Aztec Minerals (AZT.V) recently completed a C$1.1M private placement. It issued just under 4.4 million common shares of the company at C$0.25 in a no-warrant financing. Large shareholder Alamos Gold (AGI.TO, AGI) participated in the financing and subscribed for 400,000 shares (C$100,000) and Alamos now owns 8.3 million shares of Aztec Minerals (as well as 7.9 million warrants with an exercise price of C$0.40 expiring in June 2024).

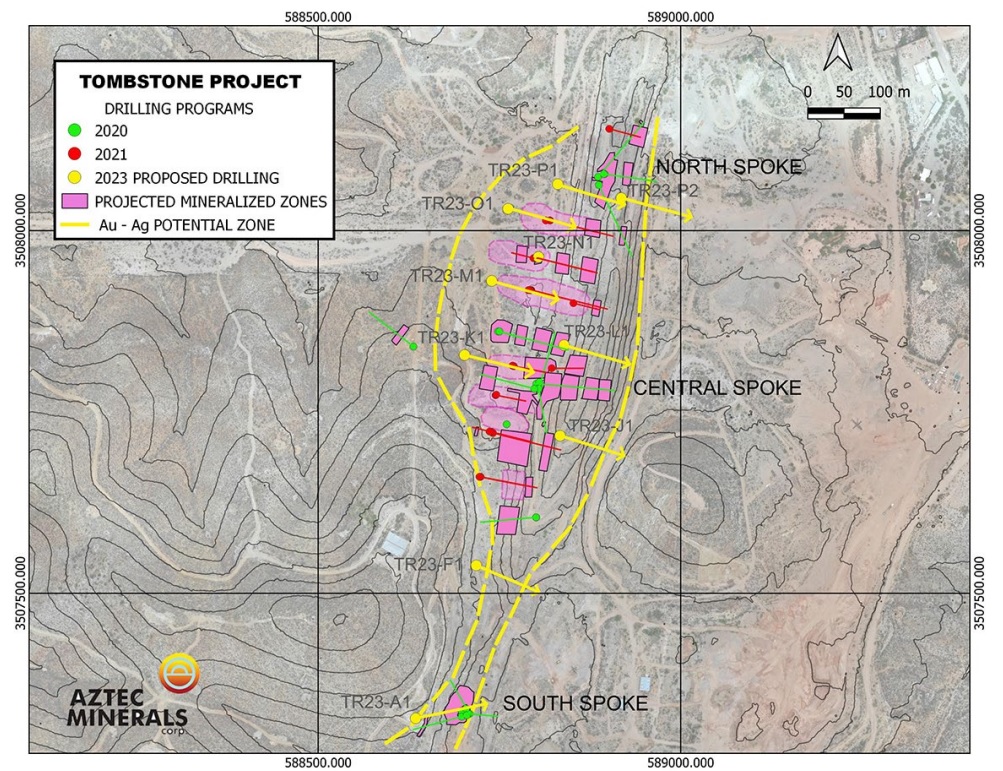

Aztec isn’t wasting any time and the company has announced a ten hole drill program on the Tombstone project for a total of 2,250 meters. While Cervantes clearly still is the company’s flagship project, let’s not forget that recent drill programs at the 75%-owned Tombstone project have unveiled high-grade gold and silver mineralization and the success ratio of the 2020-2021 drill campaign (which consisted of 44 holes) was 100% as every single hole contained shallow oxidized gold-silver mineralization over substantial widths.

There are four separate exploration focuses at Tombstone:

The 2,250 meter drill program will consist of core holes which will supplement the data from the RC drill program and will likely reach the water table. The RC holes ended above the water table and therefore never really tested the typical Tombstone mineralization (see the second bullet point above). We expect the company to release its initial assay results sometime in April.

Disclosure: The author has a long position in Aztec Minerals. Aztec is a sponsor of the website. Please read our disclaimer.