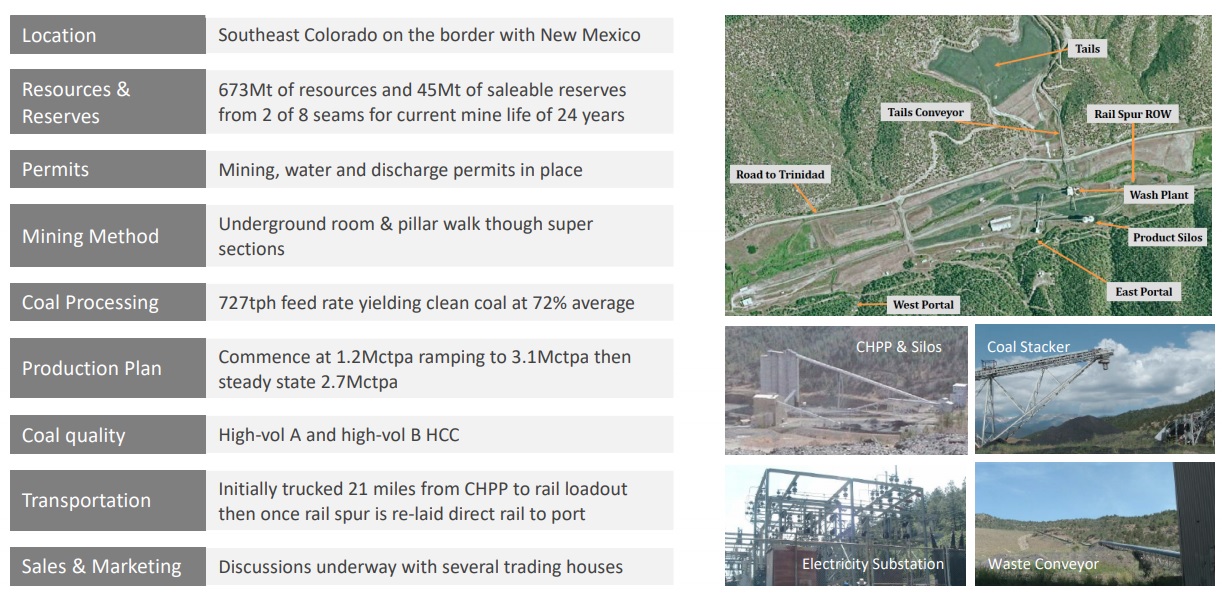

Allegiance Coal (AHQ.AX) has provided an update to the feasibility study on the New Elk coking coal mine completed in November last year. The updated study has simplified the mine plan in the first few years of the mine life, thereby reducing the total amount of saleable coal reserves by 50% and the annual output (in Y1-4) by 30% to 1.4 million tonnes of coal per year. The cash cost will increase from US$74/t to US$78/t, but this will be partly mitigated by the lower initial capex (-30% to US$40M) and a lower sustaining capex in the next two years (down 48% to US$35M).

Using an average selling price of US$131/t, the pre-tax IRR is estimated to come in at 121% with a pre-tax NPV8% of A$560M (US$340M). That’s a decrease of approximately 50% compared to the original study, and in line with the expectations as the mine plan contains fewer tonnes of saleable coal at a slightly higher cash cost.

With the results of the updated study in hand, the New Elk coal mine in Colorado looks quite promising and let’s not forget the 23 million tonnes of saleable coal make up less than 10% of the 268 million tonnes of coal in the different JORC resource categories. The New Elk mine appears to be ready to be reopened after Cline Mining went bankrupt in 2012, but we were surprised to see Allegiance Coal entering into a term sheet agreement with Nebari with the latter providing a US$25M loan facility as part of the financing package to re-open the mine. The loan terms offered by Nebari are usually quite rigid, so let’s see what the final cost of the debt package will be. Our best guess is that the all-in cost of the loan facility will be 15-18% per year, but we are happy to be proven wrong. Since seeing the Nebari-deal with Vendetta Mining (VTT.V), we are very cautious when seeing Nebari as the main lender to finance a mining project. Of course Nebari can do what it wants and these terms are excellent from their perspective. But mining companies should dare to refuse signing such expensive deals.

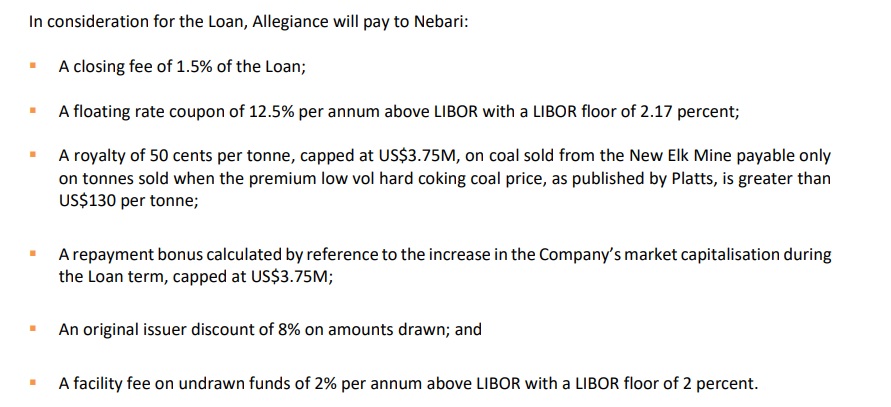

Editorial note: before this post was published, Allegiance Coal did provide more details on the term sheet and it became clear our assumptions were too optimistic. Not only is the minimum base interest rate 14.67%, Nebari will also receive a 1.5% closing fee and an 8% discount on the amounts drawn. This will work out to an average cost of debt of 17.8% based on the initial three year term and based on a full take-up of the US$25M loan. So we were pretty close with our estimate of 15-18%, but the little extras like a 50 cent per tonne royalty and a repayment bonus based on the market cap increase will push the total cost of this facility north of 20%. Before seeing the term sheet, the New Elk coal mine appeared to be very interesting but if the cheapest debt funding available will cost Allegiance over 20% per year, then standing on the sidelines may be the best bet here, just to make sure Allegiance will be able to repay the Nebari loan as fast as possible.

Disclosure: The author has no position in Allegiance Coal and no interest in going long as long as loan sharks vulture funds Nebari is involved. Well played by Nebari which is exploiting the lack of financing available in this market, but if the cost of debt is exceeding 20% Allegiance Coal should mothball the project until more acceptable debt terms can be secured.