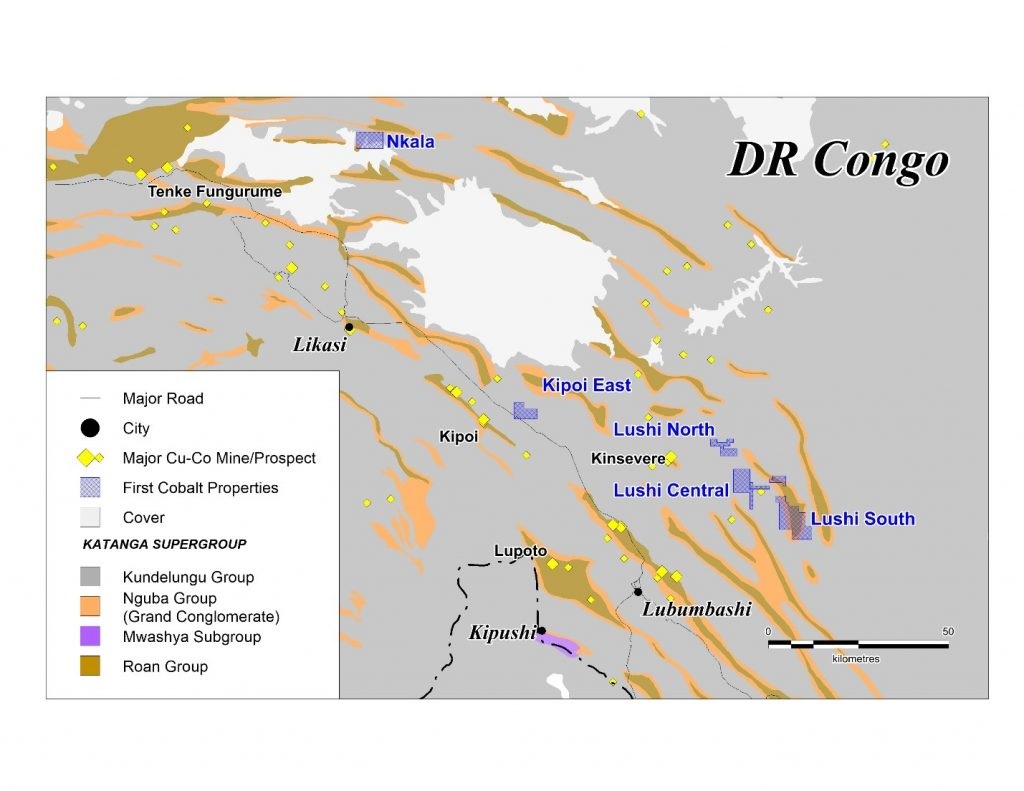

First Cobalt (FCC.V) has outlined its first exploration program at its Katanga-based Kipoi East project, which will commence immediately after FCC signs its definitive earn-in agreement.

First Cobalt will primarily focus on the Kipoi East zone, which is the most advanced property of the seven land packages it’s earning an interest in. The company is budgeting an initial US$650,000 at Kipoi east, which will include a mapping program as well as a soil geochemistry program to determine if the copper-cobalt mineralization from the nearby Kempesimpesi deposit (less than a kilometer away) is continuing onto the Kipo East tenements.

Once First Cobalt has outlined its exploration targets, the company will very likely follow up with 1,500 meter of diamond drilling and percussion drilling.

It’s always nice to see how so many cobalt companies are focusing on old mines in Canada, but the truth is the DRC has been and will continue to be one of the hot spots for cobalt exploration and production due to its grade and the copper as a common by-product. A combination of Canada-based and DRC-based projects might be the best of both worlds.

