We are watching some of the mineral sands stories very closely, as some of them might also be ‘producing’ monazite as waste material, and that’s important for Medallion Resources (MDL.V) which aims to process monazite and recover the Rare Earth Elements from the waste product of mineral sands producers.

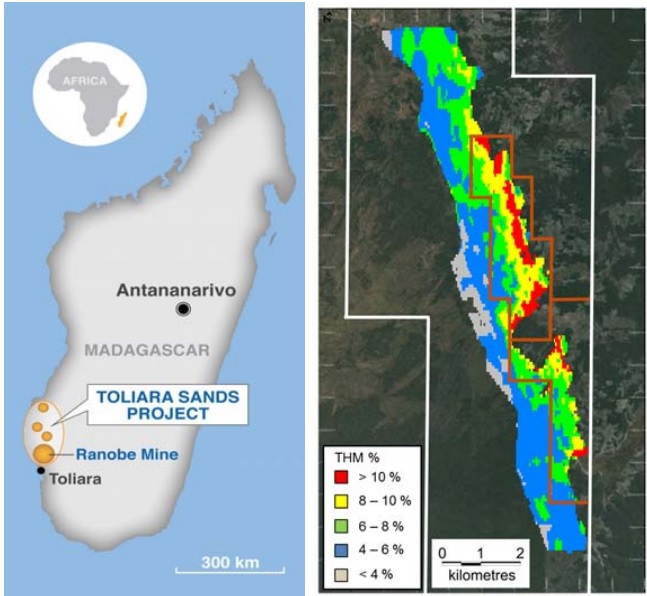

Earlier this quarter, ASX-listed World Titanium Resources (ASX:WTR) has updated its resource estimate at the Ranobe mineral sands project in Madagascar. This comes right after the completion of no less than 363 additional holes that have been drilled since 2012, and this allowed the company to increase the measured and indicated resources in two mining leases by a stunning 39% to almost 245 million tonnes at an average grade of 8.02% heavy minerals.

The total resource now stands at 884 million tonnes containing 6.19% heavy minerals, of which 72% is ilmenite, 2.33% is rutile, 5.59% is zircon with 1.85% Monazite and Xenotime. Thanks to the high percentage of zircon, World Titanium’s project might actually be quite valuable. According to our calculations, the value per tonne of the measured resource (360Mt) based on the Ilmenite, Rutile and Zircon is approximately $10/t (based on an price of respectively $100/t, $800/t and $1,100/t). That’s in line with for instance Base Resources (ASX:BSE), but World Titanium has the advantage of a lower slime percentage (less than 5% versus 25% at Base).

The company has prepared a scoping study based on a mining rate of 12 million tonnes per year resulting in a production rate of 66,000 tonnes of zircon/rutile per year, whilst the 670,000 tpa ilmenite production will be stockpiled (and we anticipate the ilmenite stockpile to be sold when the demand for ilmenite increases). The initial capex is estimated at just $48M, and this attracted African Minerals (unlisted) which wanted to buy the entire company).

This pretty much seems to be a ‘done deal’ (you’re too late to tender your shares anyway as the offer period closed on March 18th), and even though we’re disappointed it’s a cash offer and not a share-swap with for instance its largest shareholder Mineral Deposits (ASX:MDL), it provides shareholders of World Titanium with cash to reinvest it in other publicly listed Mineral Sands stories. This transaction does show you that some funds are still seeing value in the mineral sands players, which are per definition working in a cyclical market.

The author has no position in World Titanium Resources. Please read the disclaimer