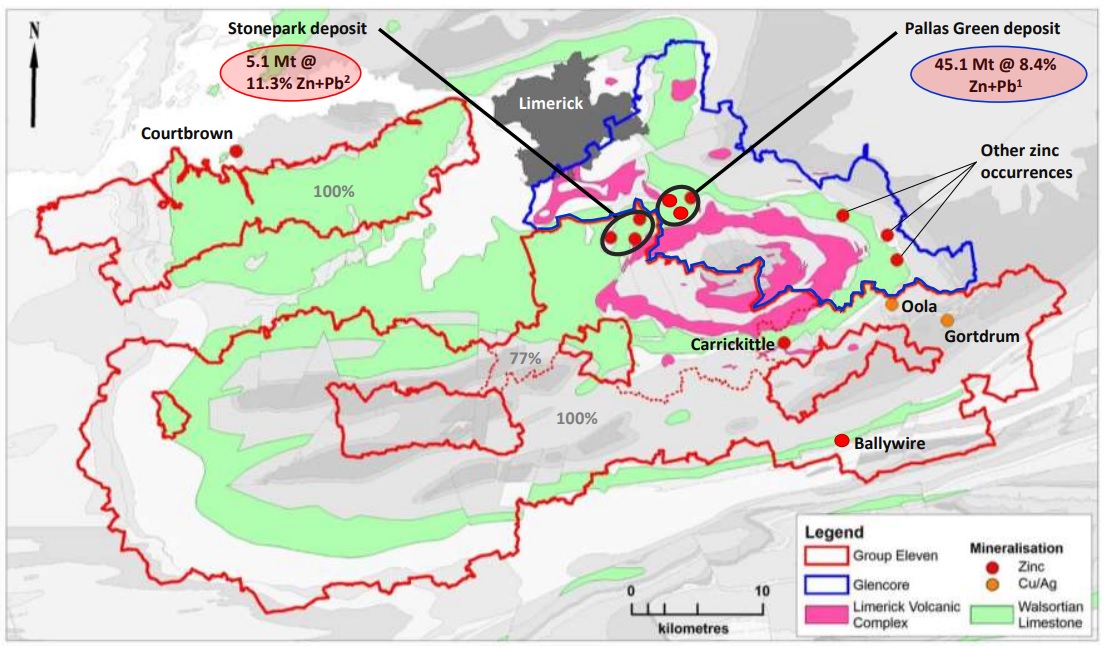

Group Eleven Resources (ZNG.V) has now finally been able to secure another large strategic investor (besides MAG Silver (MAG, MAG.TO)) as Glencore (GLEN.L) has agreed to acquire 8.4 million units at C$0.12 per unit for a total investment of C$1M for an initial ownership of almost 11.6%. Each unit consists of one share and ½ warrant with a strike price at C$0.24 expiring three years after the issue date. Glencore appears to be a logical and natural ‘partner’ as its large Pallas Green deposit is bordering Group Eleven’s Stonepark deposit which is smaller (5.1Mt versus 45.1Mt) but has a higher average grade (11.3% ZnPb versus 8% ZnPb) than Pallas Green. It would make a lot of sense to eventually combine both projects to unlock synergy advantages.

When dealing with Glencore it’s also interesting to see the requirements that are attached to this type of financing. According to the shareholders right agreement there’s nothing too egregious. Glencore gets the standard anti-dilution clause (where it’s allowed to participate pro-rata in future financings and gets a seat in the technical committee of Group Eleven), but Glencore also has negotiated the take-off rights on Group Eleven’s total potential production.

According to the Group Eleven press release the offtake agreement will be negotiated ‘on market terms’ which appears to be fine as long as Glencore doesn’t pull a similar trick like Trafigura did with Nyrstar.

The cash inflow into Group Eleven Resources was very welcome to strengthen the balance sheet and to continue the activities in Ireland. We will catch up with CEO Bart Jaworski in the near future to discuss the upcoming exploration plans.

Disclosure: The author has a long position in Group Eleven.