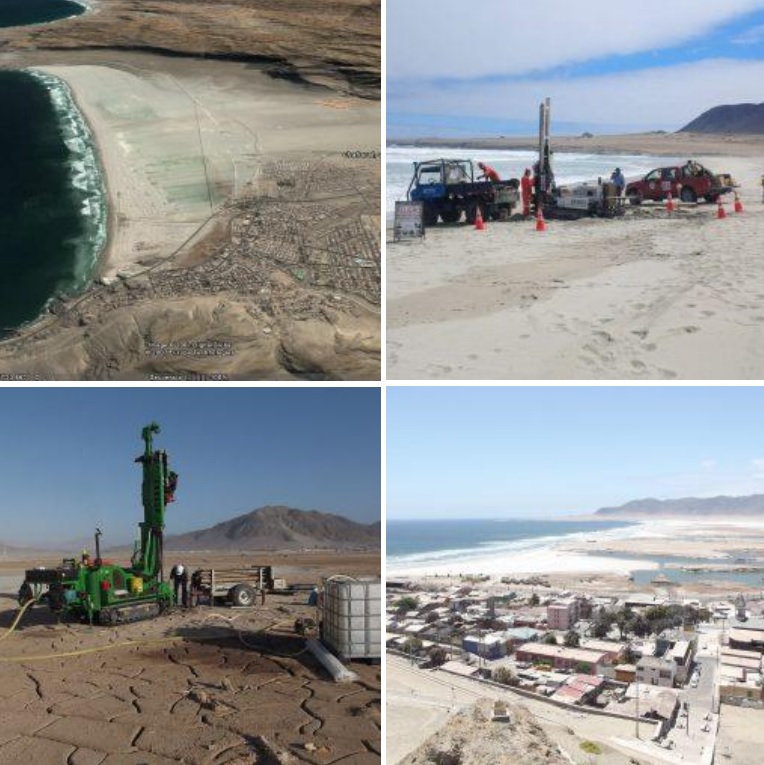

Last month, Central Asia Metals (CAML.L) released the results of the definitive feasibility study on its Copper Bay tailings project in Chile. According to the mine plan, a total of 35 million tonnes of ore at an average grade of 0.24% copper would be processed, resulting in an average copper production of approximately 19 million pounds per year during seven years.

Due to the low grade (which is obviously pretty normal for a tailings project), the C1 cash cost will be relatively high at $1.37 per pound. Due to the very high initial capex of almost $90M and the low output at a high price, the post-tax NPV8% of $34M using a copper price of $3/lbs is actually very disappointing. A golden rule in the mining sector is that you’d really like to see your NPV to be higher than the initial capex, to have some sort of margin of safety.

It’s a noble thing to be willing to clean up the beach at Chanaral Bay which was ‘polluted’ by two mines releasing tailings residues into the Rio Salado river, but for CAML’s shareholders, the project doesn’t make a lot of sense as it’s very capital intensive compared to the final potential payoff.

Go to Central Asia Metals

The author has no position in Central Asia Metals. Please read the disclaimer