Comstock Metals (CSL.V) has reached an agreement with Yukon-focused White Gold Corp (WGO.V) to sell its QV gold property to the latter. White Gold will pay C$375,000 in cash and issue 1.5 million new shares to Comstock Metals, which gives this deal a total value of approximately C$2.6M using a share price of C$1.5 for White Gold. On top of the cash and stock payment, Comstock Metals will also receive 375,000 warrants with an exercise price of C$1.50 which will remain valid for three years.

As this is the third asset Comstock Metals is selling, it looks like the company is now solely focusing on its Preview SW gold project in Saskatchewan (where we hope to see some assay results in the next few weeks), and the early-stage Rawhide Cobalt-Silver project in Ontario. The C$375,000 cash inflow will help Comstock to fund its potential work programs on both Preview and Rawhide, while the 1.5M shares of White Gold still give it some exposure to exploration successes in the greater White Gold District.

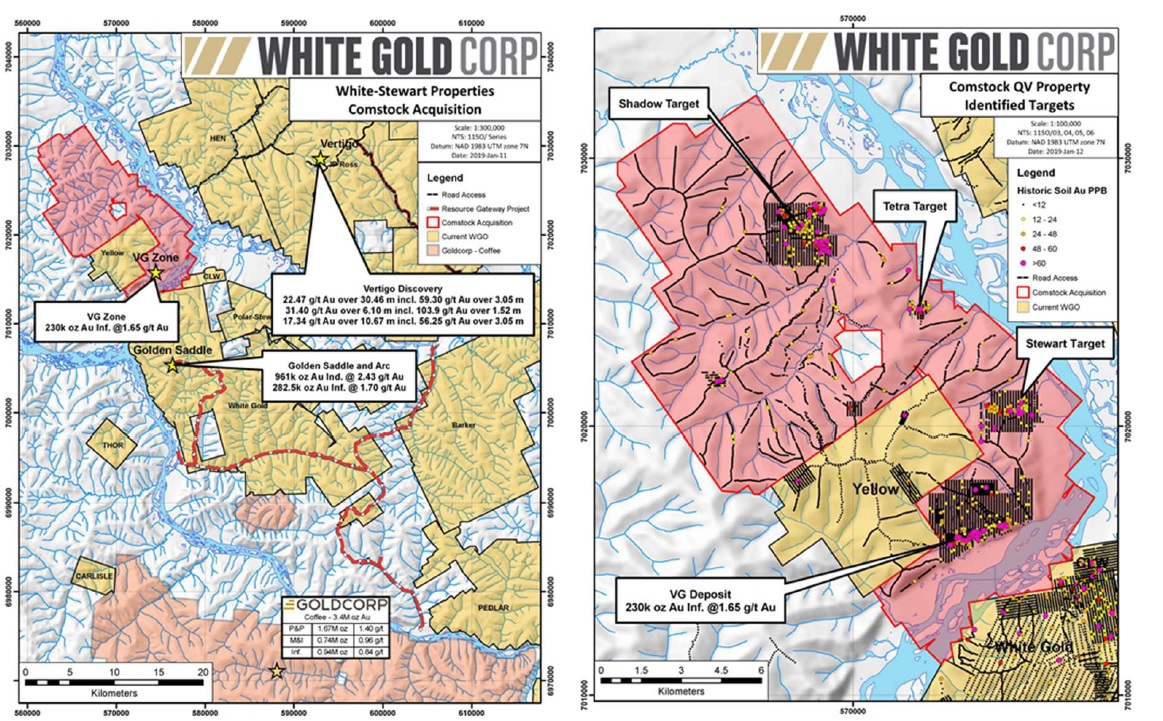

There’s always a case to be made for either selling or keeping a property but we feel the C$2.6M price tag is a fair price for an early stage gold exploration project with a current resource estimate of 230,000 ounces. Some shareholders will be disappointed to see the Yukon project go as the entire region has its day in the spotlights every once in a while, but we think Comstock’s management felt it would be getting the best returns per exploration dollar spent on the more southern projects.

It’s now also interesting to note Comstock’s equity positions in E3 Metals (ETMC.V) and White Gold Corp (WGO.V) have a net value of C$0.0275 per share of Comstock Metals. So at C$0.035 (the current bid), its enterprise value is pretty much zero as the C$3.4M market cap is almost entirely backed by its investments in ETMC and WGO and the cash position.

Go to Comstock’s website

The author has a long position in Comstock Metals. Comstock is a sponsor of the website. Please read the disclaimer