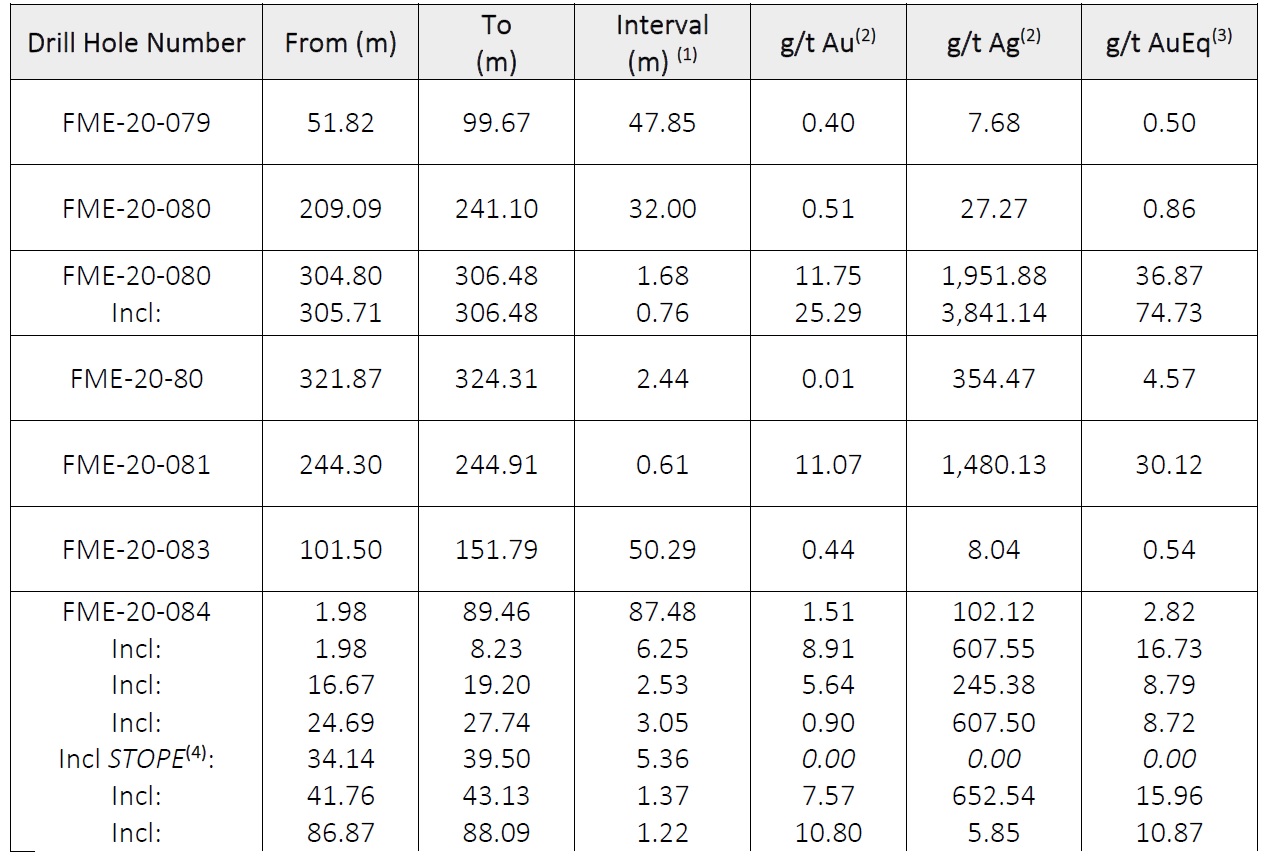

Integra Resources (ITR.V, ITRG) has released assay results from an additional five holes that were drilled on the Florida Mountain area of the DeLamar, the results of which you can find below.

