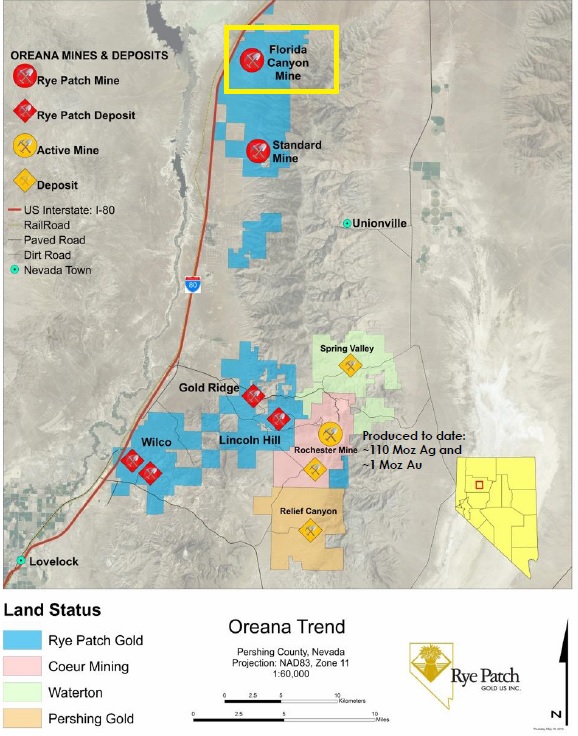

Rye Patch Gold (RPM.V) requested a trading halt before the bell yesterday, and it took a while before the company finally published the newest update. Rye Patch has signed a definitive agreement to acquire the Florida Canyon gold mine in Nevada, and will become a gold producer overnight.

The Florida Canyon mine is being acquired from Admiral Capital, which seized the asset after its Japanese owners defaulted on the debt associated with the mine. Rye Patch will pay US$15M and issue 20 million shares of Rye Patch Gold to Admiral Capital and will pay an additional US$5M in cash or shares when commercial production starts (which is expected in H1 2017). Additionally, 15 million warrants will be issued at a strike price of US$0.50/share (which is approximately 180% higher than Rye Patch’ closing price before this deal was announced).

We are still putting all pieces of the puzzle together, but this transaction seems to be extremely accretive for Rye Patch, as the total consideration of US$20M cash and 20M shares seems to be quite the bargain, considering an existing PEA on the property is estimating the after-tax NPV7.5% of the property to be US$80.2M at a gold price of $1100/oz in Y1-2 and $1265/oz in the subsequent years, which basically means Rye Patch is acquiring the asset at just 0.3 times the net present value.

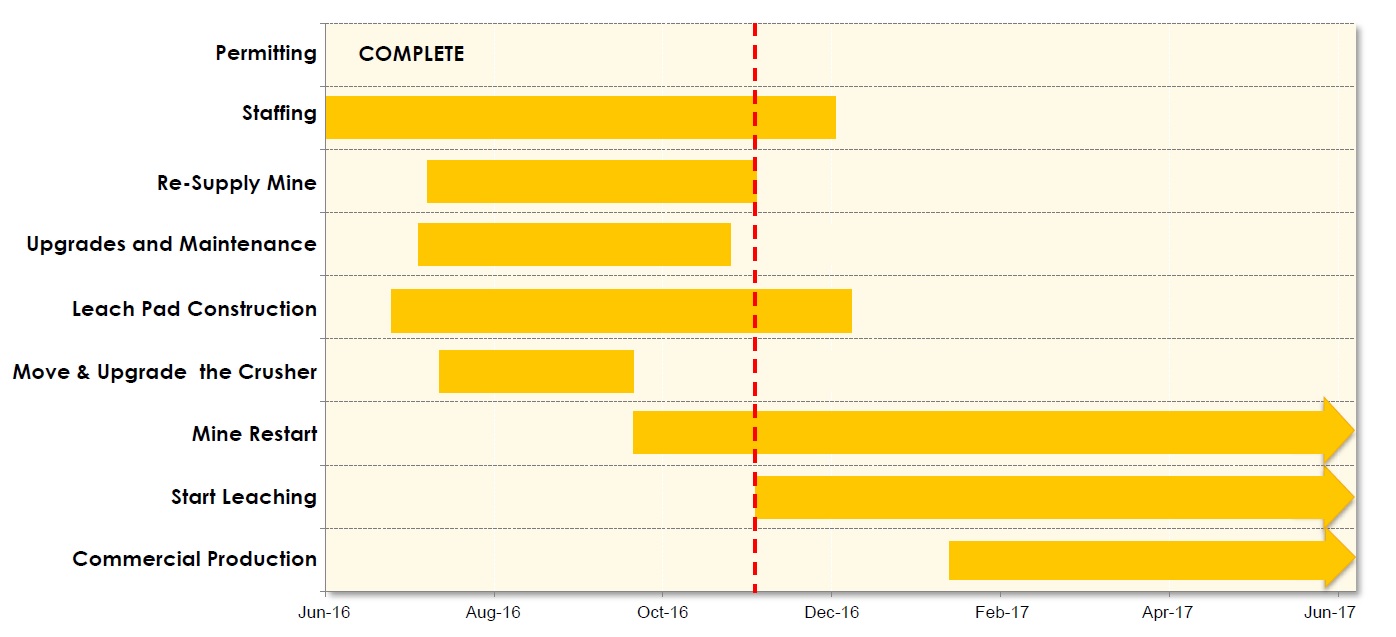

The new PEA estimates the capital needed to restart the mine to be less than $30M and considering Rye Patch expects to generate $21M in free cash flow in 2017, it didn’t have any difficulties to find debt to fund the capital expenditures. Macquarie stepped up the plate and is providing a $27M credit facility (which means 90% of the expected capex (including a $3.8M contingency allowance) is being raised in debt). As part of this deal, Rye Patch Gold will be required to hedge a part of its production, but that’s not necessarily a problem as it will protect its ability to repay the debt.

We like this deal for several reasons. First of all, it doesn’t happen very often you can pick up a fully-permitted asset with in excess of 1 million ounces of gold at 0.3 times the after-tax NPV at a conservative gold price. The acquisition will increase Rye Patch’ NAV by approximately C$0.40 per share if the economics of the PEA are indeed being confirmed ‘on the ground’. Secondly, Rye Patch will become a Nevada-based producer overnight, spitting out 75,000 ounces of gold per year at an all-in cost of less than US$900/oz, providing cash flow to further develop the Lincoln Hill project, located close to Coeur Mining’s (CDM.TO, CDE) producing Rochester mine.

Rye Patch will obviously have to raise cash to fund the initial acquisition of the project, and we are expecting to see quite a substantial capital raise in the near future, as Rye Patch likely will have to raise C$25M and the majority will probably be in equity. But even if the company would have to issue 100M new shares and end up with a share count of 250M shares, the acquisition would still be accretive, as the after-tax NPV’s of both Florida Canyon and Lincoln Hill (adjusted for the better-than-expected recovery rates) would represent a NAV/share of C$0.66/share (and you get the exploration potential and the Wilco project thrown in for free).

We will be travelling to Vancouver next week and will have an in-depth discussion with both CEO Bill Howald and CFO Tony Woods to discuss the acquisition and the production plans and you can expect an in-depth report from us once we hear all the details. But at first sight, this deal seems to be extremely accretive for the Rye Patch shareholders and even if you’d take an additional equity raise into consideration, the NAV/share of Rye Patch would still be almost three times higher than the current share price!

Go to the Rye Patch website

The author has a long position in Rye Patch Gold. Rye Patch Gold is a sponsor of the website. Please read the disclaimer