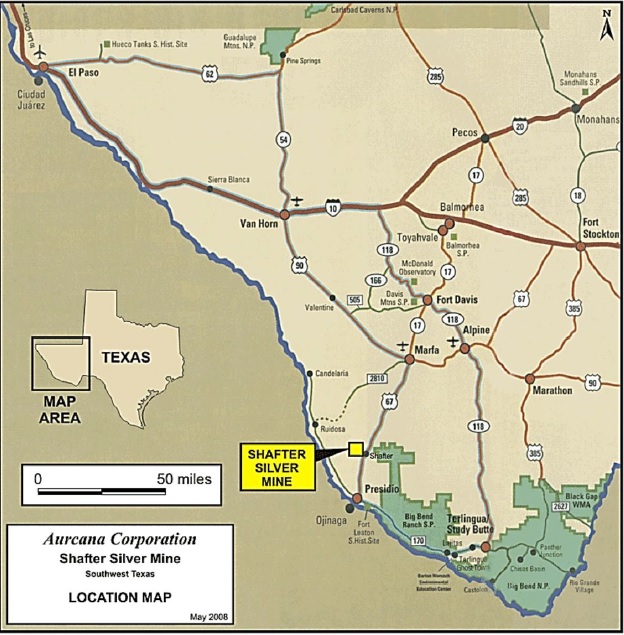

Aurcana (AUN.TO) has released the results of an updated Preliminary Economic Assessment for its 100% owned Shafter silver project in Texas, USA. This new PEA was based on an updated resource estimate after the company had to close the Shafter mine when no viable operations were able due to a below-average mine plan.

This new PEA is the company’s next chance to develop the Shafter mine, but the current mine plan indicates any production scenario at Shafter will be a mini-Shafter as the total amount of silver to be produced during the 6 year mine life is just 9.3 million ounces. Fortunately the initial capex is quite low as well, at just $13.2M as most of the capital expenditures have already been incurred during the first attempt to bring Shafter into production.

The sustaining capex is approximately $39M, which is quite high as this means the sustaining capex per ounce of silver will be in excess of $4/oz. The after-tax NPV5% using a silver price of $18/oz is just $3.4M (caused by the relatively high sustaining capex), but in the bullish scenario using a silver price of $22/oz, the after-tax NPV increases to almost $33M, with an internal rate of return of almost 70%.

Go to Aurcana’s website

The author has no position in Aurcana. Please read the disclaimer