Just a few months after completing a threeway merger, First Cobalt (FCC.V) has now entered into an agreement to acquire all of US Cobalt’s (USCO.V) outstanding shares in an all-share deal at a 62% premium compared to the closing prices of both companies before the deal was announced.

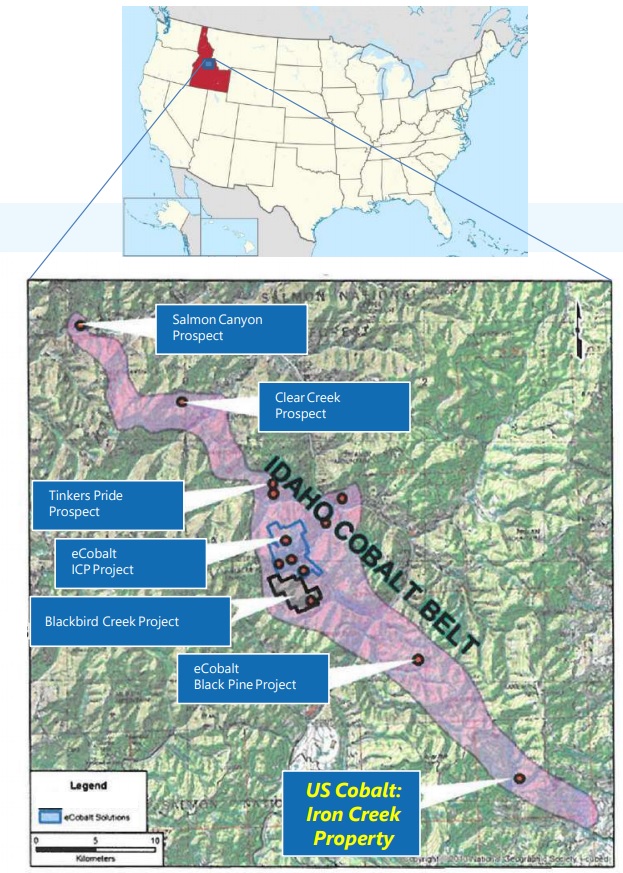

First Cobalt will issue 1.5 of its own shares per share of US Cobalt for a total valuation of C$150M on a fully diluted and in the money basis. A hefty price tag, but it allows First Cobalt to enter the very prospective Idaho Cobalt Belt where ePower Metals (EPWR.V) is also trying to prove up a cobalt resource.

Shortly after the deal was announced, US Cobalt announced more assay results from its Iron Creek project, and with 12.3 meters at 0.14% cobalt and 2.46% copper (including 1.9 meters containing 0.33% cobalt and almost 4% copper), it’s understandable why First Cobalt wanted to have exposure in this region.

Back in the Cobalt camp, First Cobalt has also started metallurgical test work on refinery residue and crushed waste rock material which is located near the mill facility. The study (which should be completed by the summer) will focus on designing an optimal flow sheet to recover as much cobalt and silver as possible, whilst removing the arsenic in the process. The ‘inventory’ has a high average grade of 0.65-1.55% cobalt, and using the expected 6,500 tonnes (which is the non-NI43 compliant resource estimate on this residue and waste rock), this represents approximately 90,000-220,000 pounds of cobalt (before applying a recovery rate) for a gross in situ value of US$3-8M and could provide a source of early cash flow.

Go to First Cobalt’s website

The author has a long position in First Cobalt. First Cobalt is a sponsor of the website. Please read the disclaimer