Columbus Gold (CGT.TO) has now finally entered in the joint venture agreement with Nordgold whereby the latter has now officially established its 55.01% ownership in the Montagne D’Or gold project in French Guiana. Columbus is free carried until December 18th, when Nordgold has to make a construction decision (note, this does not mean the construction of the gold mine will start immediately after the decision. The permitting process won’t be completed by then, so the ‘construction decision’ of the joint venture partners will be a technicality).

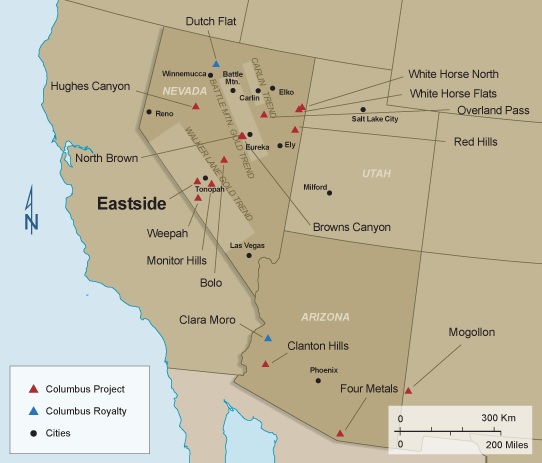

Columbus is also in the final stages of preparing to spin out its American assets into Allegiant Gold (AUAU.V) which should be trading before the end of this year. We expect Columbus to release more details on the spin-out within the next few weeks. In a July press release, Columbus Gold promised the CGT shareholders would be entitled to 1 new share of Allegiant per 5 shares of Columbus Gold whilst CGT would keep a strategic position as well. The spin-out of Allegiant will be accompanied by a capital raise which should allow Allegiant to hit the ground running on the Eastside and Bolo projects in Nevada (whilst the majority of the other projects in the portfolio will be drilled as well).

Go to Columbus’ website

The author holds a long position in all stocks mentioned in this article. Please read the disclaimer