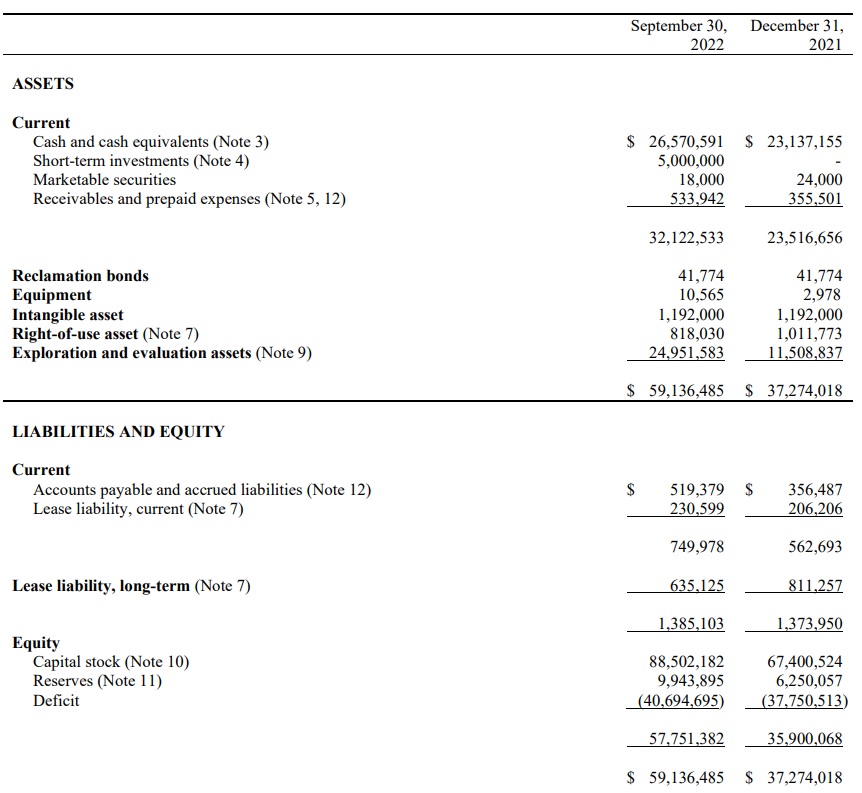

Cypress Development (CYP.V) is working towards a feasibility study on its Clayton Valley lithium project in Nevada, and fortunately the company’s management was smart enough to raise money when it was available. As per the most recent quarterly financials, Cypress ended Q3 with C$32.1M in current assets and just C$750,000 in current liabilities for a net working capital position of $31.4M. Around C$26.6M was held in cash while Cypress also invested C$5M in GICs with a 120 and 180 day term so that should yield a few ten thousand dollar in interest income.

Having a cash-rich balance sheet is a blessing in this environment. In the third quarter alone, Cypress recorded a C$175,000 net interest income, which was an acceleration from the less than C$100,000 in the entire first semester of the year. And as interest rates continue to increase, Cypress will likely see its quarterly net interest income exceed C$200,000 before too long and this will further reduce the net cash burn.

The very strong treasury in combination with the relatively low burn rate means Cypress is in an excellent position to deliver the feasibility study (in H1 2023) and explore the options for its next step.

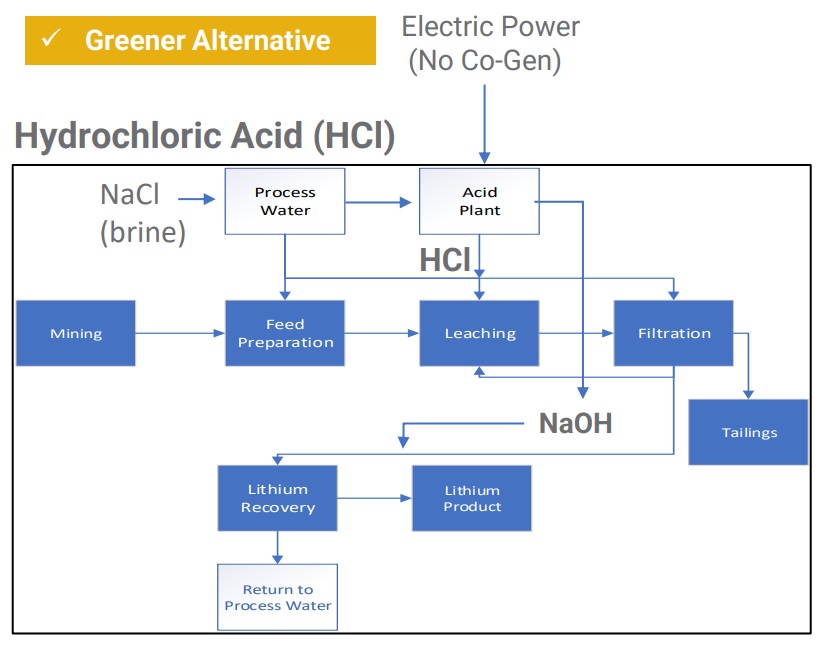

The company is making good progress with the feasibility study as the consultants have either completed or are close to complete several key items like the reserve estimates, mine plan and the processing plant design. Subsequent to the end of the third quarter, Cypress selected thyssenkrupp nucera as its preferred bidder to design and develop the chlor-alkali plant.

Disclosure: The author has a long position in Cypress Development. Cypress is a sponsor of the website. Please read our disclaimer.

Anyone care to postulate why a developing lithium mine with upwards of 3 BILLION of “lithium product” in the ground and $30 million in cash is selling for a market cap of less than $150 Million (CAD)?? w