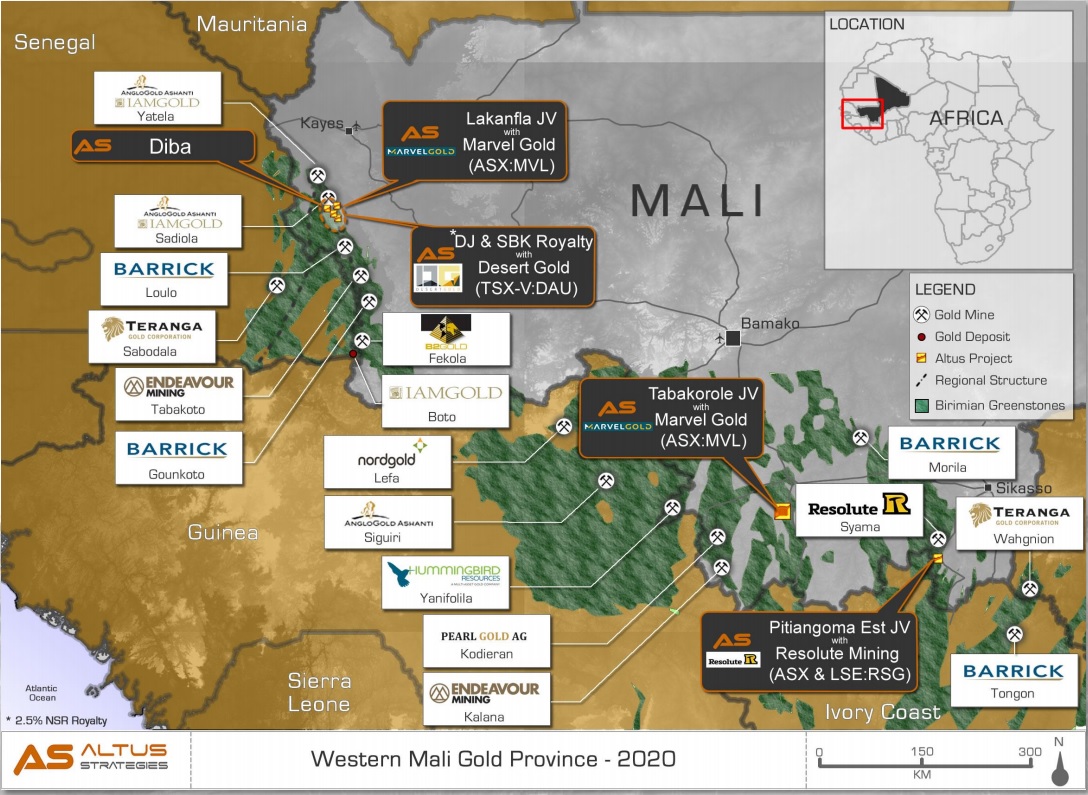

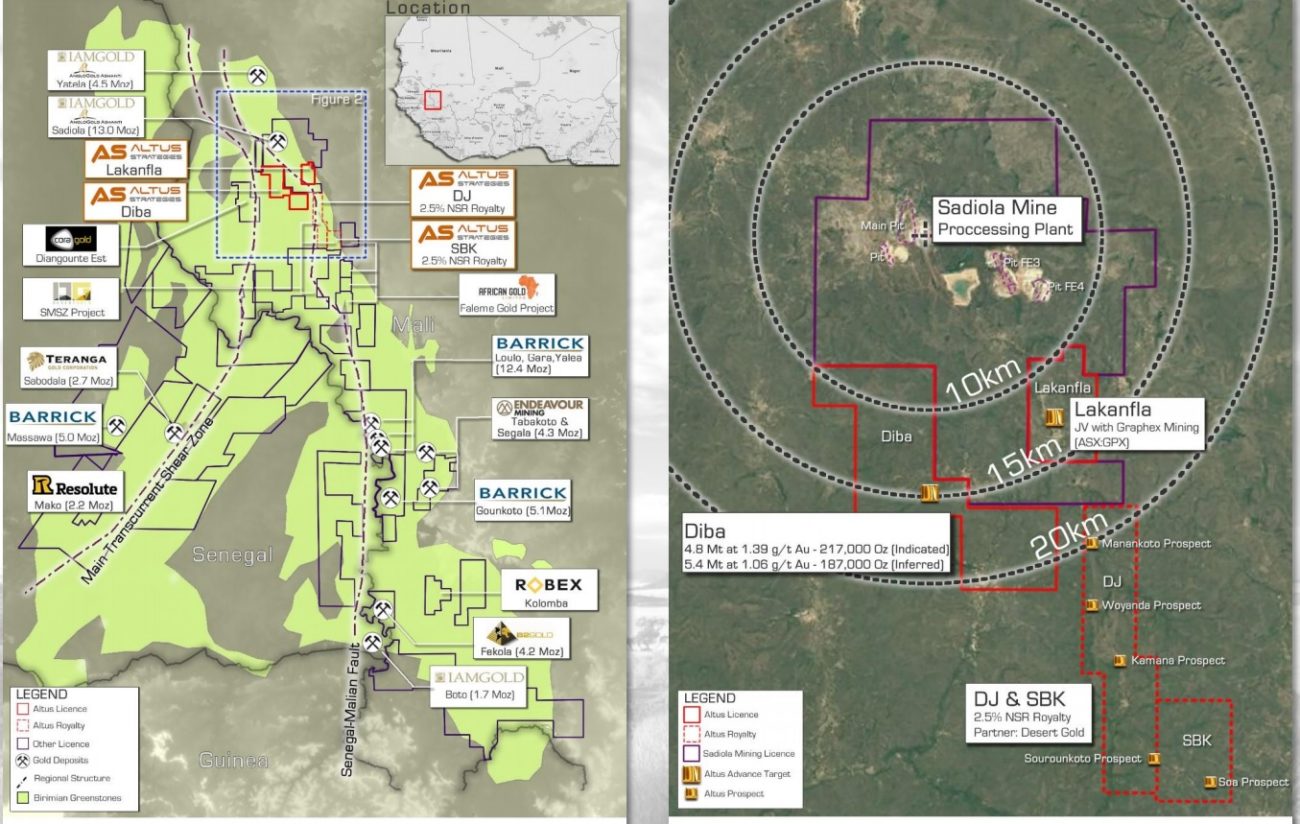

Altus Strategies (ALS.L, ALTS.V) has provided an exploration update on its Diba gold project in Mali where the current mineral resource contains about 400,000 ounces of gold (divided into 217,000 ounces at 1.39 g/t in the indicated resource category and just under 190,000 ounces in an inferred resource at an average grade of 1.06 g/t gold) which was part of a July 2020 resource estimate.

The recent drilling was focusing on a zone about 1.5 kilometers northwest of the Diba resource, and the new Diba NW zone is still expanding with a current strike length of 550 meters and a width of 150 meters. With 22 meters of 1.45 g/t gold (starting at 55 meters down hole) and 10 meters containing 1.87 g/t gold, it looks like Altus may have a satellite deposit to Diba by its tail. A lot more drilling is obviously needed but it does confirm Altus’s strategy to drill-test highly prospective zones within a three kilometer radius of the main Diba deposit. Considering Diba Central is already 0.4 million ounces of gold, adding a few satellite deposits could push the greater Diba project to in excess of a million ounces.

As the Diba project is literally within a 15 kilometer distance from the Sadiola mill owned by IAMGold (IMG.TO, IAG) and AngloGold Ashanti (AU), Altus could perhaps negotiate mill access for its non-oxide resources. It should be able to bring the oxide resources into production on its own considering the almost 200,000 ounces gold in an oxide resource resulted in an after-tax NPV of US$81M and an IRR of 469% (not a typo) thanks to its grade, good metallurgy and low initial capex of just US$20M.

Disclosure: The author has no position in Altus Strategies. Please read our disclaimer.