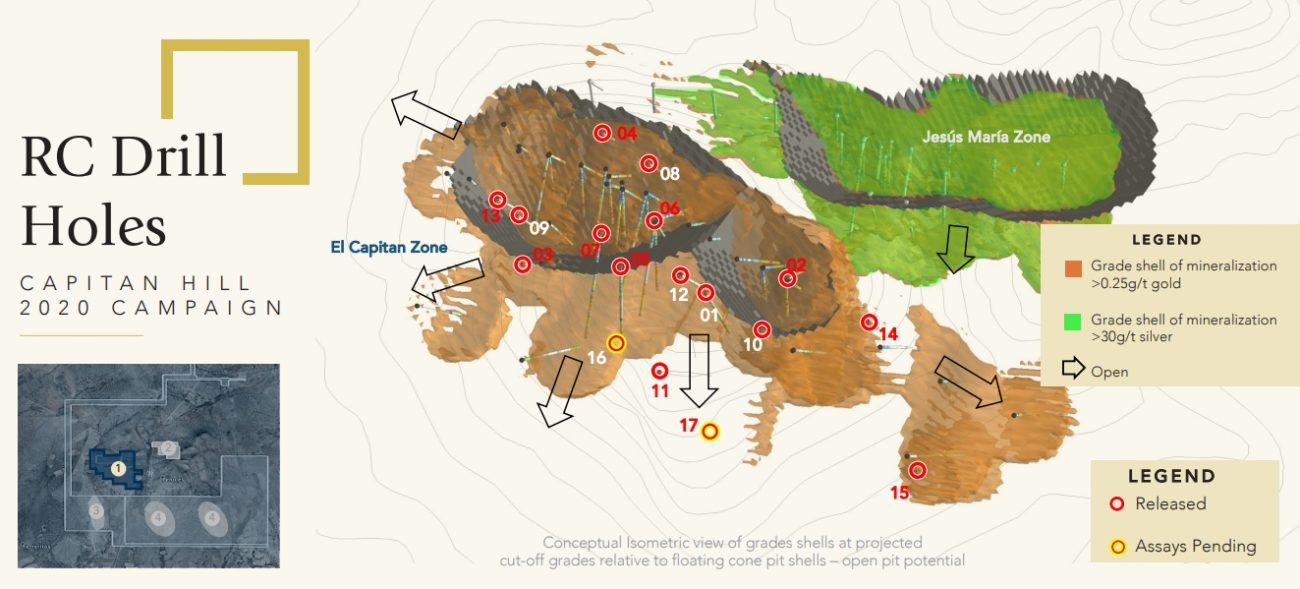

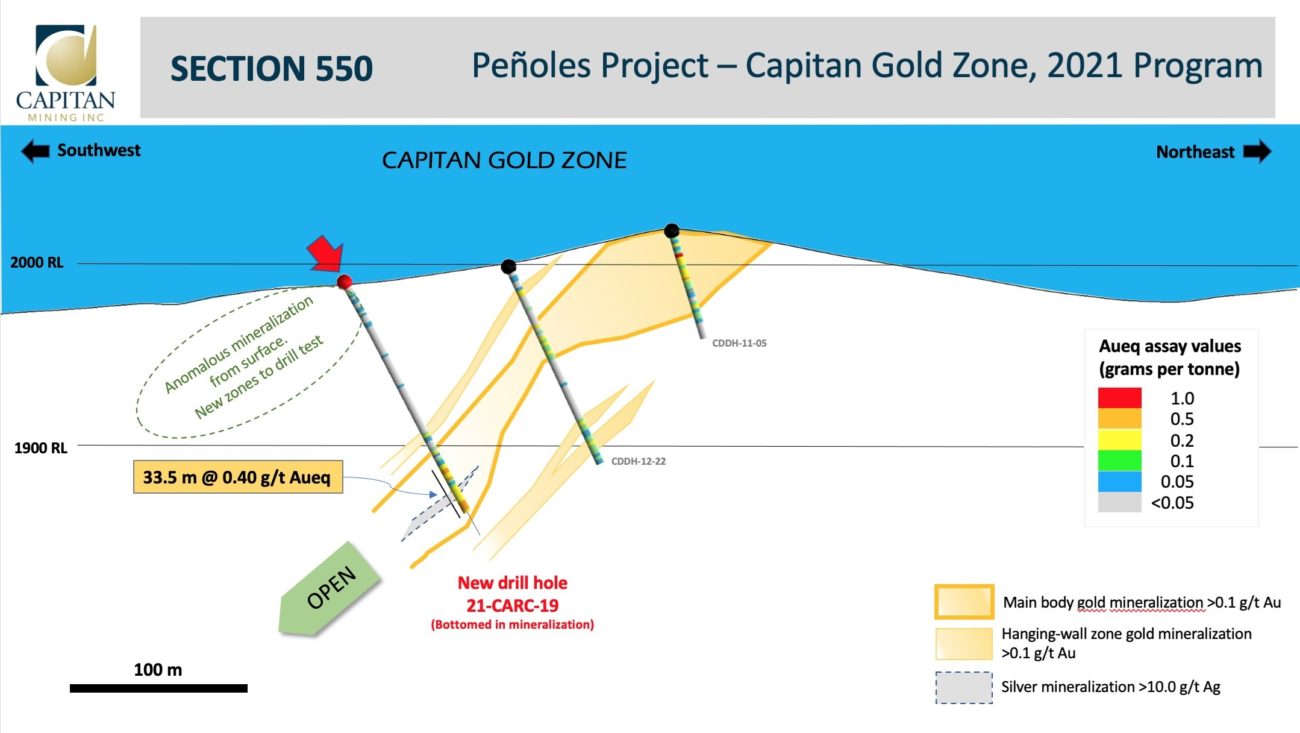

Capitan mining (CAPT.V) has released additional drill results from its flagship Capitan gold project in Mexico and the first three holes of the 2021 drill season were designed to test the continuity of the oxide gold mineralization towards the west and east from the known mineralized zones. Capitan Mining has provided a good overview of the underlying intentions of the three holes:

The combined assay results were nicely summarized in the following table. The headline result of 33.5 meters containing 0.4 g/t AuEq was encountered in hole 19 and consisted of 0.32 g/t gold and 6.1 g/t silver. It’s also important to note the hole was abandoned before reaching target depth, and the hole ended in mineralization.

While the assay result used in the headline of the press release clearly is the best one, hole 18 also deserves some attention as it intersected three distinct areas of mineralization. The widths are excellent (with 12.2 meters, 25.9 meters and 19.8 meters), but the grade doesn’t seem to be as exciting. While the assays are 100% geared towards gold (no significant silver values were intersected) and 0.22 g/t , 0.17 g/t and 0.30 g/t exceed the traditional cutoff grades for an oxide gold deposit and the rock will likely be placed on a leach pad, the margins will obviously be lower than what you could expect from the area encountered in hole 19.

Given the exploration success and the strong focus on the project, we feel Riverside Resources (RRI.V) has made the right decision to spin out its Penoles project to Capitan Mining. With a dedicated CEO and a healthy treasury, Capitan Mining is in an excellent position to advance the project.

Disclosure: The author has a small long position in Capitan Mining and Riverside Resources. Capitan is not a sponsor of the website. Please read our disclaimer.