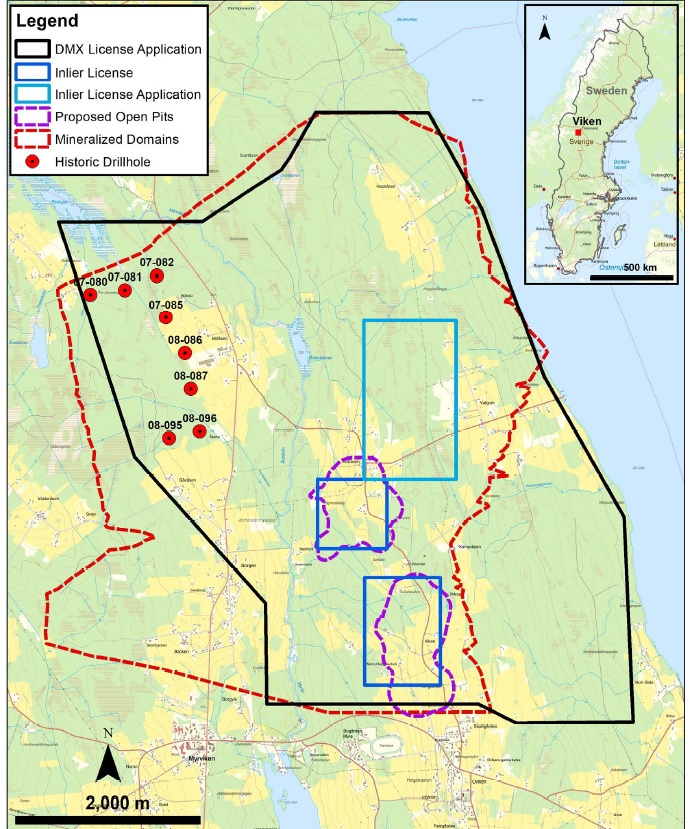

District Metals (DMX.V) announced earlier today it was able to stake claims in Sweden which represent about 68% of the Viken polymetallic deposit. Viken was the flagship project of Continental Precious Metals in the past decade before the project was ‘forgotten’ due to a moratorium on uranium mining in Sweden. District has applied for a mineral license to explore for vanadium, nickel, molybdenum, zinc and other elements and the ministry will likely reach a decision on the application by the end of next month.

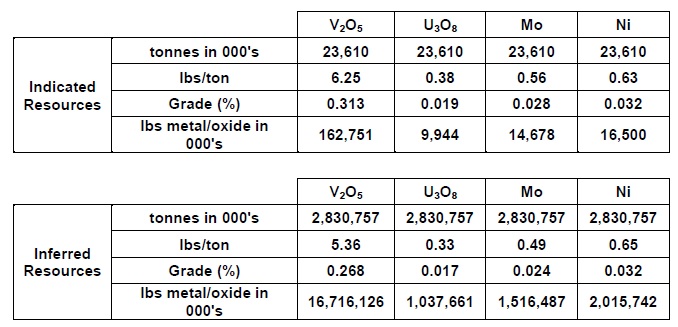

That moratorium is about to be overturned which suddenly makes the Viken project interesting again. After all, the most recent resource estimate contained 43 million tonnes of rock in the indicated resources and in excess of 3 billion tonnes (not a typo) in the inferred resource category. The 3 billion tonnes have an average grade of 0.017% U3O8, 0.034% Nickel, 0.012% copper and 0.042% Zinc. This resource excluded the vanadium and molybdenum potential which was outlined in 2010. With an average grade of 0.27% V2O5 and 0.024% Mo in the inferred resource category, Viken is one of the largest polymetallic deposits in the world.

As you can see in the image above, the inferred resource contains 16.7 billion pounds of vanadium pentoxide, 1.04 billion pounds of uranium, 1.5 billion pounds of Molybdenum and 2 billion pounds of Nickel.

Unfortunately District was not able to stake the license encompassing the entire resource as another party obtained two licenses and applied for a third license (see the map at the top of this blog post) but according to District, almost 70% of the total known resource falls on the District land.

This means District suddenly sits on a historical resource of 11.5 billion pounds of vanadium pentoxide, 700 million pounds of uranium, in excess of a billion pounds of molybdenum and about 1.4 billion pounds of nickel. For a total cost that’s not even a five digit dollar amount.

Of course the grade is low, very low. A 2014 PEA focused on uranium, nickel, copper and zinc but given the current commodity prices, vanadium and molybdenum are pretty valuable metals as well, and we expect any future study to focus on recovering those two metals as that will likely be the deciding factor on whether or not the project is economical.

We will catch up with CEO Garrett Ainsworth (who, by the way, was a uranium guy before getting involved with District Metals) soon and provide a more detailed update. But the first takeaway is that this is a very large low-grade deposit. As the mineralization is very shallow (the strip ratio in the PEA was 0.7:1) it should be very easy and fast for District to convert a portion of the historical resource estimate into a NI43-101 compliant resource. And once the uranium mining moratorium will be lifted (this is currently already in motion as Sweden likely wants to protect its ability to produce uranium in-country), District’s sub-C$10,000 staking activity could pay off handsomely.

This is a very promising pivot, to say the least, and we are certain this will make some heads turn.

Disclosure: The author has a long position in District Metals. District is a sponsor of the website. Please read our disclaimer.