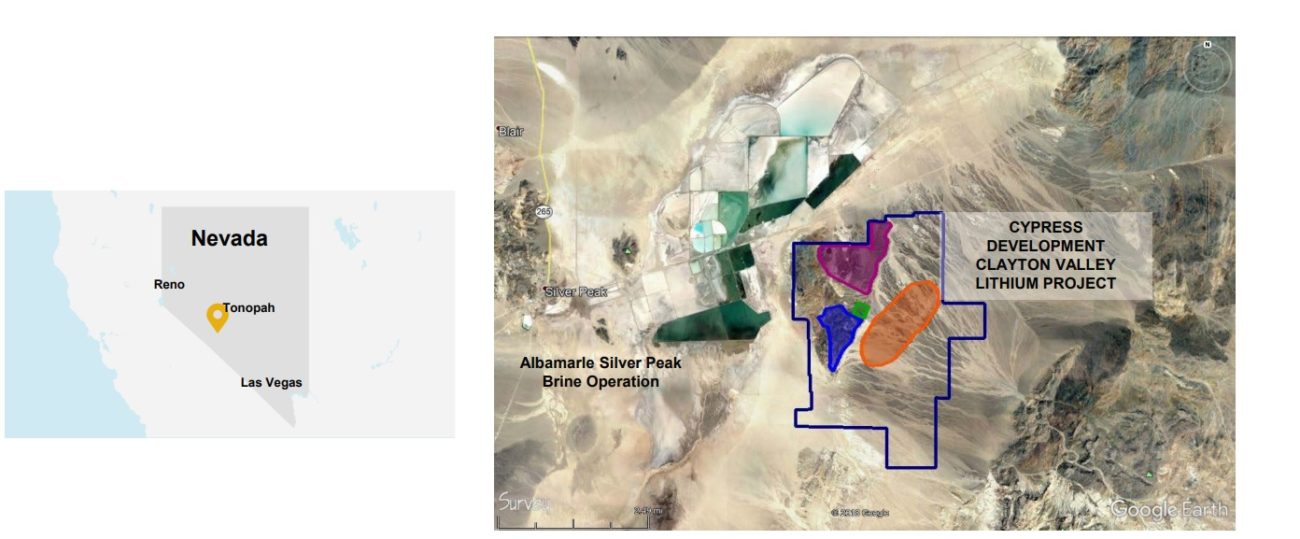

It took Cypress Development (CYP.V) a little bit longer than expected (which wasn’t an issue as the lithium price wasn’t exactly cooperating) but has now finally released the preliminary results of the pre-feasibility study on its Clayton Valley Lithium project in Nevada. We didn’t anticipate to see huge differences in the economics of the project, so we were looking forward to compare the results of the pre-feasibility study with the PEA that was originally published in September 2018.

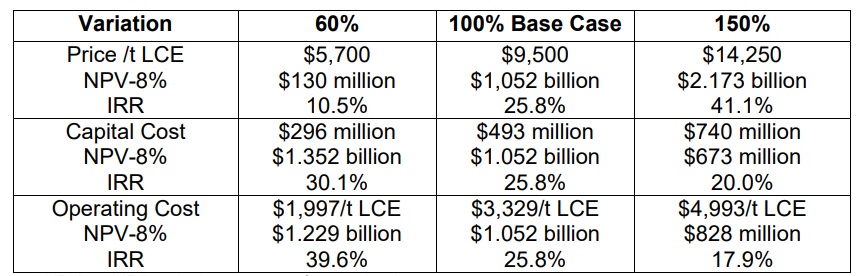

The mine plan now calls for a mining rate of 15,000 tonnes per day which should result in the production of 27,400 tonnes of LCE per year at an operating cost of $3,329 per tonne of LCE. Given the US$493M capex (including $95M contingency), the after-tax NPV8% comes in at $1.05B while the Internal Rate of Return is just over 25% based on a base case lithium price of $9,500 per LCE.

As you may remember from our update in 2018, we used a base case lithium price of $9,100/t (compared to the $13,000/t used by Cypress) which resulted in an after-tax NPV8% if around $600M. So to see a NPV of $1.05B (+75%) based on a lithium carbonate price that’s just 4% higher than what we used in 2018 is a success.

At first sight, the Pre-Feasibility Study seems to have improved the PEA numbers (the operating cost per tonne decreased from $17.5/t to $16.78/t), and we are looking forward to seeing the full technical report so we can finetune the economics at for instance $7,000 and $8,000 lithium as the sensitivity table in the press release only provides results for LCE prices of $5,700, $9,500 and $14,250 per tonne.

Once the technical report has been filed, we will provide a full update.

Disclosure: The author has a long position in Cypress Development. The company is a sponsor of the website.