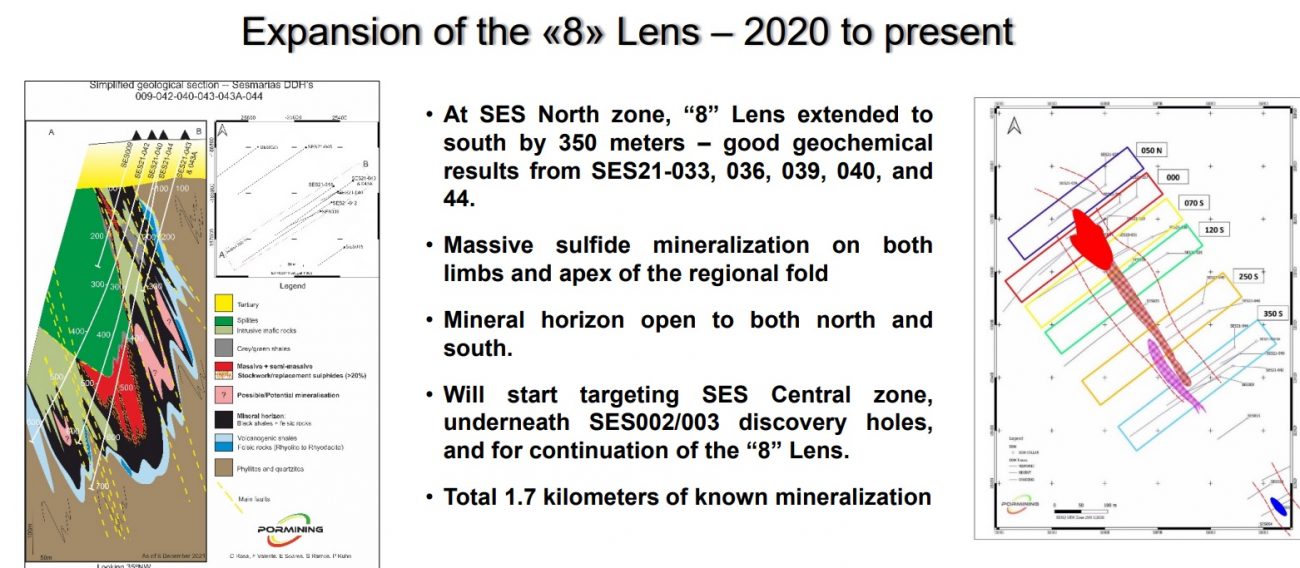

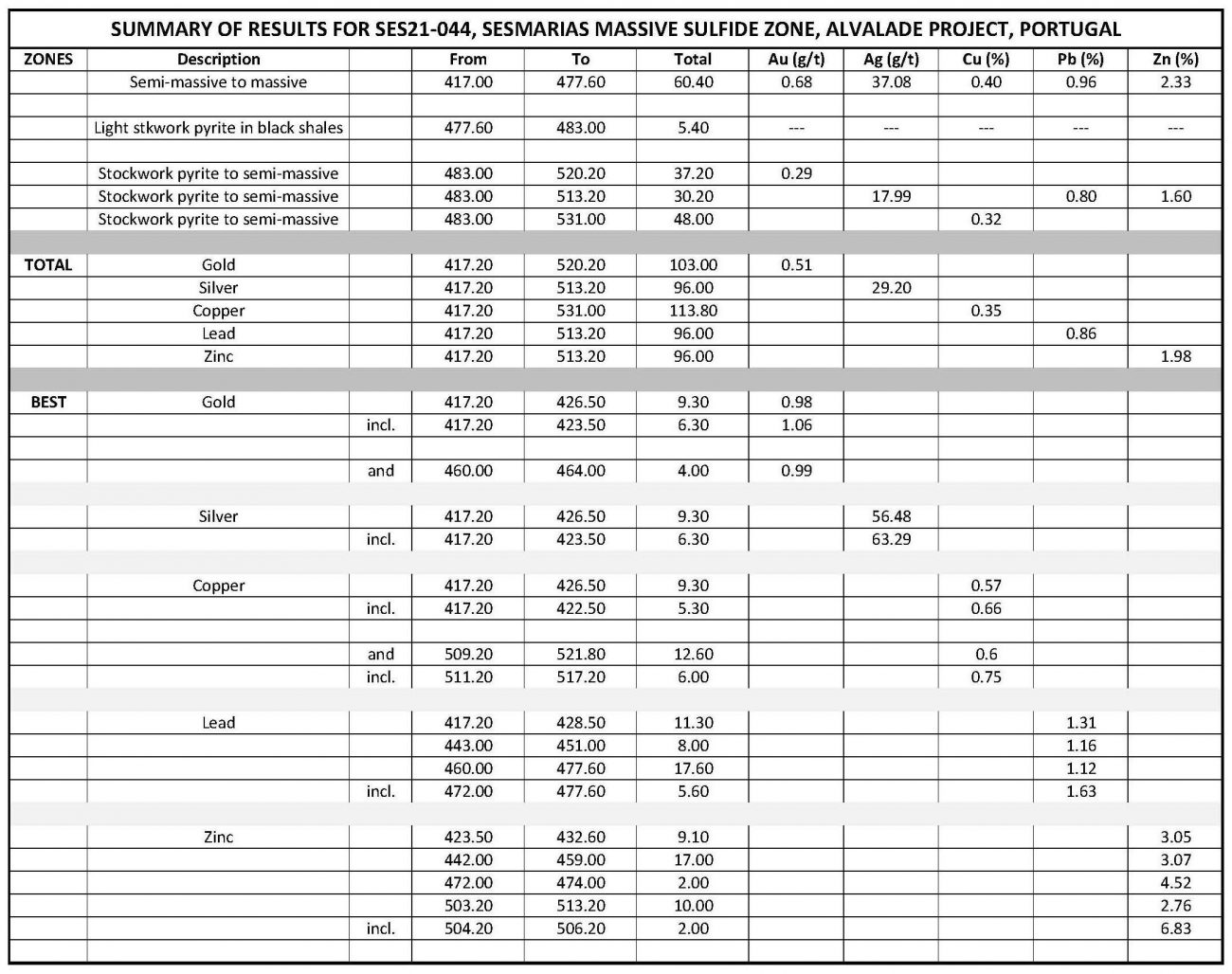

Avrupa Minerals (AVU.V) is still working on a drill program on its Sesmarias project in a joint venture with Sandfire Resources (SFR.AX) as the Australian company has completed the acquisition of MATSA. Last month, Avrupa released the assay results from hole SES21-044, a rather deep hole which successfully intersected semi massive to massive sulphide mineralization with a highlight of 60.4 meters containing 0.40% copper, 0.68 g/t gold, 37.08 g/t silver, 0.96% lead and 2.33% zinc, with an estimated true thickness of 30-40 meters.

As you can see in the table above, the in situ rock value is actually pretty strong. Although none of the grades actually ‘pops’, the combined value of the metals is quite good over such a width (the true width of the 60 meter interval is estimated at 30-40 meters). Of course not all of the metal will be recoverable and payable but a gross rock value of almost $200/t (and exceeding $200/t at the current spot prices) is a good starting point. Additionally, the mineralized zones appear to have different high lights as shown in the summary below.

The drill rig was subsequently redirected to an area approximately 100 meters northwest along strike to fill the gap between sections 120S and 350S and hopefully we will see results soon. The joint venture partners already completed in excess of 8,000 meters as of the end of January and we should see a steady stream of drill results going forward.

Sandfire Resources is funding the Sesmarias drill program but Avrupa Minerals is currently raising C$1M in a non-brokered placement to advance its other projects, including the recently acquired Finnish licenses. The financing is priced at C$0.075 per unit with each unit consisting of one common share of Avrupa with a full warrant allowing the warrant holder to acquire an additional share in Avrupa for C$0.125 during a three year period.

Disclosure: The author has a long position in Avrupa Minerals. Please read our disclaimer.