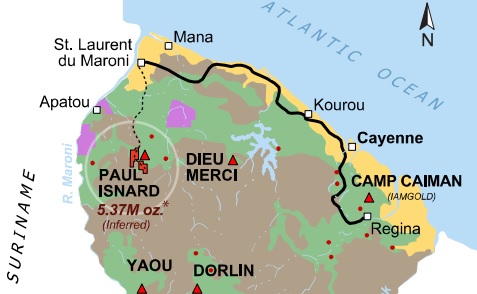

As expected, Columbus Gold (CGT.TO) has reported the results of the feasibility study on the Montagne d’Or gold project in French Guiana, wherein it holds a 44.99% interest after joint venture partner Nordgold (NORD.L) completed its earn-in requirements.

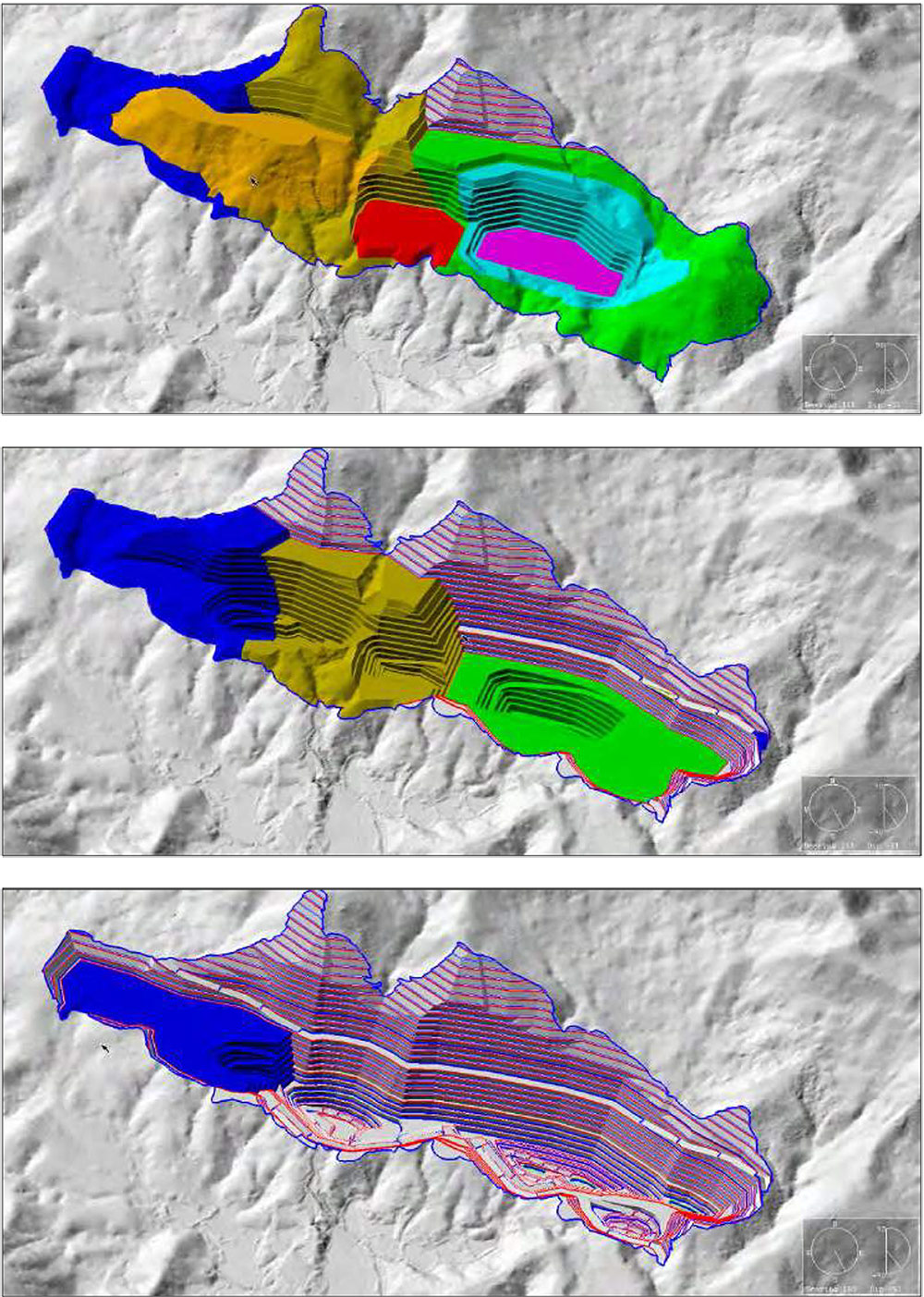

The mine plan includes 2.75 million ounces of gold reserves (@ US$1,200 Au) at an average grade of 1.58 g/t gold, which should result in an annual gold production of 237,000 ounces of gold per year during the first 10 years, at an average grade of 1.73 g/t (214,000 oz/yr at 1.58 g/t over the entire mine life). With a cash cost of $666/oz and an all-in sustaining cost of just below $750/oz. Assuming a total initial capex of US$361M, the after-tax NPV5% is approximately US$370M.

Even though the IRR of 18.7% misses our expectation and requirement of 20%, we are still quite happy with the result of the feasibility study, considering there’s a lot potential to improve the economics. It’s also important to remember that this study was completed and delivered on time under an accelerated three-year timeline. For example, approximately 960,000 inferred ounces haven’t been included in the mine plan even though every single one of these ounces is located within the pit shell

Nordgold and Columbus Gold are considering a near-term $1.5M, 4,300 meter infill drill program to convert some of these inferred ounces into a reserve category. This would allow Columbus to include more gold in the mine plan. Subsequently, this will have an impact on the project’s NPV and IRR as well, which should both be boosted. Using a gold price of $1250/oz, and assuming up to an additional 200,000 ounces (20%) are added to the mine plan, the NPV could easily increase to in excess of US$400M, whilst the IRR should be boosted to over 20%. Additionally, the ‘regional exploration program’ which was announced earlier this year will target gold zones located close to the planned pit shell, and you don’t have to be a rocket scientist to see this could result in an updated pit shell containing even more ounces.

Long story short; even though this is a feasibility study, we merely see this as a starting point for Columbus Gold and Nordgold. It should be pretty easy to upgrade inferred ounces to a higher category and incorporate those in the mine plan, whilst the regional exploration program will also add more value.

Investors might be disappointed with the sub-20% IRR at first, but the Montagne d’Or feasibility study is actually quite robust, and it looks like the project will be built, even at $1200-1250 gold. That should definitely please the local government, as according to our calculations, the direct and indirect jobs provided by Montagne d’Or will reduce the unemployment rate in French Guiana by 15-20%. And that’s huge.

Go to Columbus’ website

The author has a long position in Columbus Gold. Columbus Gold is a sponsor of the website. Please read the disclaimer