A few brief updates from Almonty Industries (AII.TO), as the company has now completed the process to upgrade its US listing from the pink sheets to the more respected OTCQX market. This should enhance the visibility of the company, and also increase the credibility amongst US investors. Although Almonty Industries is a fully-reporting company adhering to the Canadian standards, foreign investors can still be a bit wary of Pink sheets stocks. Almonty’s OTCQX listing will use ALMTF as ticker symbol.

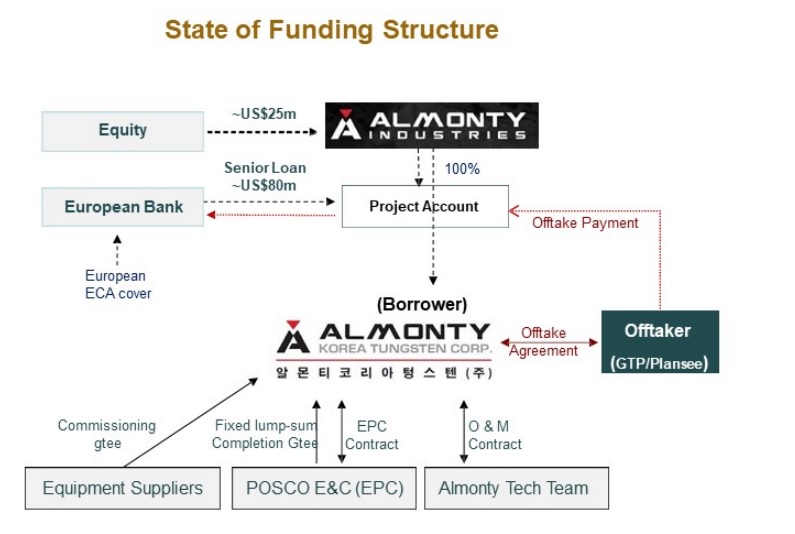

Meanwhile, the company also reported the demolition activities at the Sangdong mine site have now been completed. Pretty much a ‘non event’ as nobody really cares about it, but it’s another box that has now been ticked. It also appears Almonty Industries is in the final straight line to complete a construction finance package. The company reiterated its expectation to close a ‘non-dilutive’ financing, which would be a great achievement. The term ‘Non Dilutive’ has been hollowed out and abused by other companies in the past which avoided issuing more shares by engaging in a streaming deal (which isn’t diluting the share count, but dilutes the incoming cash flow, so a streaming agreement really isn’t non-dilutive).

But Almonty’s case could be different. Considering the low capex of the Sangdong project, the appetite for tungsten in the region and the strong tungsten prices, Almonty does have a good shot at effectively completing a non-dilutive financing. We would imagine a tungsten concentrate prepayment (with a small discount on the current tungsten price) would take care of the equity portion of the financing. If that’s indeed the case, Almonty is ready for its next growth phase.

Go to Almonty’s website

The author has no position in Almonty Industries. Almonty is not a sponsor of the website, but we were compensated by a third party. Please read the disclaimer