Emmerson (EML.L), which is developing the Khemisset potash project in Morocco, has announced it has signed an agreement with a group of investors led by Singapore-based Global Sustainable Minerals to invest about $46.75M. The investment will be divided in a $6.75M equity component whereby new shares will be issued at 6 pence which was an 8% premium to the 30 day VWAP of the Emmerson shares, while the remaining $40M will be raised through issuing a convertible loan note.

This two year convertible debenture will have a conversion price of 8.2 pence per share and will be issued with a coupon of 9%. This financing will allow Emmerson to continue its discussions with potential partners to fully fund the development of the Khemisset potash project.

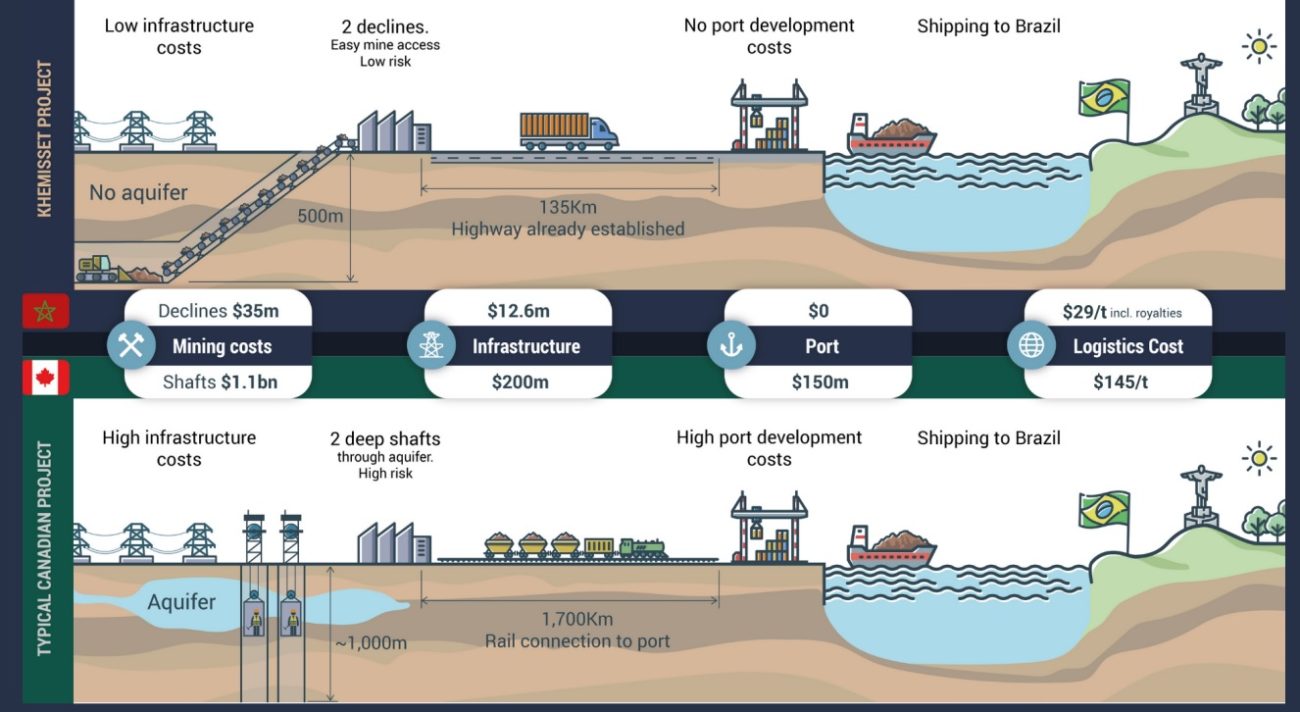

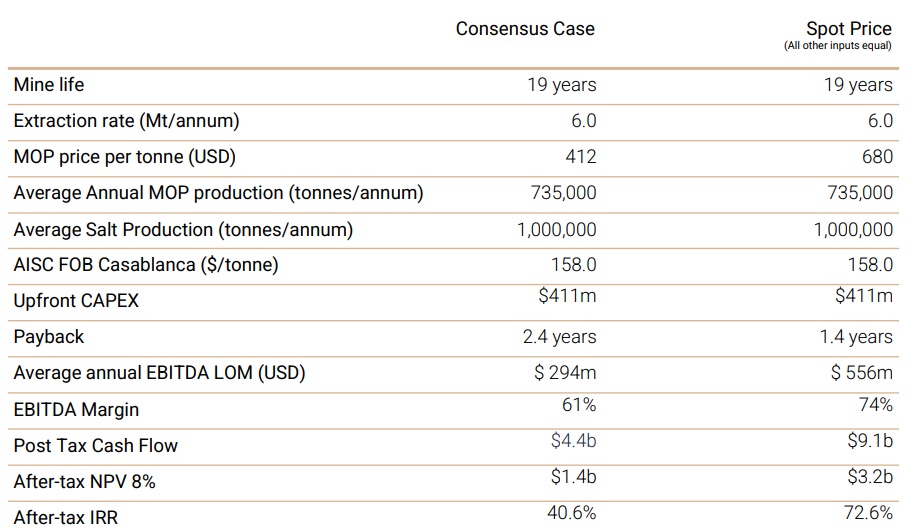

The feasibility study confirms a $411M capex to produce an average of 735,000 tonnes of MOP per year at an AISC of $158/t. Using a base case price scenario of $412/t, the after-tax IRR comes in at just over 40% while the after-tax NPV8% is approximately $1.4B. Applying a more optimistic MOP price scenario of $680/t, the after-tax NPV8% increases to $3.2B while the IRR jumps to in excess of 72%.

Disclosure: The author holds a long position in all stocks mentioned in this article. Please read our disclaimer.