A few months after securing C$2.85M in funding in a private placement that was priced at C$0.29 per share, Contact Gold (C.V) has now (finally) nailed down the terms of its raise with the two underwriters of the pre-announced prospectus offering. Contact will raise C$4M at a fixed price of C$0.20 per share and as this is a prospectus offering, the shares will be free tradeable. It’s a straight share deal and no warrant has been included.

Waterton has agreed to participate pro rata, so the two underwriters only had to find C$2.8M of the C$4M offering. The underwriters (Cormark Securities and Raymond James; it’s probably not a coincidence these two firms have initiated analyst coverage on Contact Gold) were granted an additional (standard 15%) overallotment option which could result in issuing an additional 3M shares for C$600,000. Excluding the over-allotment option, Contact Gold will have approximately C$6M in cash which should be sufficient for this year’s summer drill season.

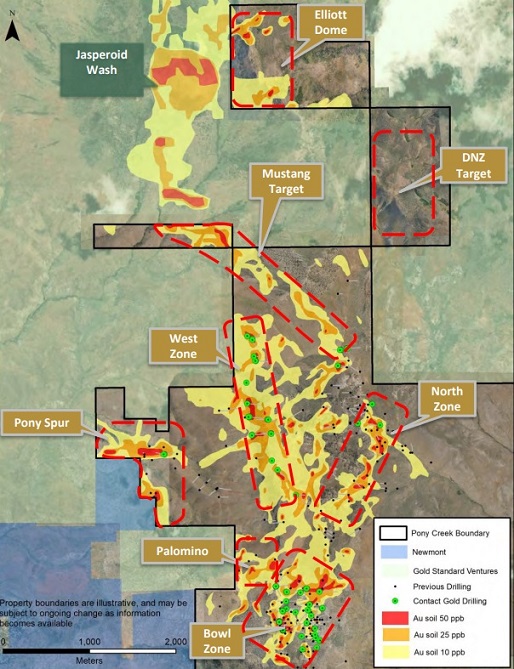

The prospectus offering will close soon, and we expect Contact Gold to unveil its exploration plans soon thereafter. Last year, its exploration program found huge zones of low-grade gold mineralization, and we would expect the company to focus on discovering economic grade gold mineralization this year as that will be the only thing the market will understand. Finding 33.5 meters of 0.44 g/t, 93 meters containing 0.33 g/t and 50 meters at 0.26 g/t gold are excellent achievements for an early stage exploration project and while it confirms the potential of the property, this should be the year of pursuing and finding higher-grade zones.

Go to Contact’s website

The author has a long position in Contact Gold. Contact is a sponsor of the website. Please read the disclaimer