Bravada Gold (BVA.V) has recently been focusing on the PEA on the Wind Mountain gold project in Nevada, but let’s not forget the company still is a prospect and project generator with plenty of assets in its portfolio.

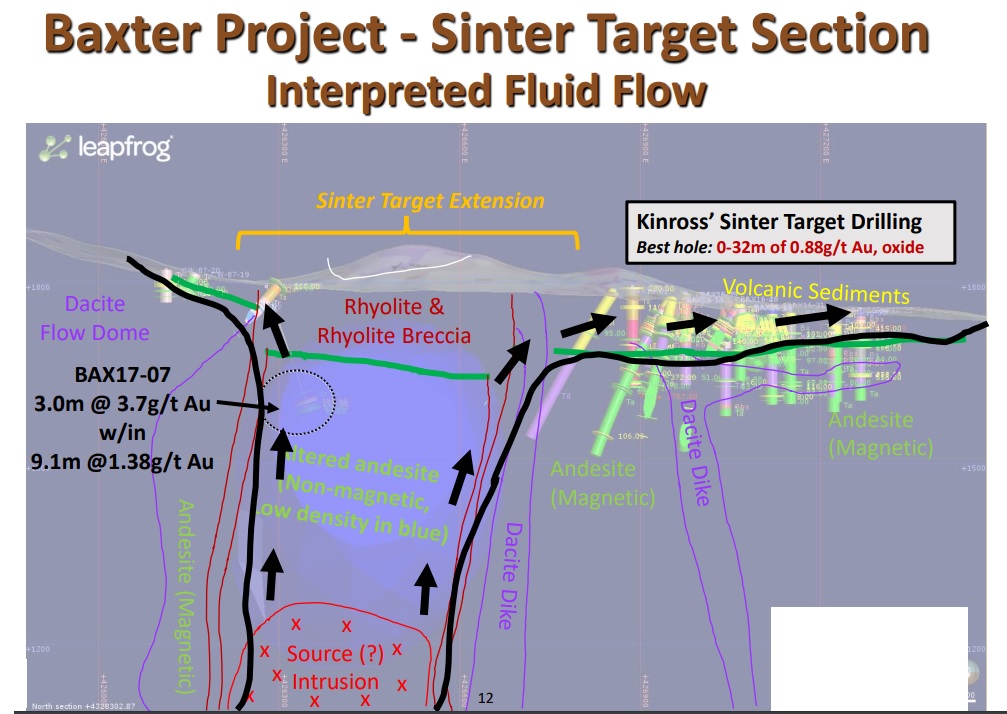

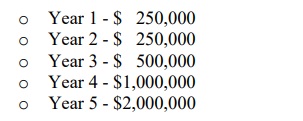

And Bravada struck a deal on one of those assets, the 920 hectare Baxter project. The company signed an agreement with Endeavour Silver (EDR.TO, EXK) whereby the latter has secured an option to earn a stake of up to 85% in the Baxter project. The agreement consists of a five year period wherein Endeavour Silver will be required to meet minimum spending commitments on the property (these required investments start of pretty benign but continuously increase during the five year option period, as you can see below.

Additionally, Endeavour Silver is required to pay Bravada Gold US$100,000 in cash per year, and that will be a very welcome cash inflow for Bravada. Once all payments have been completed, both partners will advance the project in an 85/15 joint venture. Additionally, should the project ever go into production, Bravada will be carried to production with repayments to Endeavour Silver from the net income generated by the production. Interestingly, Bravada mentioned the ‘net income’ and not ‘out of cash flow’ as once a mine has been built, the cash flows are traditionally higher than the net income as the sustaining capex tends to be lower than the depreciation expenses which weigh on the bottom line.

Disclosure: The author has a small position in Bravada Gold. Bravada Gold is a sponsor of the website. Please read our disclaimer.