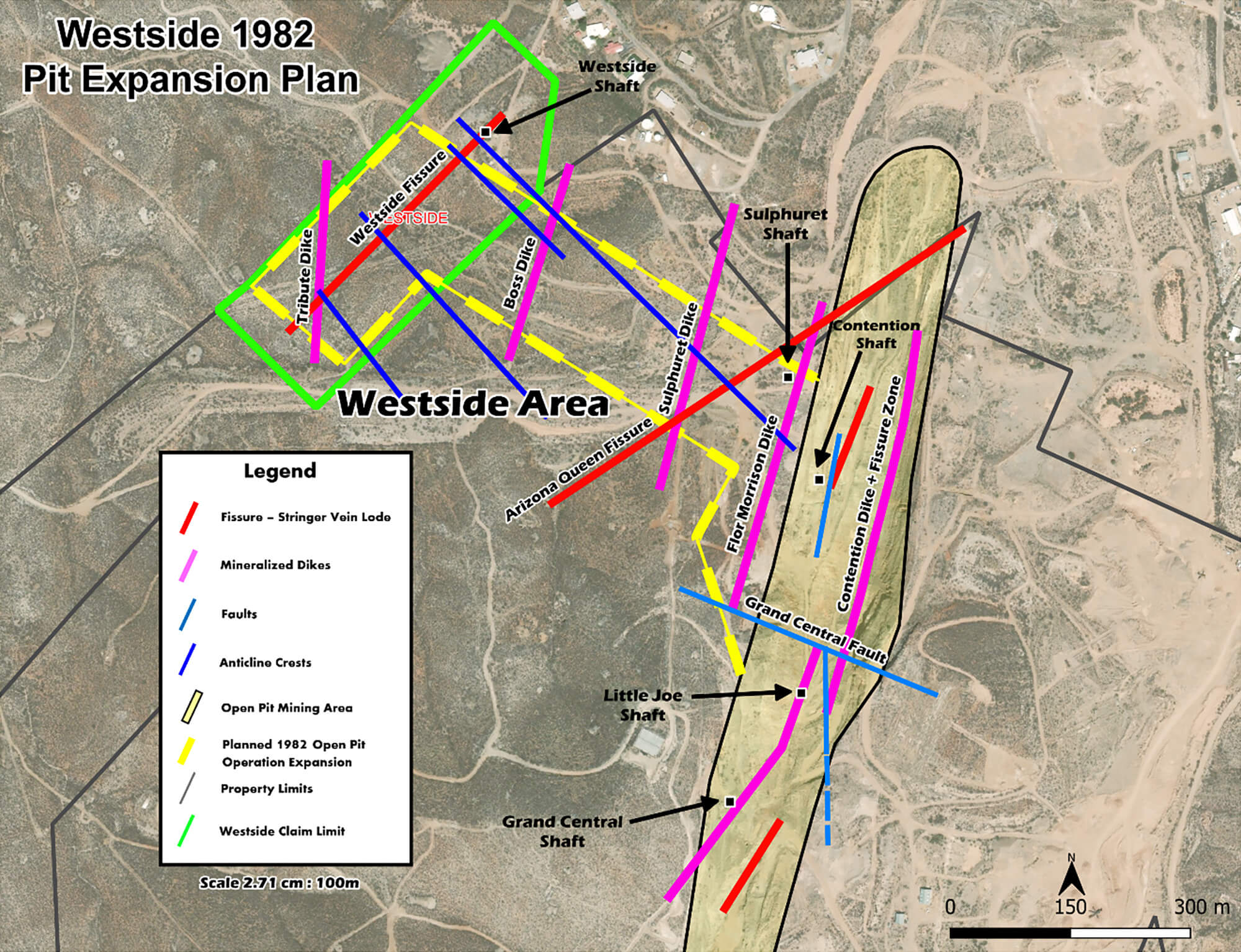

In what way did the results of the sampling program confirm your confidence in the Westside Area as a high-priority exploration target?

Lines G and H are adjacent to the westside area and are well mineralized. The Westside area was drilled in the 1980s and was to form an open pit expansion in 1982, which was not developed at the time. The surface sampling demonstrates the mineralized structures intersected in DH 18, 17and 22 from our 2021 drilling campaign outcrop at pit surface. The westside area appears to be prospective for discovery of further mineralization down dip of these recently discovery zones.

And although it won’t be a focus this year, could you elaborate a bit on the CRD potential at Tombstone? How do the historical holes play a role in the interpretation of the CRD potential?

Deeper drilling of the CRD targets could come later this year depending on the results of the shallow exploration of the Westside target area and the availability of funds. The CRD potential at depth at Tombstone is very strong, notable – a 1989 drillhole by Santa Fe Mining intersected 7.16m of approximately 10% metal (Silver-Lead-Zinc-Copper). This deep drillhole was located at the North end of the Contention Pit and there has been no known historical deep drilling further South where Aztec’s 2020 AMT survey has identified large potentially conductive targets at similar vertical depths.

What is your current cash position and how much runway does that provide?

We had C$834,000 in cash at the end of March 31, 2024 which is our last reported quarter. We are sufficiently funded up to our next drilling program.

Briefly circling back to Cervantes; are you anticipating any work to be done there this year?

We are planning to return to Cervantes to expand on the California zone target later this year upon the conclusion of the rainy season.

Conclusion

The company has now released the data from 422 samples, of which 482 samples were taken as part of this sampling program, which means we can likely expect Aztec Minerals to release another update with the final results over the coming weeks.

And while not every single sample contained jaw-dropping results, some of the high-grade results the company has released are impressive. And although silver usually doesn’t leach well, leading to poor recovery rates, historical metallurgical testing activities at Tombstone have confirmed the recovery rate for the silver was 60% with minor crushing. As that production occurred in the eighties, perhaps a more modern approach could further increase the recovery rates, making silver a valuable by-product when calculating a gold-equivalent grade.

The results of the sampling program are encouraging, and although we still like Cervantes, the Tombstone project appears to be a valuable ‘plan 1A’ with plenty of merit.

We hope the company will soon be in a position to drill-test the high-priority target areas and to start putting a resource calculation together when its technical team feels the critical mass has been reached.

Disclosure: The author has a long position in Aztec Minerals; Aztec Minerals is a sponsor of the website. Please read our disclaimer.