Abraplata (ABRA.V) has released the final results of its Preliminary Economic Assessment on the 100% owned Diablillos silver-gold project in Argentina’s Salta province. The company anticipates a production scenario of 9.8 million silver-equivalent ounces (or 136,000 gold-equivalent ounces) which would be produced at an all-in cost of $7.52 per silver-equivalent ounce ($542/oz AuEq) using a silver price of $20/oz and a gold price of $1300/oz.

According to the mine plan, the peak production years will be in year 2 and 4 with a total silver-equivalent production of almost 14 million ounces in those years. That’s great to see as strong cash flows in the first few years of a mining operation have a positive impact on the Net Present Value calculations (the total cumulative discount rate to be applied on the cash flows will be lower, which increases the present value of those cash flows). Using the aforementioned silver and gold prices, the pre-tax NPV7.5% of Diablillos is $342M whilst the payback period is just 2.9 years.

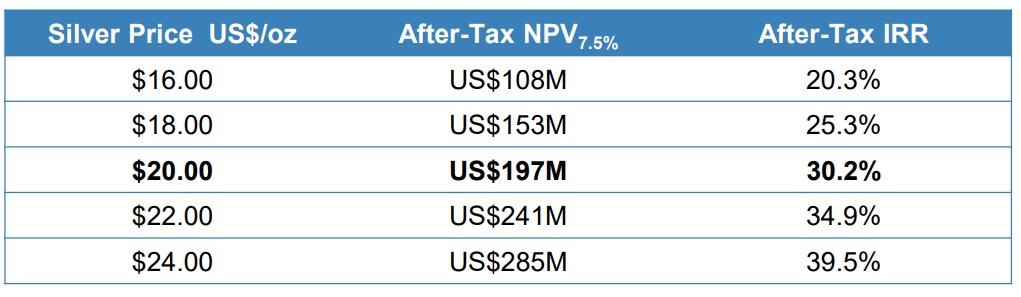

As you can imagine, the project’s economics are heavily depending on the commodity prices. If you’d use a silver price of $18/oz, the after-tax NPV7.5% drops to $153M whilst the IRR remains a very respectable 25.3%. An after-tax NPV of $153M looks pretty weak compared to the total initial capex of $311M (which includes in excess of $93M in stripping expenses), the short payback period might allow Abraplata to make a construction decision anyway.

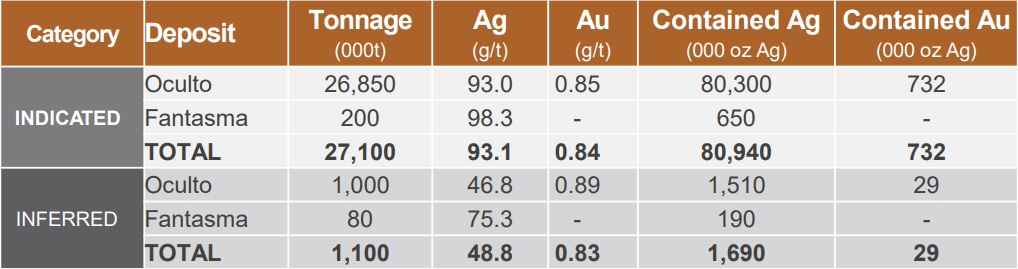

On top of that, Abraplata appears to be optimistic it will be able to add resources towards the east of the Oculto deposit as well as in the satellite zones around Oculto. We would also hope Abraplata will be able to add more tonnes at Fantasma, as the current 280,000 tonnes for 840,000 ounces of silver is a bit lower than what we were expecting/hoping for.

Go to Abraplata’s website

The author has a long position in Abraplata Resource Corp.. Please read the disclaimer