Bluebird Battery Metals (BATT.V) remains very active, as the company has acquired an additional project in Australia’s New South Wales province. Bluebird seems to be getting along just fine with Impact Minerals (ASX:IPT) as this is the second deal both companies are completing in the past few months. The new project is conveniently called the ‘Broken Hill District’ and consists of several different zones (or deposits, if you wish).

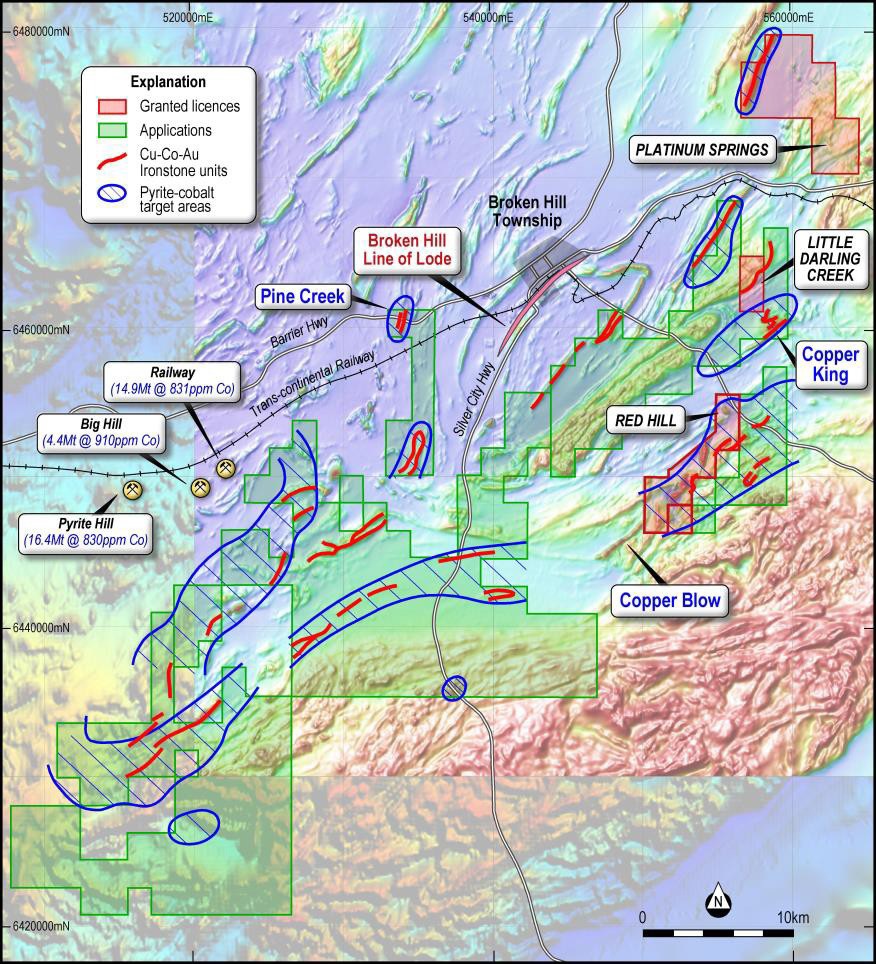

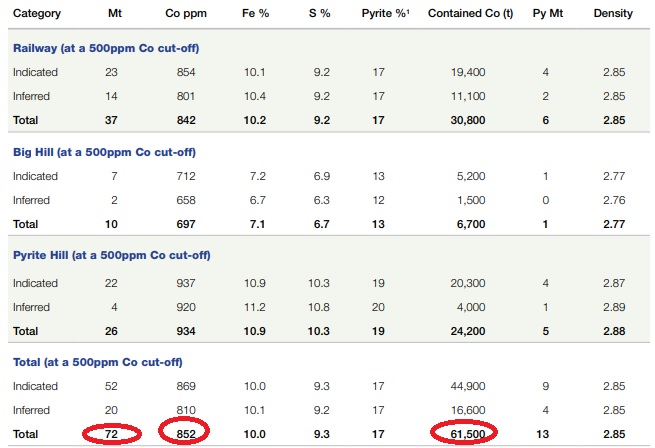

What’s interesting here is that in between the tenements and the railway connecting the Broken Hill township with the outside world, other explorers have been able to define meaningful cobalt resources. The Railway, Big Hill and Pyrite Hill projects combined host a total of just over 72 million tonnes of rock at an average grade of approximately 852 ppm Cobalt. This represents a total cobalt resource of approximately 135 million pounds at an average grade of 0.084% and whilst that’s definitely not high enough to warrant a cobalt-only development plan, the owner of these deposits, Australian outfit Cobalt Blue Holdings (ASX:COB), reckons it can make it work thanks to the sulphur credit. The truth for Cobalt Blue will be in eating the pudding (as its resource grade might be a bit too low), but it shows Bluebird’s new tenements are located in the right place.