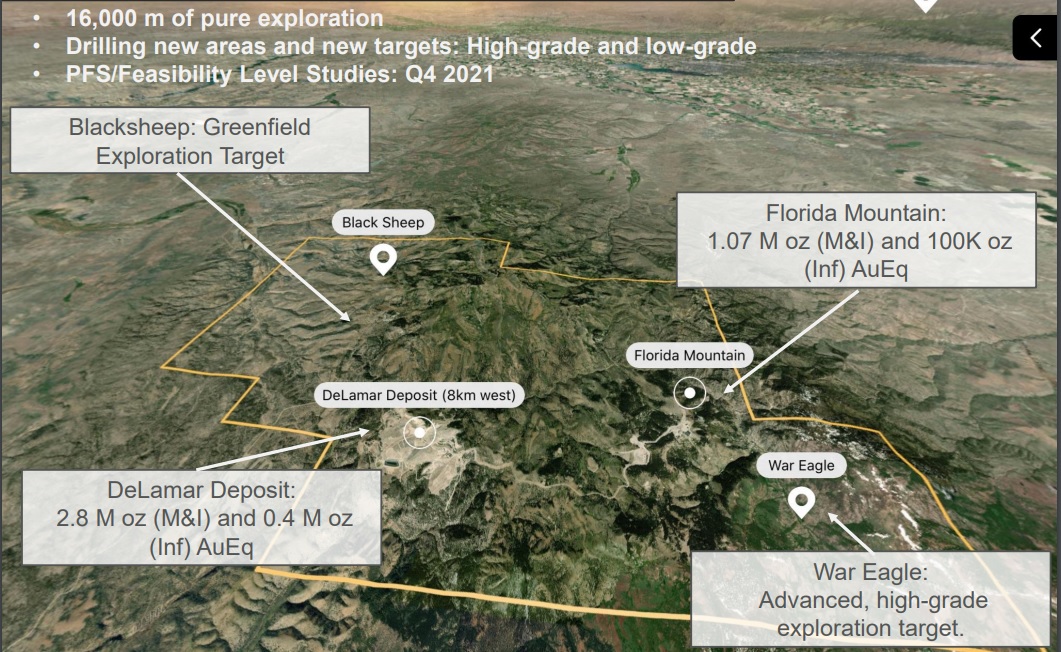

Integra’s three drill rig program continues to deliver high-grade gold and silver results at Florida Mountain where Integra has been focusing on the high-grade vein structures (with a combination of infill drilling and step out drilling beyond the current resource boundaries). A total of 7,000 meters of drilling has been earmarked for exploration at Florida Mountain and the five holes above represent approximately 1/5th of that drill program. The results are pretty consistent with the exploration theory there as the lower grade thicker zones closer to surface are underlain by narrow, steeply dipping but high grade veins. The company’s exploration team has now modeled seven of those high-grade vein structures which appear to occur as plunging shoots. In fact, hole 84 is an excellent testament to the exploration theory as that specific hole successfully intercepted several of the shoots modelled by the Integra geologists.

We are working on a full update on Integra’s exploration successes in the DeLamar district and the high gold and silver price will have an excellent impact on the economics of the pre-feasibility study. It’s also important to realize Integra is fully funded for the completion of the pre-feasibility study, and we estimate the company now has enough cash on hand to cover all expenses until the end of last year.

Integra closed a bought deal financing in September whereby the company issued 6.785M shares (this was a straight share financing, no warrants were issued) at US$3.40 to raise US$23.1M. After deducting the underwriters commission, Integra will add roughly US$22M or almost C$29M to its treasury. As the company still had a working capital position of in excess of C$20M as of the end of Q2, the company will very likely end Q3 2020 with a working capital exceeding C$40M, putting Integra in an excellent shape. With the 6 million ounce gold-equivalent within reach and thanks to the high gold and silver prices, we expect the PEA to be dwarfed by the pre-feasibility study.

Disclosure: The author has a long position in Integra Resources and participated in the bought deal. Integra is a sponsor of the website.