Bravada Gold (BVA.V) has closed an oversubscribed placement to boost its treasury. Originally eyeing to raise C$600,000 at 8 cents per unit, Bravada ended up issuing 8.3M units to raise a total of C$664,400. Each 8 cent unit consisted of one common share as well as a full warrant allowing the warrant holder to purchase an additional share at C$0.15 for a period of three years after closing. The new 8 cent stock becomes free tradeable on October 12th.

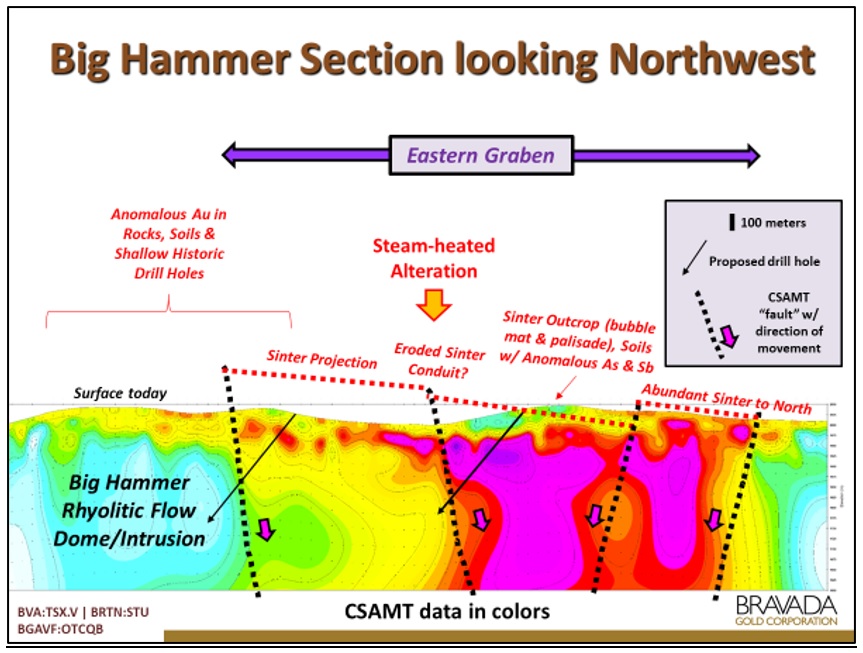

In its press release announcing the closing of the financing, President Kizis took the time to highlight the Highland gold-silver project where partner OceanaGold (OGC.TO) is earning a 75% stake by spending US$10M on the ground. Bravada is the operator at Highland and has now selected the high-priority areas where drilling will be focusing on. Bravada submitted the paperwork applying for a drill permit for 12 drill sites on two targets: Geyser and Big Hammer and aims to drill one or two of the Big Hammer targets in the second half of the third quarter.

Disclosure: The author has a long position in Bravada and participated in the placement. Bravada Gold is a sponsor of the website.