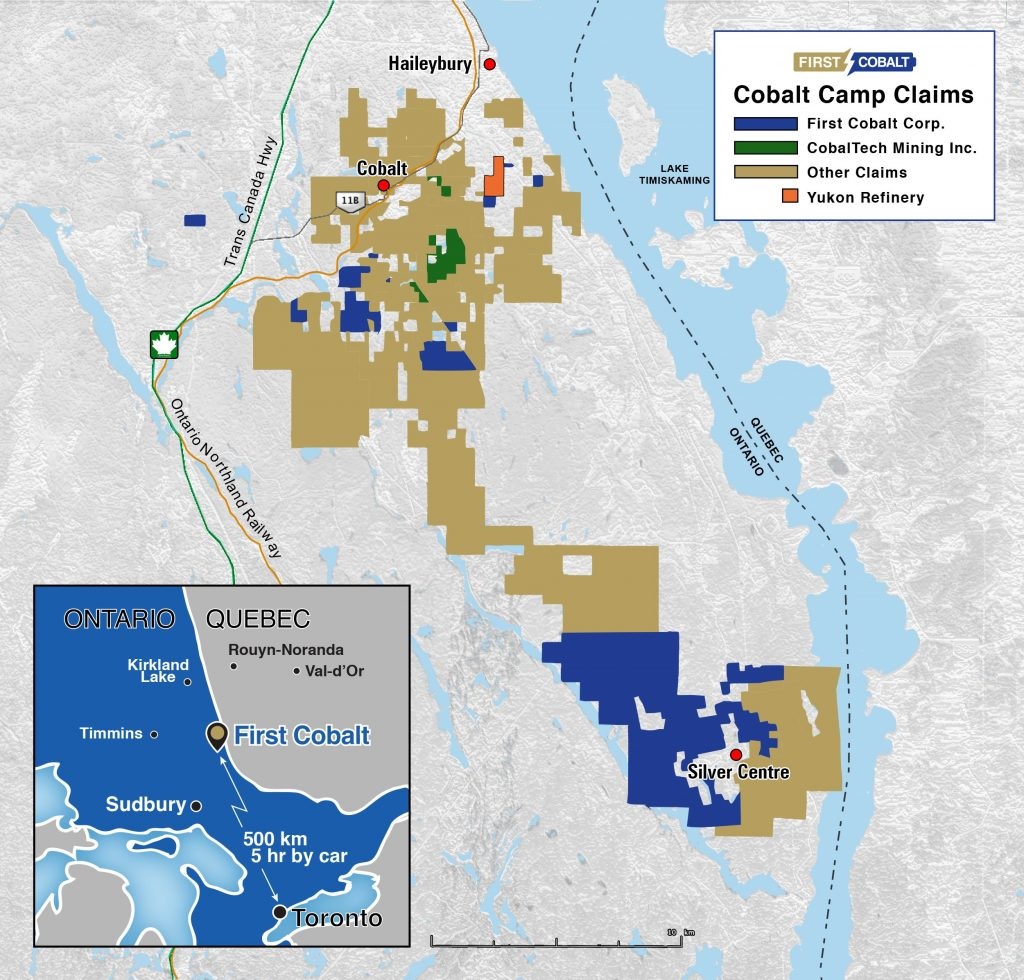

That’s also why First Cobalt is fully focusing on this two-pronged approach, and the company announced its plans to merge with ASX-listed Cobalt One (ASX:CO1) and to acquire Cobaltech Mining (CSK.V). The Cobaltech-deal is just in the ‘Letter of Intent’ stage and no share exchange ratio has been announced just yet. CobalTech owns 11 past-producing cobalt mines as well as an inventory of almost 6,600 tonnes of rock with an average grade of 0.95% Cobalt and 761 g/t silver. Using today’s metal prices, this stockpile represents a total value of C$8M (excluding the recovery factor). Even more important is Cobaltech’s fully-permitted 100 tonnes per day mill.

First Cobalt also proposed a friendly merger to the board of Cobalt One, which would allow FCC to consolidate the ownership of the Yukon refinery in the Cobalt camp. Upon completion of the transaction, the First Cobalt shareholders would own 40% of the company whilst Cobalt One shareholders would own the remaining 60%. According to FCC, this transaction makes sense as the refinery is an asset of strategic importance, and FCC’s Canada-based management is in a better position to maximize the potential. We would also like to point out that by obtaining a listing on the ASX, First Cobalt could also tap into the Australian markets to raise money in a later stage.

Right now, both Cobalt One and First Cobalt are in a trading halt, so we expect an official statement from both companies shortly. Should both transactions be completed, FCC will be the (only?) major player in the region owning numerous past-producing mines as well as a fully functional refinery and a fully permitted mill.

The combination of these three assets will put First Cobalt lightyears ahead of its competition.

Go to First Cobalt’s website

The author has a long position in First Cobalt. First Cobalt is a sponsor of the website. Please read the disclaimer