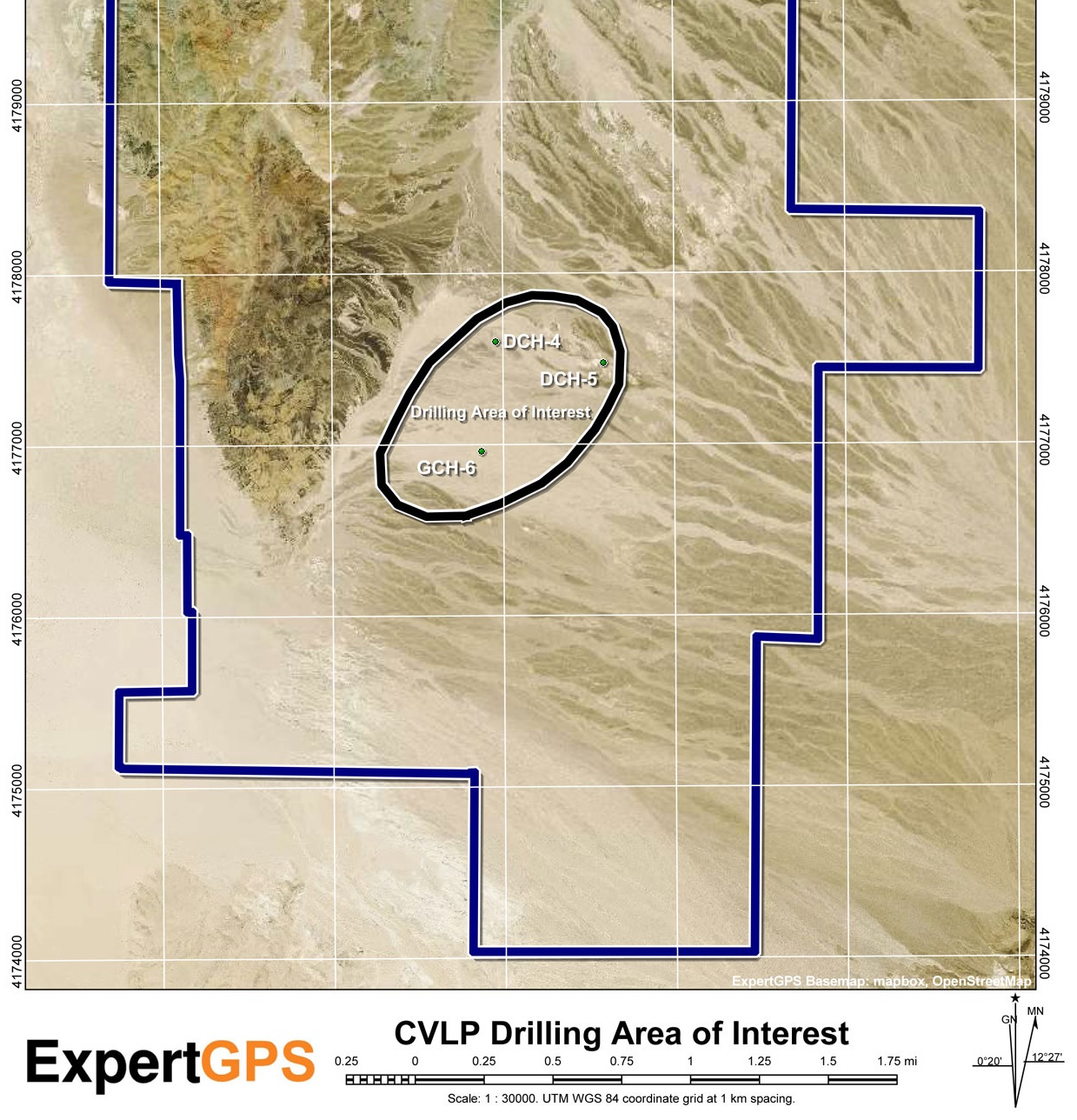

Cypress Development (CYP.V) is now in a straight line towards the finish line as the company has now completed its six hole drill program to do some infill drilling on a one square kilometer surface area where the southwestern portion of the pit has been planned. The infill program will give its independent consultants more data to use in the upcoming pre-feasibility study, which we expect will confirm the results of the Preliminary Economic Assessment.

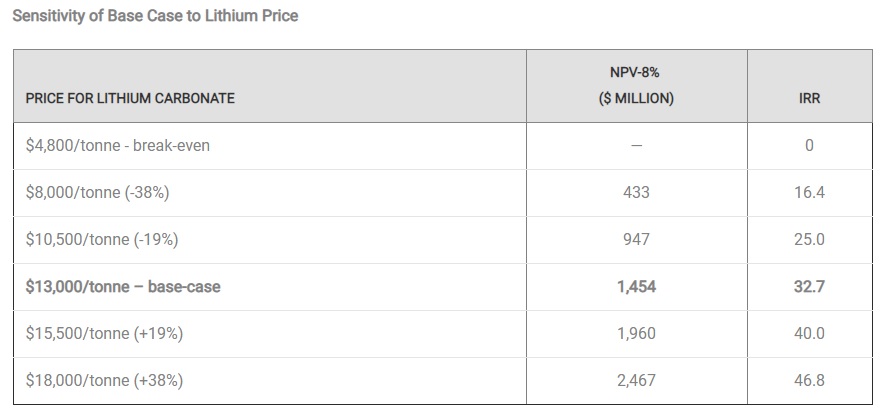

That PEA showed an after-tax NPV8% of almost US$950M and an Internal Rate of Return of 25% using a lithium price of US$10,500/t. Considering the lithium price is currently trading lower than the US$14,000t used in Cypress’ base case scenario, we would expect the upcoming Pre-Feasibility Study to also use a lower base case lithium price to show how robust the economics are. Based on the Preliminary Economic Assessment and the recent drill results, the Clayton Valley project doesn’t need high lithium prices to be developed as even US$8,000/t would be sufficient to generate returns that are attractive enough for a mining project with a long mine life.

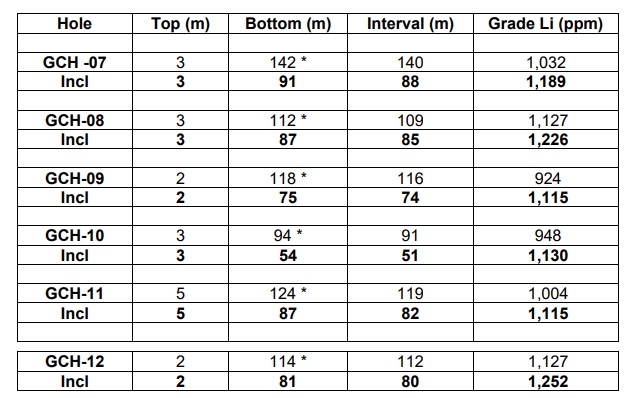

Some of the drill core will also be used to conduct further metallurgical and geotechnical testing as well, so perhaps we will see an interim update on the met work before the pre-feasibility will be published. The assay results are very promising as the mineralization almost starts at surface (the intervals start at 2-5 meters below surface) and with the excellent thickness (between 91 and 140 meters at a consistent average grade of 1,000 ppm lithium, we don’t anticipate to see any negative surprises in the pre-feasibility study.

Go to Cypress’ website

The author has a long position in Cypress Development. Cypress also is a sponsor of the website. Please read the disclaimer