Canterra Minerals (CTM.V) has now closed the previously announced non-brokered placement, raising a total of C$2.7M. Canterra issued 13.58 million units priced at C$0.20 with each unit consisting of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share at C$0.30 for a period of two years.

The majority of the placement (13.18M units) was acquired by Eric Sprott who now owns 19.8% of Canterra Minerals (and 27.1% assuming all warrants will be exercised). By adding Sprott to the shareholder register, Canterra Minerals has now likely popped up on the radar screen of Sprott-followers and the company’s share price is currently trading at almost twice the placement price.

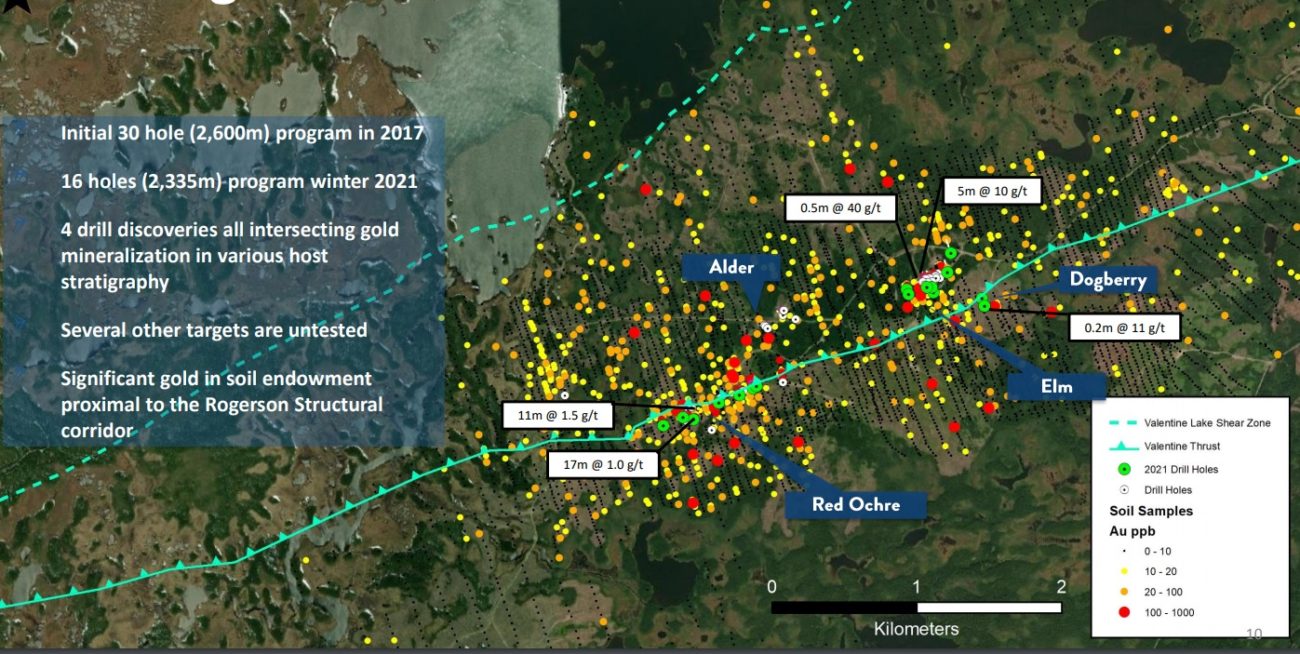

Including this cash injection, Canterra has a cash position of just over C$5M which will go a long way to execute the exploration programs on the flagship Wilding gold project in Newfoundland.

Disclosure: The author has a long position in Canterra Minerals. Please read our disclaimer.