And that has been confirmed by historical exploration results on the tenements that will soon be 75% owned by Bluebird. A 2012 trenching program confirmed 23 meters of 1.5% copper and whilst that already is an amazing result on a standalone basis, the lab didn’t perform any assays to detect other (expected) metals like gold and cobalt.

With these tenements, Bluebird Battery is adding a polymetallic asset to its portfolio and although cobalt (and the other battery metals) will remain BATT’s main priority, we are also keen to see the company following up on some of the precious metals (mainly the PGM) components, discovered by historical exploration programs.

Bluebird will be able to buy 75% of the Broken Hill district by spending C$125,000 in cash and issue 5.25 million shares to Impact Minerals. On top of that, BATT will have to issue C$525,000 worth of common stock and spend a minimum of C$2.25M on exploration expenditures during the three year period of the earn-in agreement. And finally, an additional 1.05M shares will have to be issued within six months after the definitive agreement.

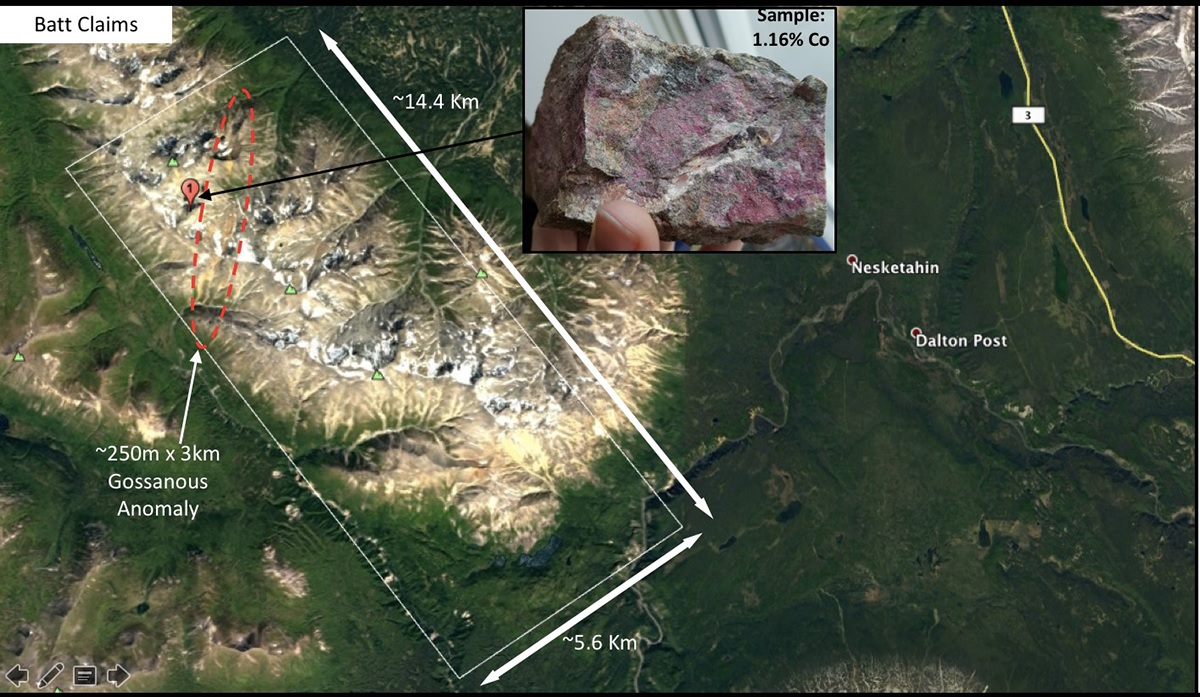

Although Bluebird is definitely focusing on Australia, the company is still planning to do some work on its Batt project in Canada’s Yukon Territory. Bluebird recently received the assay results from the lab, which tested a cobalt bloom rock for cobalt and other minerals. The sample returned 1.16% cobalt and 0.66 g/t gold. A good result which confirms the potential of the Batt property, but let’s remain cautious: a cobalt bloom will always return good values, but that doesn’t mean the property is hosting an economic deposit.

Bluebird is still working on the Batt project and will start a ten day exploration program next month. This program will consist of a mapping, soil and rock chip sampling program to evaluate the mineralized trend that has been identified on the claims. Additionally, the 250 meter by 3,000 meter anomaly should will also be followed up on. Once all exploration results will have been received, Bluebird will decide on a follow-up exploration program in the fall which will further investigate the merits of the property.

Go to Bluebird’s website

The author has a long position in Bluebird Battery Metals. Bluebird is a sponsor of the website. Please read the disclaimer